EUR/USD soars ahead of US elections, Fed policy week

- EUR/USD climbs around 1.0900 as the US Dollar faces intense selling pressure ahead of the US presidential election and the Fed’s policy announcement.

- The latest polls have shown Harris having a slight advantage over Trump.

- The Fed is expected to cut interest rates again on Thursday, but at a slower pace than the 50 bps trim it delivered in September.

EUR/USD jumps around the key resistance of 1.0900 in Monday’s North American session. The major currency pair strengthens amid increasing uncertainty ahead of the United States (US) presidential election on Tuesday and the Federal Reserve’s (Fed) monetary policy meeting on Thursday.

The US Dollar has started the week on a bearish note, with the US Dollar Index (DXY) declining below 103.70 as market participants expect a neck-to-neck competition between former President Donald Trump and current Vice President Kamala Harris.

US Dollar PRICE Today

The table below shows the percentage change of the US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.64% | -0.33% | -0.23% | -0.13% | -0.63% | -0.10% | -0.46% | |

| EUR | 0.64% | 0.28% | -0.02% | 0.11% | 0.33% | 0.15% | -0.21% | |

| GBP | 0.33% | -0.28% | -0.53% | -0.17% | 0.05% | -0.13% | -0.49% | |

| JPY | 0.23% | 0.02% | 0.53% | 0.10% | 0.15% | 0.34% | 0.08% | |

| CAD | 0.13% | -0.11% | 0.17% | -0.10% | -0.29% | 0.02% | -0.33% | |

| AUD | 0.63% | -0.33% | -0.05% | -0.15% | 0.29% | -0.17% | -0.51% | |

| NZD | 0.10% | -0.15% | 0.13% | -0.34% | -0.02% | 0.17% | -0.37% | |

| CHF | 0.46% | 0.21% | 0.49% | -0.08% | 0.33% | 0.51% | 0.37% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The sharp sell-off in the US Dollar came after the release of the Des Moines Register/Mediacom Iowa Poll, which showed Harris up three points on Trump in the state, Reuters reported. The poll’s result marks a turnaround from September in a state that Trump won clearly both in 2016 and 2020.

Traders see a Trump victory as positive for the US Dollar and Treasury yields as he has vowed to raise tariffs on imports and lower taxes, measures that would likely boost inflationary pressures and force the Fed to return to a restrictive policy stance. On the contrary, a Harris win is perceived to be a continuation of current government policies, which traders interpret as beneficial for risk-sensitive currencies.

Meanwhile, the Fed is set to meet on Thursday to decide about interest rates. The meeting, however, is likely to be overshadowed by the US election outcome and also by the fact that traders have fully priced in a rate reduction of 25 basis points (bps), which would push key borrowing rates lower to 4.50%-4.75%, according to the CME Fedwatch tool.

Still, investors will pay close attention to the guidance for monetary policy action for the last meeting of this year to be held in December. Markets also expect that the Fed will cut interest rates by 25 basis points (bps) next month.

On the economic data front, investors will focus on the US ISM Services Purchasing Managers’ Index (PMI) data for October, which will be published on Tuesday. The Services PMI is estimated to come in at 53.5, lower than 54.9 in September, suggesting that the index continues to expand but at a slower pace.

Daily digest market movers: EUR/USD rises as US Dollar weakens ahead of US elections

- EUR/USD surges to near 1.0900 at the US Dollar’s (USD) expense and Euro's (EUR) sustainable performance, which performs strongly since last week after a slew of Eurozone economic data diminished expectations of the European Central Bank (ECB) delivering large rate cuts in December.

- The Eurostat reported that the Eurozone economy expanded at a faster-than-expected pace in the third quarter of the year. Upbeat Eurozone Gross Domestic Product (GDP) data forced trades to pare bets supporting a larger-than-usual interest rate cut of 50 bps in the policy meeting next month. Inflationary pressures in the Eurozone accelerated to 2% in October, according to the flash estimate, also weighing on the ECB's big rate cut bets.

- Meanwhile, the final HCOB Manufacturing PMI data for October from Germany and the overall Eurozone has come in better than flash estimates. The Manufacturing PMI, which gauges activity in the factory sector of Germany and the Eurozone, improved to 43.0 and 46.0, respectively. Eurozone Sentix Investor Confidence, a sentiment indicator that shows the collective opinion of numerous financial experts on current economic health and forward expectations, remained negative but improved to -12.8 for November from the October reading of -13.8.

