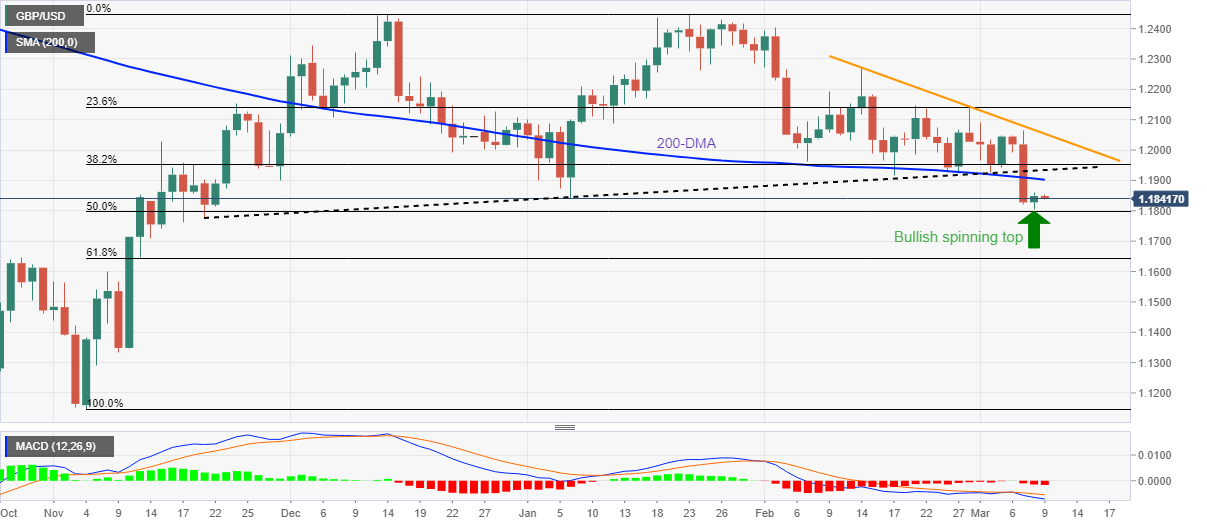

GBP/USD Price Analysis: Fails to justify bullish spinning top near multi-day low around 1.1850

- GBP/USD retreats from intraday high, fades bounce off the lowest levels since late November 2022.

- Bearish MACD signals, sustained trading below the key support line and 200-DMA favor sllers.

- Buyers lack conviction below 1.2150, one-month-old descending trend line adds to the upside filter.

GBP/USD struggles to extend the previous day’s corrective bounce off the lowest levels since November 21, 2022, making rounds to 1.1850 on Thursday morning in Asia.

In doing so, the Cable pair fails to justify the previous day’s bullish candlestick on the daily chart, namely the bullish spinning top.

The reason could be linked to the pair’s sustained downside break of a 15-week-old ascending trend line, previous support near 1.1935, as well as the 200-DMA breakdown. Also adding strength to the downside bias are the bearish MACD signals.

That said, the GBP/USD quote’s fresh weakness could aim for the 50% Fibonacci retracement level of November 2022 to January 2023 upside, near 1.1800.

Following that, a slump toward the 61.8% Fibonacci retracement level surrounding 1.1645, also known as the golden ratio, can’t be ruled out.

Meanwhile, the 200-DMA hurdle of around 1.1900 restricts immediate GBP/USD recovery before highlighting the support-turned-resistance line close to 1.1935.

Even if the Cable pair crosses the 1.1935 hurdle, a downward-sloping resistance line from early February, near 1.2055 could act as the last defense of the GBP/USD bears.

To sum up, GBP/USD remains on the bear’s radar despite the latest rebound, as well as posting the bullish candlestick.

GBP/USD: Daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.