EUR/USD gives up some gains as ECB's rate-cut bets soar after soft German Inflation

- EUR/USD surrenders some of its intraday gains due to a more-than-expected decline in the German inflation data for June.

- The Euro gains as the first round of France’s legislative elections showed far-right dominance but by a small margin.

- Investors await the preliminary Eurozone HICP and US ISM Manufacturing PMI for June.

EUR/USD consolidates some gains in Monday’s American session after posting more than a two-week high near 1.0770. The major currency pair strengthens as exit polls of the first round of France's parliamentary elections on Sunday showed that Marine Le Pen's far-right National Rally (RN) is in a comfortable position but with a smaller margin than projected and a significant correction in the US Dollar (USD).

The uncertainty over RN gaining an absolute majority has significantly improved the Euro’s appeal. “We might actually get less fears of more expansionary and unsustainable fiscal policy if the far-right party did a little bit worse," said Carol Kong, a currency strategist at Commonwealth Bank of Australia.

Now, investors will turn to the second-round runoffs, scheduled for July 7.

On the monetary policy front, soft preliminary German Harmonized Index of Consumer Prices (HICP) data for June has boosted expectations of subsequent rate cuts by the European Central Bank (ECB). The data showed that the annual German HICP decelerated to 2.5% from expectations of 2.6% and May's reading of 2.8%. In the same period, the Consumer Price Index (CPI) declined to 2.2% from the estimates of 2.3% and the former release of 2.4. On month-on-month, HICP and CPI grew steadily by 0.2% and 0.1%, respectively.

The ECB started reducing interest rates in early June after maintaining a restrictive interest rate stance for two years to tame price pressures prompted by pandemic-led stimulus.

This week, the major trigger for the Euro will be the preliminary Eurozone’s HICP data for June, which will be published on Tuesday.

Daily digest market movers: EUR/USD gains as Far Right dominates French elections

- EUR/USD surged to 1.0770 as the US Dollar corrects after the expected decline in the United States (US) core Personal Consumption Expenditures Price Index (PCE) data for May cemented expectations of early rate cuts by the Federal Reserve (Fed). The US PCE report showed on Friday that the core PCE inflation data, the Fed’s preferred inflation measure, decelerated expectedly to 2.6% from the prior release of 2.8%.

- According to the CME FedWatch tool, 30-day Federal Fund futures pricing data shows that the probability for rate cuts in September is 63.4%. The data also suggest the Fed is expected to deliver two rate cuts this year against one projected by policymakers in their latest dot plot.

- The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, declines to near 105.60.

- On the economic data front, the ISM Manufacturing Purchasing Managers’ Index (PMI) unexpectedly declined in June. The Manufacturing PMI declined to 48.5, while economists forecasted an improvement to 49.1 from the prior reading of 48.7. A figure below the 50.0 threshold is considered a contraction in manufacturing activities.

- Other sub-components, such as Price Paid, which indicates a change in input prices of the manufacturing sector, expanded at a slower pace. The New Orders Index, a measure of the factory outlook, improved significantly but remains below the 50.0 threshold.

