EUR/USD trades in tight range in a holiday-shortened week

- EUR/USD is stuck in a tight range around 1.0400 amid thin trading volumes in a holiday-truncated week.

- ECB Lagarde said she is confident about inflation sustainably returning to the bank’s target of 2% sooner than previously thought.

- According to UBS, the Fed will deliver two interest rate cuts next year, in June and September.

EUR/USD stays sideways, following the footprints of the US Dollar (USD) in North American trading hours on Tuesday. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, oscillates in a tight range above the key support of 108.00 amid thin trading volume due to holidays in Forex markets on Wednesday and Thursday on account of Christmas Day and Boxing Day, respectively.

The broader outlook for the USD remains firm as the Federal Reserve (Fed) has guided fewer interest rate cuts for 2025.In the latest dot plot, the Fed signaled only two interest rate cuts in 2025 compared to the four cuts projected in September. According to analysts at UBS, the Fed will deliver two 25-bps interest rate cuts in the June and September policy meetings.

Latest commentaries by Fed officials have shown that they have moved to a more measured approach to interest rate cuts due to stubborn inflation, better labor market conditions than previously anticipated, and the uncertainty over the impact of incoming policies by President-elect Donald Trump on the economy.

Going forward, investors will focus on the US Initial Jobless Claims data for the week ending December 20, which will be published on Thursday. Due to a light US economic calendar, investors will pay close attention to the data. Economists estimate that the number of individuals claiming jobless benefits for the first time was at 218K, lower than the previous release of 220K.

Daily digest market movers: EUR/USD stays broadly under pressure amid dovish ECB bets

- EUR/USD consolidates in a tight range around 1.0400 in Tuesday’s North American session. The overall outlook of the major currency pair is bearish. The Euro (EUR) weakened slightly on Monday after European Central Bank (ECB) President Christine Lagarde told the Financial Times (FT) in an interview that the central bank is “very close” to declaring that inflation has been brought sustainably to its medium-term target of 2%.

- However, Christine Lagarde also warned that the central bank should remain vigilant to inflation in the services sector. While headline Eurozone inflation has eased to 2.2%, service inflation is still high at 3.9%.

- When asked about her views on how the European Union (EU) should address incoming tariffs from United States (US) President-elect Donald Trump, Lagarde said that "retaliation was a bad approach because I think that overall trade restrictions followed by retaliation and this tit-for-tat, conflictual way of dealing with trade is just bad for the global economy at large”.

- ECB dovish bets for 2025 stay afloat amid firm expectations that Eurozone inflation will return to the bank’s target of 2%. Traders expect the ECB to cut its Deposit Facility rate by 25 basis points (bps) in each of the next four policy meetings.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.04% | -0.26% | 0.05% | -0.04% | 0.18% | 0.06% | 0.15% | |

| EUR | -0.04% | -0.30% | 0.00% | -0.07% | 0.15% | 0.02% | 0.11% | |

| GBP | 0.26% | 0.30% | 0.30% | 0.23% | 0.45% | 0.32% | 0.41% | |

| JPY | -0.05% | 0.00% | -0.30% | -0.08% | 0.17% | 0.02% | 0.14% | |

| CAD | 0.04% | 0.07% | -0.23% | 0.08% | 0.21% | 0.09% | 0.18% | |

| AUD | -0.18% | -0.15% | -0.45% | -0.17% | -0.21% | -0.13% | -0.03% | |

| NZD | -0.06% | -0.02% | -0.32% | -0.02% | -0.09% | 0.13% | 0.09% | |

| CHF | -0.15% | -0.11% | -0.41% | -0.14% | -0.18% | 0.03% | -0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Technical Analysis: EUR/USD weakens amid strong bearish momentum

