GBP/USD Price Analysis: Fades Brexit deal-inspired upside momentum near 1. 2050

- GBP/USD remains sidelined after rising the most in seven weeks.

- UK PM Sunak manages to strike all-around acceptability with latest Brexit deal.

- Sluggish oscillators probe traders around previous resistance line.

- Key DMAs, support line challenge Cable bears despite snapping four-month uptrend in February.

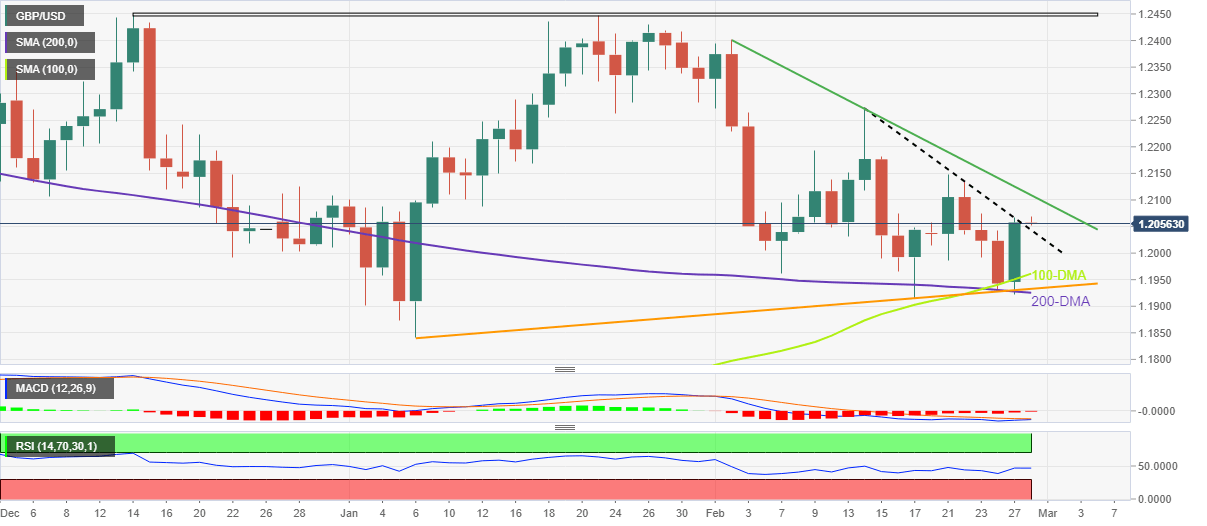

GBP/USD struggles to extend the Brexit deal-induced gains around 1.2050-60 during early Tuesday. Even so, the Cable pair defends the previous day’s rebound from the key technical levels while also keeping the upside break of a short-term key resistance line, now support.

It’s worth noting that the sluggish MACD and RSI conditions challenge the Cable pair buyers after the quote rose the most on a daily since early January. That said, the GBP/USD remains on the way to posting the first monthly loss in five.

On a different page, optimism surrounding UK Prime Minister Rishi Sunak’s Brexit deal keeps the GBP/USD buyers hopeful as most of the hard Brexiteers have so far praised the initial deal for the Northern Ireland Protocol (NIP) that needs UK Parliamentary approval.

Also read: UK PM Sunak: Found a way to end the uncertainty for Northern Ireland

Hence, recent inaction in the market pushes back the bearish bias surrounding the GBP/USD as it defends the previous day’s fundamental, as well as technical, catalysts that recalled the bulls on Monday.

As a result, the Cable pair is on the way to poking a downward-sloping resistance line from February 02, close to 1.2110 by the press time, unless it drops below the resistance-turned-support line near 1.2040.

Even if the quote drops below 1.2040, the 100-DMA and 200-DMA, respectively near 1.1960 and 1.1920, could challenge the GBP/USD bears. Also acting as a downside filter is an upward-sloping support line from early January, close to 1.1930 by the press time.

On the flip side, a successful break of the 1.2110 resistance line could propel the GBP/USD price toward the mid-February high surrounding 1.2270. However, the double tops marked near 1.2445-50 appear a tough nut to crack for the bulls afterward.

GBP/USD: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.