Technical Analysis: EUR/USD remains below 200-day EMA

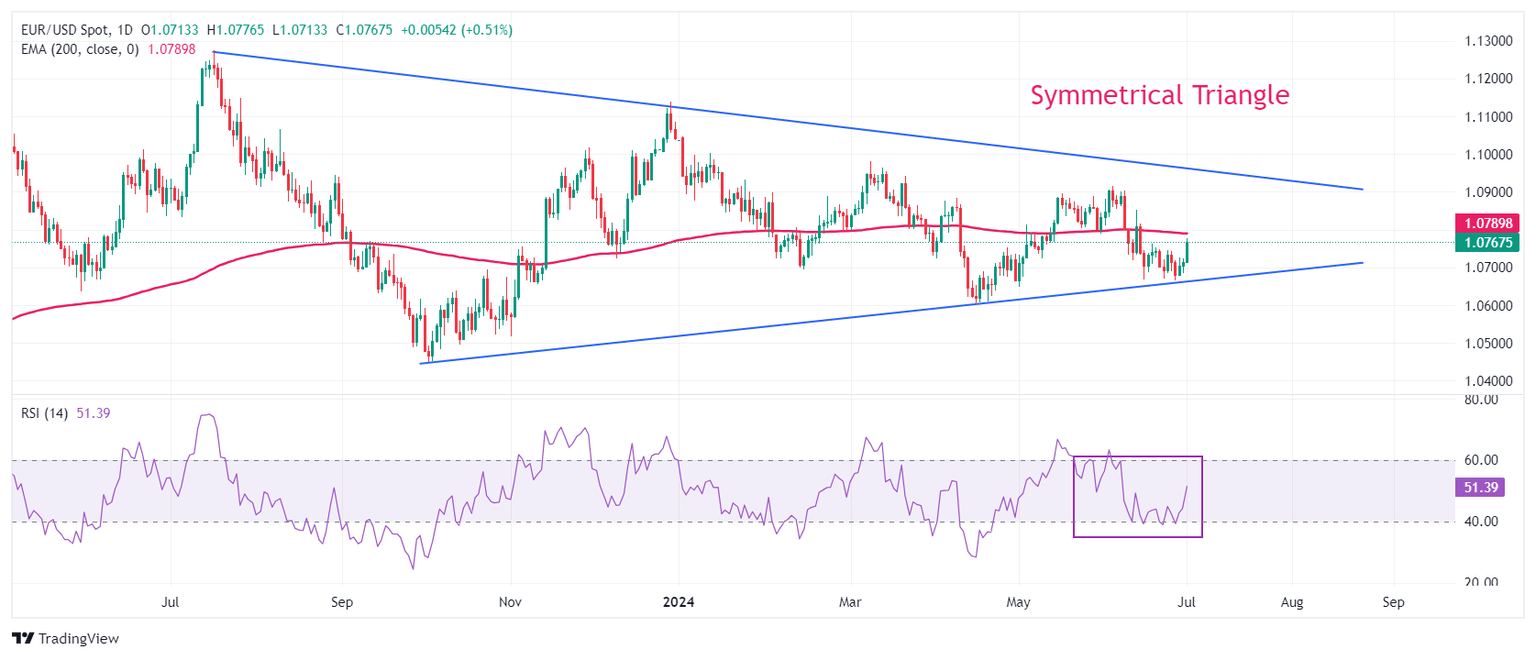

EUR/USD rebounds after discovering strong buying interest near the upward-sloping border of the Symmetrical Triangle formation on a daily timeframe near 1.0666, which is marked from 3 October 2023 low at 1.0448. The downward-sloping border of the above-mentioned chart pattern is plotted from 18 July 2023 high at 1.1276. The Symmetrical Triangle formation exhibits a sharp volatility contraction, which indicates low volume and narrow ticks.

The major currency pair remains below the 200-day Exponential Moving Average (EMA) near 1.0790, suggesting that the overall trend is bearish.

The 14-period Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, suggesting indecisiveness among market participants.

Economic Indicator

ISM Manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US manufacturing sector. The indicator is obtained from a survey of manufacturing supply executives based on information they have collected within their respective organizations. Survey responses reflect the change, if any, in the current month compared to the previous month. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the US Dollar (USD). A reading below 50 signals that factory activity is generally declining, which is seen as bearish for USD.

Read more.Last release: Mon Jul 01, 2024 14:00

Frequency: Monthly

Actual: 48.5

Consensus: 49.1

Previous: 48.7

Source: Institute for Supply Management

The Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers Index (PMI) provides a reliable outlook on the state of the US manufacturing sector. A reading above 50 suggests that the business activity expanded during the survey period and vice versa. PMIs are considered to be leading indicators and could signal a shift in the economic cycle. Stronger-than-expected prints usually have a positive impact on the USD. In addition to the headline PMI, the Employment Index and the Prices Paid Index numbers are watched closely as they shine a light on the labour market and inflation.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.