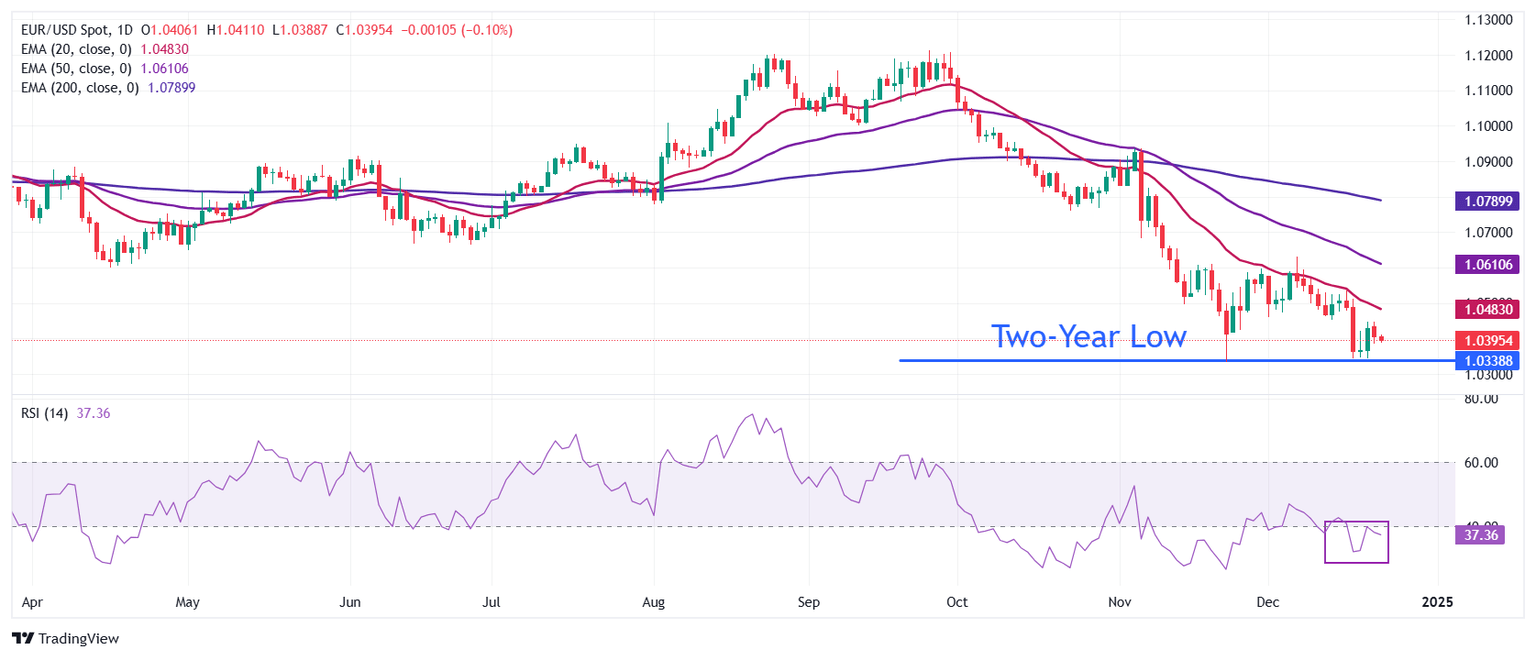

EUR/USD juggles around 1.0400 on Tuesday, holding above the two-year low of 1.0330. However, the outlook for the major currency pair remains strongly bearish as all short-to-long-term Exponential Moving Averages (EMAs) are declining.

The 14-day Relative Strength Index (RSI) oscillates in the bearish range of 20.00-40.00, indicating a downside momentum.

Looking down, the asset could decline to near the round-level support of 1.0200 after breaking below the two-year low of 1.0330. Conversely, the 20-day EMA near 1.0500 will be the key barrier for the Euro bulls.

Economic Indicator

Initial Jobless Claims

The Initial Jobless Claims released by the US Department of Labor is a measure of the number of people filing first-time claims for state unemployment insurance. A larger-than-expected number indicates weakness in the US labor market, reflects negatively on the US economy, and is negative for the US Dollar (USD). On the other hand, a decreasing number should be taken as bullish for the USD.

Read more.Next release: Thu Dec 26, 2024 13:30

Frequency: Weekly

Consensus: 218K

Previous: 220K

Source: US Department of Labor

Every Thursday, the US Department of Labor publishes the number of previous week’s initial claims for unemployment benefits in the US. Since this reading could be highly volatile, investors may pay closer attention to the four-week average. A downtrend is seen as a sign of an improving labour market and could have a positive impact on the USD’s performance against its rivals and vice versa.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.