GBP/USD bears stepping up to the plate below counter trendline

- Cable is on the verge of a significant downside move should counter-trendline hold.

- Central banks and economic performances in the spotlight.

GBP/USD is currently trading at 1.4158 trading between a low of 1.4115 and a high of 1.4211, trading flat on the day following a recent recovery from the lows of the session as the greenback takes a trip to the downside.

The US dollar hit new lows against major currencies while Federal Reserve officials continue with a mantra of their dovish monetary policy stance which has eased inflation concerns.

Central bank speakers in focus

This week, the messages have been consistent with what Fed Chairman Jerome Powell has said repeatedly over recent weeks.

On Monday, Fed Board Governor Lael Brainard assuaged inflation concerns, saying she expects that price spikes associated with supply bottlenecks and the reopening of the economy to "subside over time."

James Bullard, president of the St. Louis Federal Reserve, also said on Monday that while still in the pandemic, it was not the time to talk more about changing the parameters of monetary policy.

Today, Fed's Richard Clarida said the threats to financial stability are manageable and that data continue to support inflation forecasts that are well anchored.

Meanwhile, a lack of positive drivers for the British currency has put the focus elsewhere for currency traders. Britain's rapid rollout of vaccines has sparked optimism in the pound.

''There have been several reports regarding levels of strong consumer activity in the UK after the partial relaxations of Covid restrictions. That said, optimism may be restrained by concerns over Covid variants which could delay a full re-opening of the economy,'' analysts at Rabobank stated.

As for British policymakers, this week there has been a calm in their tone towards inflation, helping the pound to hold recent gains.

Bank of England Governor Andrew Bailey explained, for instance, that he does not see long-term implications from an expected pick-up in inflation.

Deputy Governor Cunliffe said inflation will return to the bank’s 2% target as growth slows.

With that being said, there are others on the Monetary Policy Committee that are of a different opinion.

Member Saunders said the UK economy may need a “modest” tightening of monetary policy if there’s a more sustained pickup in inflation than the central bank expects.

Overall, analysts at Brown Brothers Harriman explained that the market pricing for BOE tightening remains hawkish, ''with the short sterling futures strip showing that the first hike is mostly priced in by Q1 22 and fully priced in by Q3 22.''

Meanwhile, the UK reported April public sector net borrowing and May CBI distributive trades survey.

Net borrowing ex-banking came in at GBP31.7 bln vs. GBP31.0 expected and a revised GBP26.3 bln (was GBP28.0 bln) in March. Elsewhere, CBI’s retailing reported sales component came in at 18 vs. 25 expected and 20 in April.

''This is a rare downside miss for UK data in recent weeks and bears watching,'' analysts at Brown Brothers Harriman explained.

''Last week, May CBI industrial trends survey came in firm, with total orders at 17 vs. -8 in April and selling prices at 38 vs. 27 in April. Clearly, the economy is recovering strongly as the nation reopens.

Of note, headline inflation picked up in April to 1.5% YoY, while the the10-year breakeven inflation rate has risen nearly 60 bp this year to 3.60% currently, the highest since 2008.''

US dollar positioning improving

As for positioning, net GBP long positions gave back some of the previous week’s gains made after the various election results in the UK according to the latest Commitment of Traders report.

This comes in contrast to speculators’ net long positions in the dollar index that drifted higher for a second consecutive week.

''The USD’s performance in the spot market in recent sessions has been mixed, with sentiment still governed by the inflation debate,'' analysts at Rabobank explained.

GBP/USD technical analysis

As per the prior analysis, GBP/USD Price Analysis: It is make-or-break time, where cable was on the verge of either a significant upside continuation or a downside breakout, the bears have stepped in and the focus is on the downside below what was dynamic support as follows:

