EUR/USD rises after France welcomes Francois Bayrou as Prime Minister

- EUR/USD rises to near 1.0500 as the US Dollar surrenders its intraday gains.

- French Macron appoints Francois Bayrou as Prime Minister, putting an end to political instability.

- The ECB reduced its key borrowing rates by 25 basis points on Thursday, but a few officials also discussed the possibility of a 50-bps cut.

EUR/USD rise to nearly 1.0500 as President Emmanual Macron appointed centrist ally Francois Bayrou as Prime Minister of France, improving hopes of political stability. Macron promised to find a potential PM candidate sooner after Michel Barnier was forced to resign after losing a confidence vote in Parliament. Barnier's government collapsed after the Far Right and left wing showed dissatisfaction over his fiscal budget, which included €60 billion ($62.9 billion) worth of tax hikes. The priority for Bayrou, a close Macron ally, will be passing a special law to roll over the 2024 budget, with a nastier battle over the 2025 legislation looming early next year, according to Reuters.

Hopes of fixation on political instability in France have offered support to the Euro (EUR). However, its outlook remains weak as European Central Bank (ECB) officials back more interest rate cuts after the completion of the blackout period. ECB policymakers: Bank of France Governor Francois Villeroy de Galhau, Latvian central bank Governor Mārtiņš Kazāks, and Governor of Bank of Estonia Madis Muller have supported more interest rate cuts, a scenario that is bearish for the Euro’s (EUR) outlook.

On Thursday, the comments from ECB President Christine Lagarde also indicated that more interest rate cuts are in the pipeline. After the ECB opted to reduce its Deposit Facility rate by 25 basis points (bps) to 3%, Christine Lagarde highlighted the deteriorating Eurozone growth outlook amid a slowdown in exports and weak business investment, which points to the need for further policy easing. “Surveys indicate that manufacturing is still contracting and growth in services is slowing,” she said, adding that “firms are holding back their investment spending in the face of weak demand and a highly uncertain outlook.”.

Lagarde's comments also indicated that a handful of ECB officials supported a larger-than-usual interest rate cut of 50 bps, suggesting that policymakers are worried about faltering economic growth. The new ECB staff projections forecast the Eurozone economy to grow by 0.7% in 2024 and 1.1% in 2025, less than previously expected.

Christine Lagarde was confident about inflation returning to 2% on a sustained basis. “Our projections are telling us that we will be at 2% target in the course of 2025.” When asked about the impact on inflation from higher import tariffs by the United States (US), Lagarde said that these are “probably net inflationary” in the short term, but that “It is going to depend on the scope of the measures and retaliation that is decided, on the rerouting of trade traffic from other parts of the world”.

On the economic data front, Eurozone Industrial Production remained flat in October after a sharp contraction in September. Economists expected the factory data to have declined by 0.1%. On year, Industrial Production declined by 1.2%, slower than estimates of 1.9%.

Daily digest market movers: EUR/USD rises as US Dollar gives up intraday gains

- EUR/USD gains as the US Dollar (USD) surrenders its intraday gains and rebounds to near 1.0500 in Friday’s North American session. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, falls after facing selling pressure above 107.00. The Greenback ticks lower despite firm expectations that the Federal Reserve (Fed) will deliver a slightly hawkish interest rate guidance after cutting its key borrowing rates by 25 basis points (bps) to 4.25%-4.50% in the policy meeting on Wednesday.

- According to the CME FedWatch tool, traders have priced in a 25-bps interest rate reduction on Wednesday but are confident about leaving them unchanged at 4.25%-4.50% in the policy meeting in January.

- “The recent slowdown in the pace of US disinflation, a lower Unemployment Rate than what the Fed projected in September, and exuberance in US financial markets are contributing to this more hawkish stance,” analysts at Macquarie said.

- A faster-than-expected acceleration in the United States (US) Producer Price Index (PPI) data for November has also added to evidence that the Fed could turn slightly hawkish on the interest rate outlook. The US PPI report showed that the annual headline and core PPI – which excludes volatile food and energy prices – rose by 3% and 3.4%, respectively.