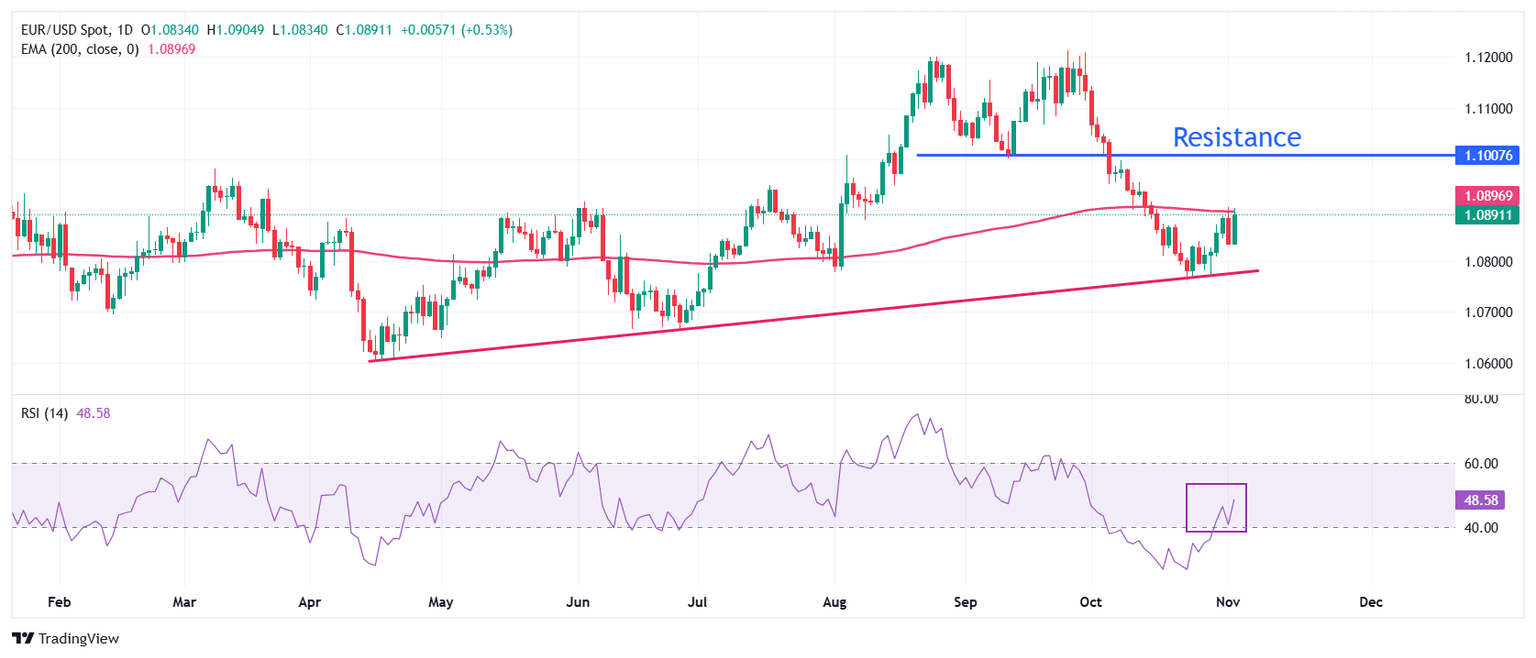

Technical Analysis: EUR/USD remains firm around 1.0900

EUR/USD strives to extend its upside above the key resistance of 1.0900, which also aligns with the 200-day Exponential Moving Average (EMA). The pair rebounded sharply after gaining a firm footing near the upward-sloping trendline around 1.0750, which is plotted from the April 16 low at around 1.0600.

The 14-day Relative Strength Index (RSI) climbs to near 50.00, suggesting that the bearish momentum is fading.

Looking up, the shared currency pair could rise to near the September 11 low around 1.1000 after breaking above the 200-day EMA around 1.0900. On the downside, the October 23 low of 1.0760 will be the key support area for the Euro bulls.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.