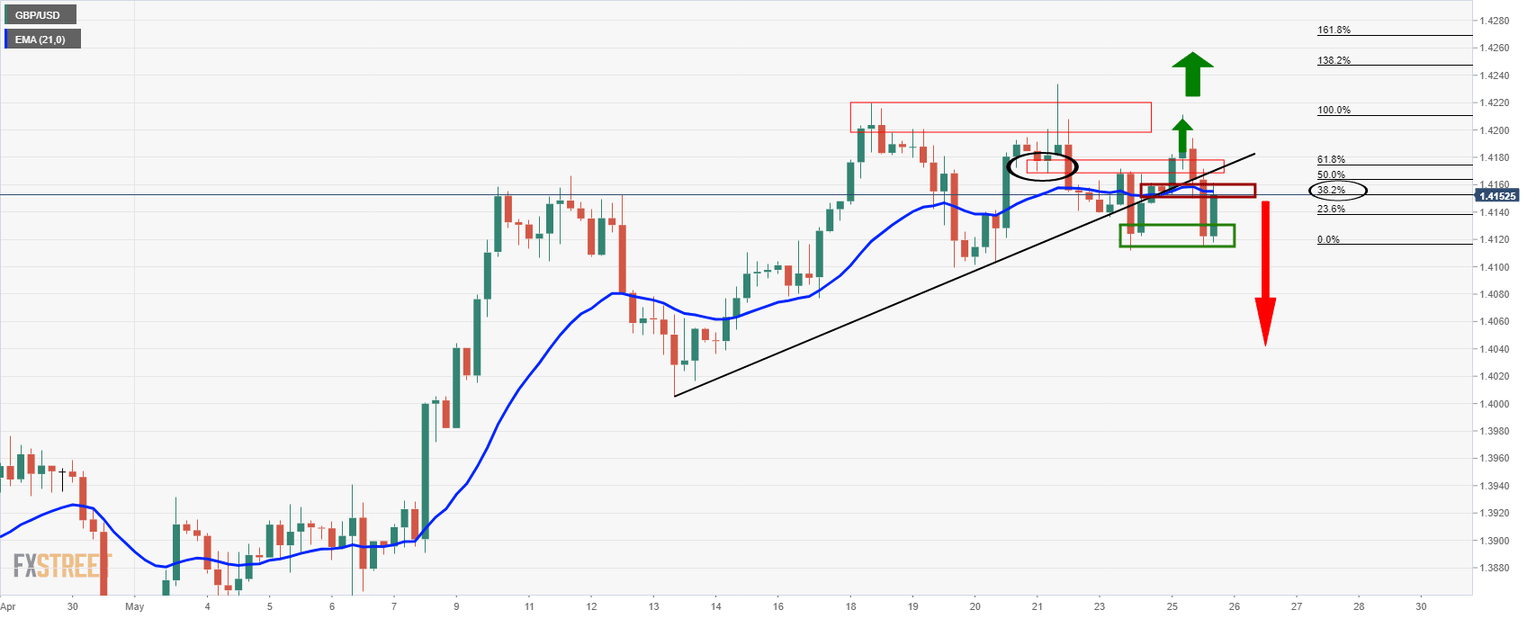

Prior analysis, 4-hour chart

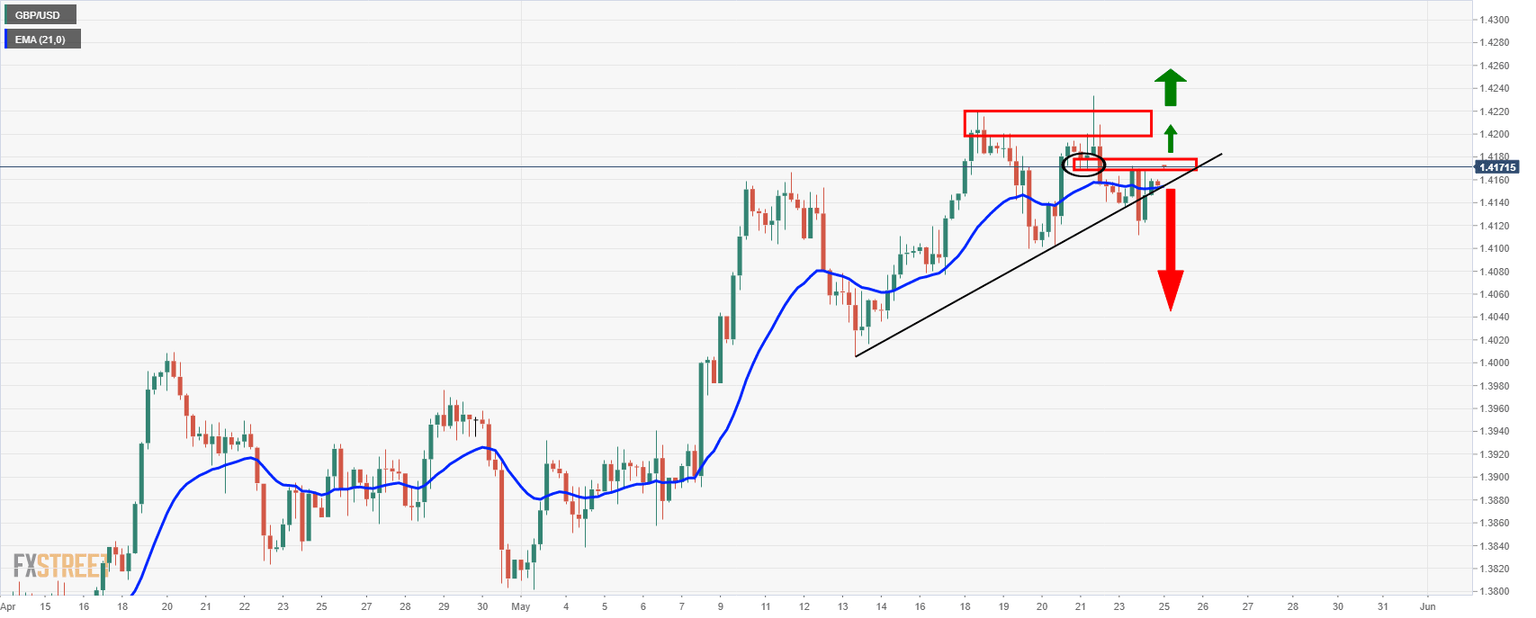

Live market update, 4-hour chart

The price has made a correction to the prior lows on the 4-hour basis and this has a confluence with not only the 21-EMA but also a 38.2% Fibonacci retracement.

This is reinforcing the resistance below the counter trendline and offering extra conviction for the downside bias.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.