Gold shooting for the stars as Friday's US session sets fresh all-time high for bullion

- Gold pops as the US session on Friday starts to pick up.

- A volatile weekend is forecasted after President Trump confirmed tariffs to be implemented Saturday.

- Gold hits another fresh all-time high just ahead of US PCE release.

Gold’s price (XAU/USD) is printing an all new all-time high at the time of writing, near $2,581.75, set to hit an intraday resistance level as the US session gets underway. On the geopolitical front, markets got rattled by comments from US President Donald Trump who confirmed 25% tariffs to be imposed on Canada and Mexico, the two largest US trading partners, starting on Saturday, and threatened to impose 100% tariffs on BRICS nations if they try to replace the US Dollar with a new currency in international trade. This should act as a headwind for Bullion since it could lead to a trade war and inflation fears with price surges for consumers and manufacturers in the US.

On the economic data front, inflation will be drawing all the attention, with the US Personal Consumption Expenditures (PCE) Price Index releases for December, the Federal Reserve’s preferred inflation gauge, due later on the day. Overall, figures are expected to remain stable or marginally higher.

Daily digest market movers: After German CPI fell, expectations are for softer PCE

- US President Donald Trump is poised to unleash his first wave of tariffs on Saturday, sending foreign governments and businesses rushing to skirt potential duties and prepare for retaliation. Trump has pledged 25% tariffs on about $900 billion in goods from both Canada and Mexico, Bloomberg reports.

- On Thursday, bullion already printed a fresh all-time high after the preliminary 2024 fourth-quarter reading of the US Gross Domestic Product (GDP) came in softer than expected, pointing to lesser growth in the US, Reuters reports.

- President Trump reiterated on Thursday his threat of imposing 100% tariffs on BRICS nations if they try to replace the US Dollar (USD) with a new currency in international trade. Trump posted on TruthSocial: “We are going to require a commitment from these seemingly hostile countries that they will neither create a new BRICS currency, nor back any other currency to replace the mighty US Dollar or, they will face 100% tariff,” and continued “there is no chance that BRICS will replace the US Dollar in international trade, or anywhere else, and any country that tries should say hello to tariffs, and goodbye to America!”

- At 13:30 GMT, the US Personal Consumption Expenditures (PCE) Price Index data for December will be released. Expectations are for the monthly core PCE reading to increase by 0.2% from 0.1% in November. The monthly headline PCE data should tick up 0.3% from 0.1% the previous month.

- Markets might face substantial volatility on Monday due to the possible sanctions being imposed over the weekend by the Trump administration on Canada and Mexico.

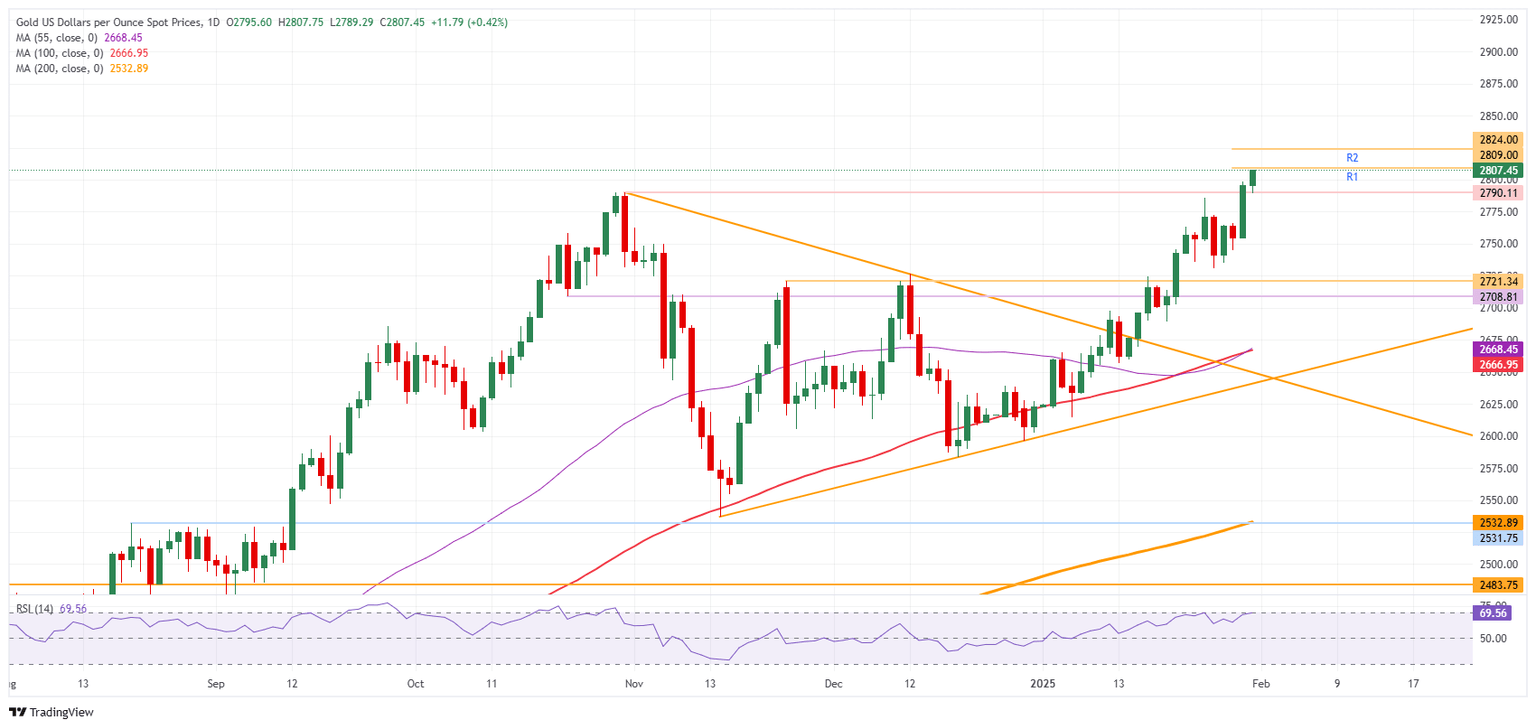

Technical Analysis: No limits

After a spike higher on early Friday, hitting a fresh all-time high of $2,800.93, the question will be whether bullion will not face some substantial profit-taking. Tariffs are always considered inflationary, thus a headwind for the precious metal. Should the US data come in higher than expected later in the day, inflation concerns would spark more selling pressure, and Gold might quickly dive lower in search of support.

The first support is quite far off, at $2,721, a triple top in November, December and January, broken on January 21. Just below that, $2,709 (October 23, 2024, low) is in focus as a second nearby support. In case both abovementioned levels snap, look for a dive back to $2,680 with a full-swing sell-off.

Analysts and strategists have called for $3,000, but $2,800 looks like a good starting point for the next upside resistance. Based on the price action from Thursday, technical analysis (pivots) shows $2,809 and $2,824 as important daily resistance levels.

XAU/USD: Daily Chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.