Gold sideways ahead of Trump making its way back to the White House

- Gold price goes nowhere while markets brace for four years of volatility.

- US markets remain closed due to Martin Luther King day.

- Gold supported above $2,700.00 though concerns are swelling for more downturn.

Gold’s price (XAU/USD) is staying afloat above $2,700 despite an earlier decline to $2,689 during the Asian session, while traders are still concerned over President-elect Donald Trump, who will be sworn in as the 47th United States (US) President later in the day. Traders are assessing what to do in their Bullion positioning with concerns about Trump's policies, including tariffs and immigration, which could boost Gold's value as a haven but also lift the US Dollar (USD). Heightened political and trade uncertainties and geopolitical tensions fueled the recent gains in Gold.

Meanwhile, a minority group of bond traders believe the Federal Reserve's (Fed) next move on interest rates will be to increase them instead of a rate cut as most market participants anticipate, Bloomberg reports. Based on options linked to the Secured Overnight Financing Rate (SOFR), those traders see about a 25% chance that the Fed’s next move will be to lift rates by year-end, according to an analysis by Bloomberg Intelligence. That would be disaster news for Gold, which, in normal conditions, has an inverse correlation with yields.

Daily digest market movers: Risks on higher yields

- State Street Global Advisors, one of the world’s largest investors, says Gold prices could reach $3,100 an ounce this year, extending the 2024 rally that pushed the precious metal to its biggest annual gain in 14 years, Financial Review reported.

- The recent Commitment of Traders (COT) publication from the Commodity Futures Trading Commission (CFTC) reveals that hedge fund managers have boosted their net long Gold and Silver calls to a 5-week high, according to Reuters.

- In the Middle East, a ceasefire in the Gaza region has begun taking hold as Hamas released three female hostages in exchange for 90 Palestinians held in Israeli prisons, Reuters reports.

- Pakistan’s deal with Saudi Arabia for the sale of a stake in the copper and gold mining project, is still in the process of negotiating key details, including where the minerals will be processed, Bloomberg reports.

Technical Analysis: Bumpy road ahead

Gold will be on a path of uncertainty in the coming days and weeks. A large number of instructions and directives are set to be released once President-elect Donald Trump is sworn in as the 47th President on Monday. The main tailwind is that quite a few of the outlined instructions are inflationary or could trigger geopolitical uncertainty, which, in both cases, is not beneficial for Gold.

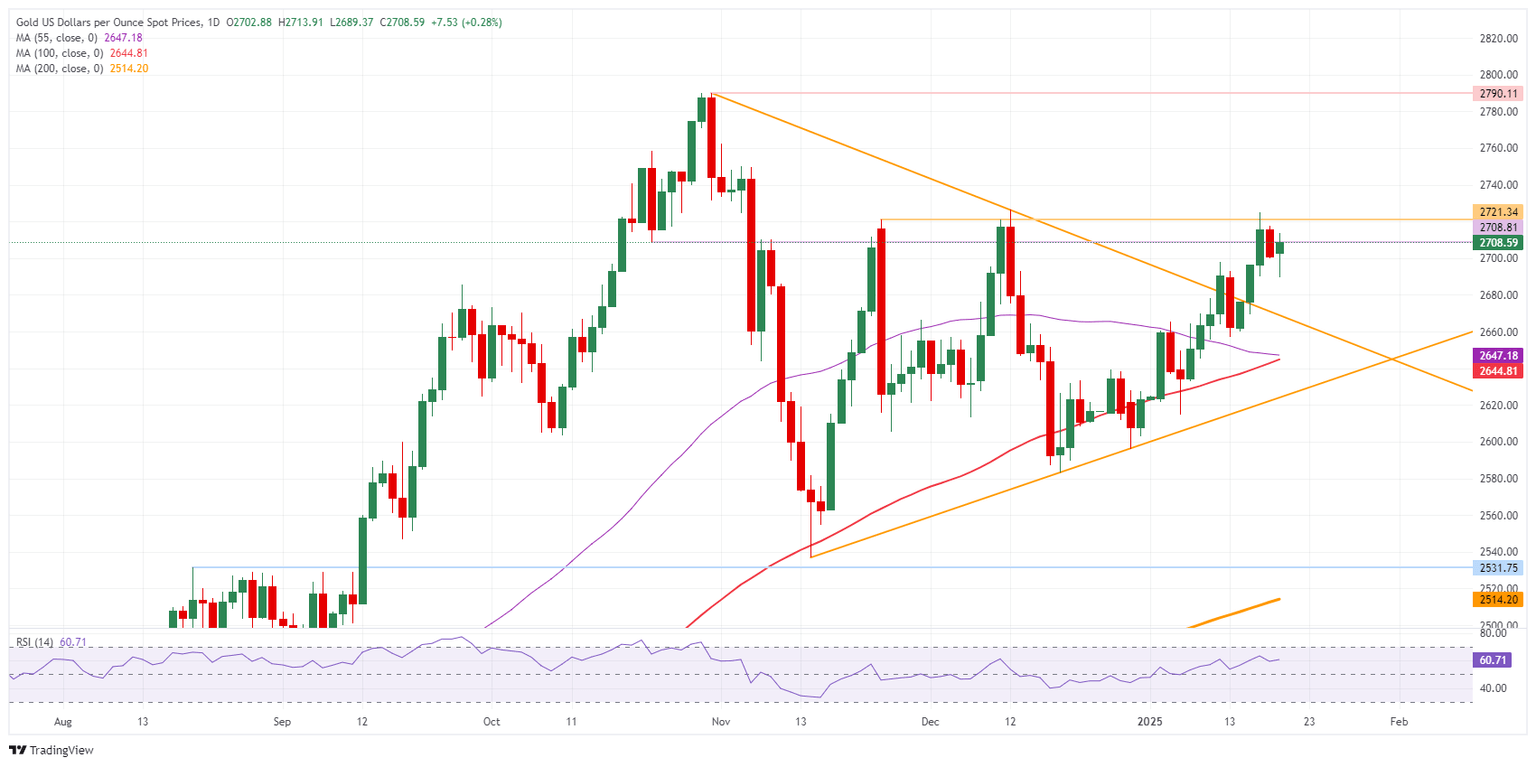

There is quite some downside risk, with no key pivotal levels nearby. If traders cannot keep the Gold price above $2,700, they should consider the downward-slopping trendline of the broken pennant chart pattern last week at $2,669 as the next support. In case more downside occurs, the 55-day Simple Moving Average (SMA) at $2,647 is next, followed by the 100-day SMA at $2,644.

Looking up, the $2,708 level needs to be regained before considering further upside. Further up, the next level to look at is $2,721, a sort of double top in November and December. In case Bullion powers through that level, the all-time high of $2,790 is the key upside barrier.

XAU/USD: Daily Chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.