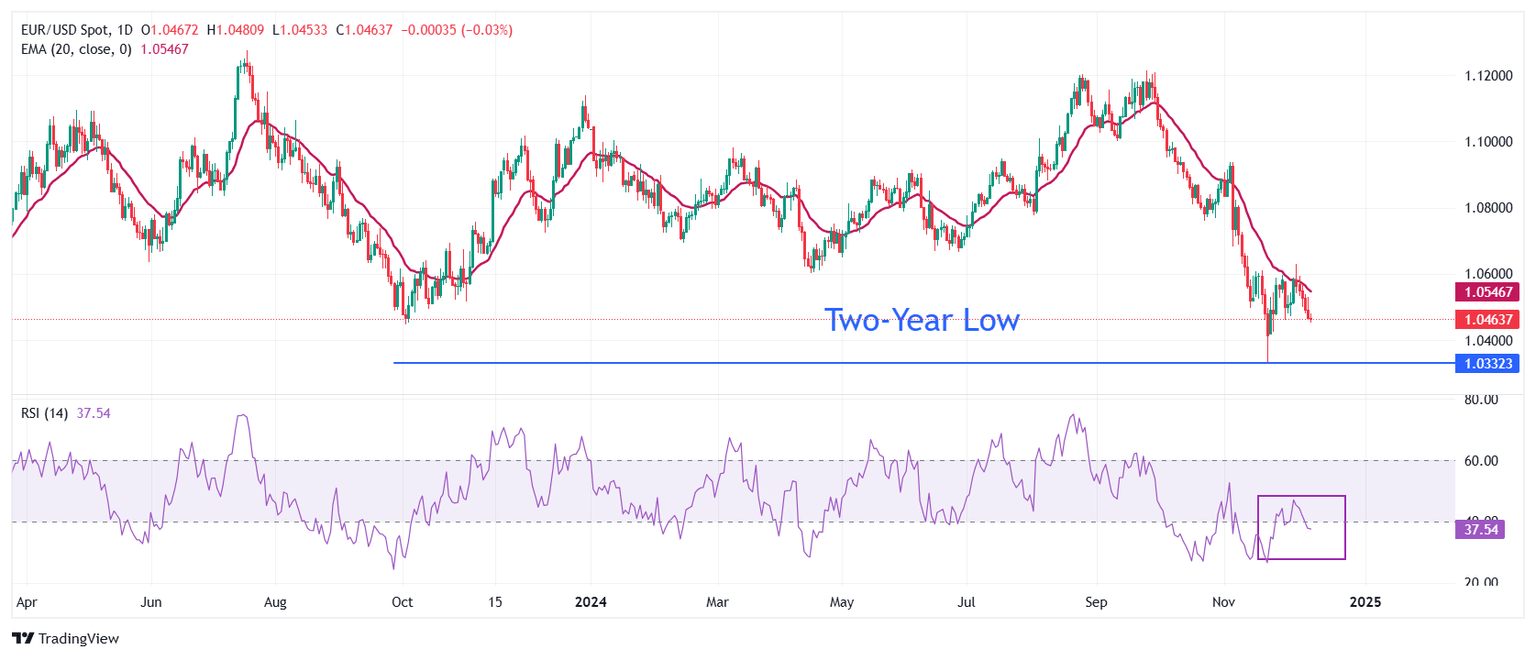

Technical Analysis: EUR/USD rebounds but stays below 20-day EMA

EUR/USD rebounds to near the psychological figure of 1.0500. However, the outlook of the major currency pair remains bearish as it retreated after a mean-reversion move to near the 20-day Exponential Moving Average (EMA) around 1.0580, which is close to 1.0550 at the press time.

The 14-day Relative Strength Index (RSI) dives below 40.00, suggesting a resumption of the downside momentum.

Looking down, the two-year low of 1.0330 will provide key support. Conversely, the 20-day EMA will be the key barrier for the Euro bulls.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.