Gold Price Analysis: Bears finally catch a break

- Gold bears take control and break into fresh bearish territory.

- Further downside on the cards, but market volatility is here to stay.

From an ongoing analysis, the bears have finally managed to catch the break that they were looking for and the prior analysis had forecasted originally, here:

and again, here:

Original forecast

End result

To be continued...

Next?

As illustrated, the trendline resistance held and the price eventually crumbled to the first target area.

So where is next?

Casting minds back to the original analysis, the expectations are of a deeper retracement of the monthly bullish impulse to at least a 38.2% Fibonacci target.

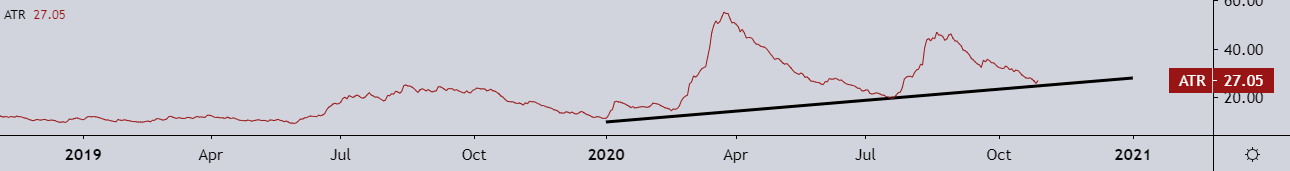

However, markets rarely move this far without offering a discount, especially in an asset class such as gold which is proving to be very choppy of late offer a higher ATR for the year 2020:

It is reasonable to expect a pullback to the prior support structures, which are now expected to act as resistance:

There is a cluster of Fibonacci retracement confluence with the various resistance structures.

If the price does indeed hold below these, then the monthly 38.2% Fib in the $1,840 area is on the cards.

Gold levels

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637393565166091744.png&w=1536&q=95)

-637395164358159173.png&w=1536&q=95)

-637395170934272259.png&w=1536&q=95)

-637395180652740035.png&w=1536&q=95)