Gold Weekly Forecast: Sellers look to retain control following uninspiring rebound

- Gold registered modest weekly gains but failed to clear key resistance.

- Focus shifts to US June labour market report.

- XAU/USD could regain bearish momentum with a break below $1,770.

After losing 5% in the previous week, gold managed to stage a rebound on Monday and rose more than 1%. However, XAU/USD struggled to gather bullish momentum in the remainder of the week and fluctuated in a relatively tight range. As the inflation report from the US failed to trigger a significant market reaction on Friday, gold finished the week with small gains a little below $1,780.

What happened last week

In the absence of high-tier macroeconomic data releases and fundamental developments, the USD’s market valuation drove XAU/USD’s movements at the start of the week. The US Dollar Index, which registered its largest weekly percentage gain since the beginning of the pandemic, lost 0.5% on Monday and dropped below 92.00.

Although the USD selloff continued on Tuesday following FOMC Chairman Jerome Powell’s remarks, gold struggled to break above the key technical resistance that formed a little below $1,800.

While testifying before the House Select Subcommittee on the Coronavirus Crisis, Powell adopted a less-concerned tone with regards to price pressures and said that a substantial part of the overshoot in inflation was from categories directly affected by reopening.

Nevertheless, hawkish Fed commentary allowed the USD to stay resilient against its rivals later in the week and did not allow gold to extend its recovery. Atlanta Federal Reserve President Raphael Bostic told NPR that the phase of high inflation will likely be longer than initially expected and noted that they could see a decision on asset tapering in the next three or four months. On a similar note, San Francisco Federal Reserve Bank President Mary Daly acknowledged that it was appropriate to start talking about the timing of asset purchase adjustment.

On Thursday, the US Bureau of Economic Analysis (BEA) left the annualized first-quarter real Gross Domestic Product growth unchanged at 6.4% as expected. Other data from the US revealed that the weekly Initial Jobless Claims declined modestly to 411,000 from 418,000 and Durable Goods Orders increased by 2.3% on a monthly basis in May, compared to analysts’ estimate for an increase of 2.7%.

Finally, the BEA reported on Friday that the Core Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred gauge of inflation, edged higher to 3.4% in May from 3.1% in April. This print matched the market expectation and its impact on the USD was short-lived.

Next week

There will not be any high-tier macroeconomic data releases at the start of the week. The Conference Board will release the US Consumer Confidence data for June on Tuesday. On Wednesday, the Automatic Data Processing (ADP) Research Institute will publish the private sector employment figures for June.

The ISM Manufacturing PMI report will be featured in the US economic docket on Thursday. Investors will keep a close eye on the Prices Paid Index for fresh clues on the inflation outlook rather than the headline PMI reading.

Ahead of the weekend, the US Bureau of Labor Statistics will release the June jobs report. The market consensus points to a 600,000 increase in Nonfarm Payrolls (NFP). The Unemployment Rate is seen edging lower to 5.7% from 5.8%. A stronger-than-expected NFP reading could provide a boost to the USD and weigh on gold as it would reaffirm the FOMC’s hawkish tilt in the policy outlook.

Gold technical outlook

Following this week’s choppy action, key technical levels for gold remain intact. Furthermore, the Relative Strength Index (RSI) on the daily chart continues to move sideways a little above 30, suggesting that gold’s modest rebound was a technical correction of the previous week’s sharp decline rather than a sign for a reversal.

On the upside, key resistance seems to have formed in the $1,795/$1,800 (psychological level, 100-day SMA, Fibonacci 50% retracement of April-June uptrend) region. A daily close above that area could attract buyers and help gold extend its rebound toward $1,825 (Fibonacci 38.2% retracement) and $1,835 (200-day SMA, 50-day SMA).

$1,770 (Fibonacci 61.8% retracement) aligns as key support and bears could see a decline below that level as another selling opportunity toward $1,756 (April 29 low, static level) and $1,745 (static level).

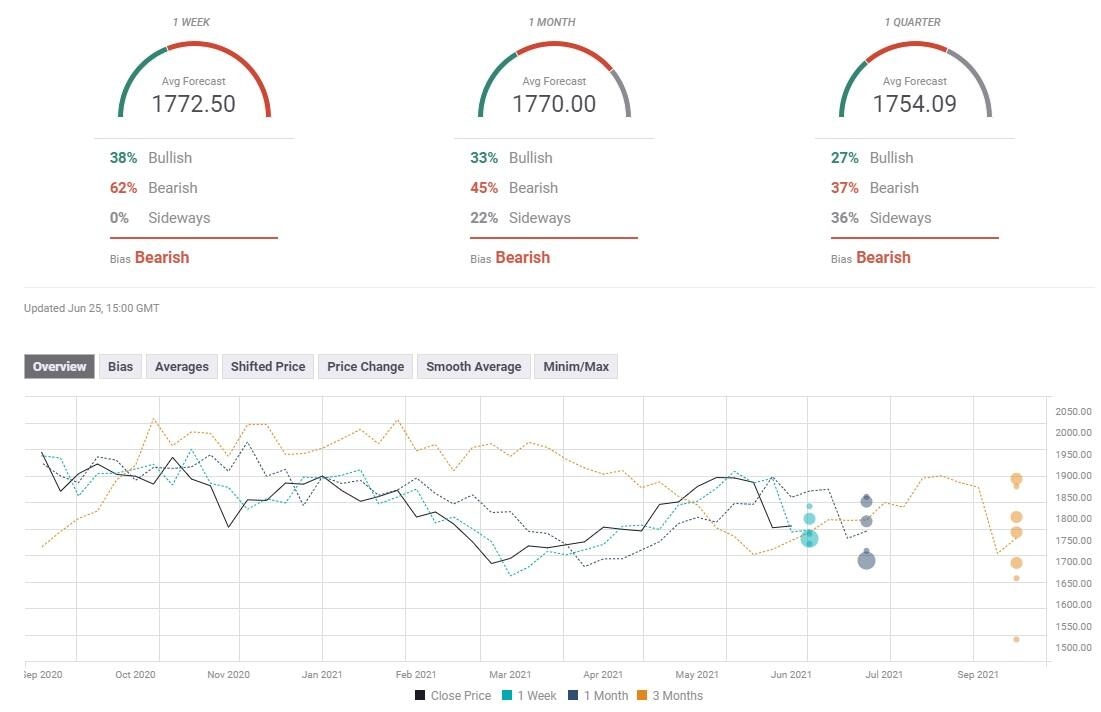

Gold sentiment poll

The FXStreet Forecast Poll shows that gold is likely to trade in the lower half of its recent horizontal range in the near term with the average target on the one-week view sitting at $1,772. The bearish bias also remains intact on the one-month and one-quarter views, aiming at $1,770 and $1,754, respectively.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.