GBP/USD: Bulls rocket to critical resistance area, pause for thought

- GBP/USD has rallied to a critical resistance area on Brexit breakthrough possibility.

- COVID-19 curve slowing, escalating trade tension shrugged off.

- USD under pressure, aiding bulls to hold in bullish territory.

- Bigger picture talks to make for plenty of volatility.

The pound has been the outperformer, living up to its tendency to really move when it gets going. GBP/USD rallied from a low of 1.2176 to a high of 1.2363 on the day. Meanwhile, the next round of Brexit talks gets underway next Monday. There have been headlines circulating that British negotiators could seal their first major victory in their next talks with the European Union and encourage concessions from the bloc on its "maximalist" fisheries demands.

Mr Barnier has said conceding access to Britain’s fishing waters would be just one of the prices the Government must pay for a trade deal with the bloc. But privately, EU diplomats have recognised that their current negotiating position is “impossible” and will likely result in a no-deal scenario. Consequently, one of Mr Barnier's senior aides welcomed the possibility that a halfway house could be found between the UK and EU’s positions.

Sources said, according to the UK's Express, “Our opening line of keeping the current terms is impossible to uphold and that there have been hints of a possible reconciliation of approaches. We would be looking to shift on demands to keep everything as is now, a somewhat maximalist opening position if the UK also moved from its position of coastal attachment."

BoE's Haldane a little more optimistic

BOE’s Haldane: Not reached remotely yet a view on doing negative interest rates

Meanwhile, the Bank of England (BOE) Chief Economist Andy Haldane dropped a hint earlier today that the UK central bank has not reached remotely a view on doing negative interest rates yet. Haldane, participating in a webinar discussion hosted by the Confederation of British Industry (CBI), also said that data was "coming just a shade better than the BOE scenario."

Despite the optimistic rhetoric, cable was unable to extend the Brexit lead gains, but his comments should serve as broader support for days to come.

USD not likely to fade into the night

While we may have seen a pullback in the US dollar, given the geopolitical environment, it is not about to fade away into the night. The weak hands will not be comfortable in a risk-on environment, indeed, there are opportunities in global equity rallies this week, so far. The S&P index opened above 3000 and above its 200-day moving average for the first time since March, likely punishing bears to quick to assume that the 61.8% Fibonacci retracement levels in the US benchmarks were gospel entry positions for the next bearish leg in the 2020 financial market crash.

Nevertheless, the US dollar longs edged higher last week for a ninth consecutive week following the mid-March dip. Demand for US dollars still should be recognised, especially in the face of the Federal Reserve and a coordinated effort during the crisis by other central banks measures aimed at helping USD liquidity. As being the world's reserve currency and for its safe-haven value, the dollar remains in a bullish scenario, both on the charts and fundamentally.

Brexit uncertainties loom

A flare-up in global trade wars or stronger rhetoric in the war of words between the US and China would be enough to set up another flight to safety. Should Brexit throw up an inkling of hard Brexit scenarios following a breakdown in positive progress during forthcoming negotiations, it will be the perfect storm for a major sell-off in cable at this juncture.

Analysts at Standard Chartered bullet-pointed three major Brexit related themes and major uncertainties to keep GBP bulls on their toes:

- Prospect of UK-EU deal are 50:50 at best; any deal is unlikely to go beyond bare-bones FTA.

- UK-EU talks could collapse in June given lack of progress and focus on NI protocol.

- Transition period extension very unlikely by end-June, but still possible later in the year.

The Hong Kong debacle is a definite risk to pay closer attention to and its brewing up to be a catastrophe for financial markets. The UK is also caught up in this risk and sterling traders should be aware, More on that here: The Hong Kong Dollar, the next black swan?

GBP/USD levels

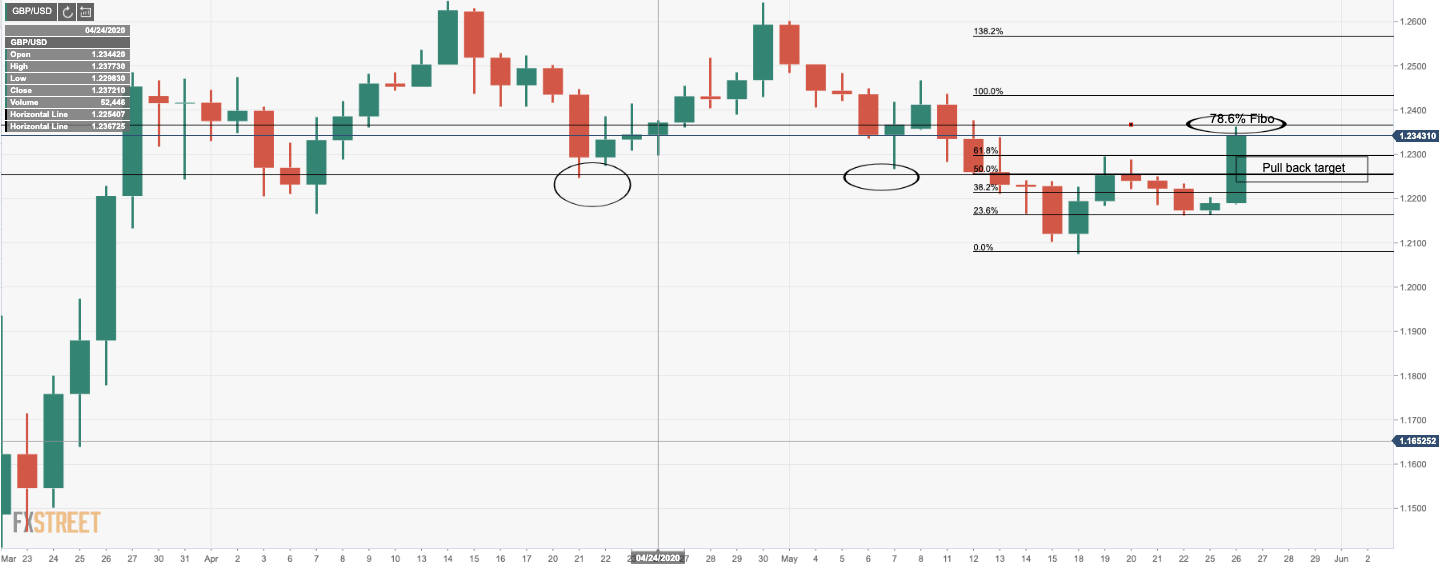

Bulls have reached a 78.6% Fibonacci retracement target level. Given the geopolitical environment, Brexit uncertainties and sheer support for the US dollar, with the tendency for pullbacks on extended rallies such as this, a strong level of support comes as the prior resistance in W formation (19.20th May highs) located around 1.2250. This level has a confluence with the April supportive pivots for additional conviction.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.