EUR/USD strengthens on upbeat Eurozone flash PMI

- EUR/USD raises sharply to near 1.0500 as upbeat Eurozone preliminary PMI data for January has strengthened the Euro.

- The ECB is widely anticipated to cut its Deposit Facility rate by 25 bps to 2.75% on Thursday.

- Trump’s call on immediate rate cuts and his soft tone for China have weighed heavily on the US Dollar.

EUR/USD rallies to near the psychological resistance of 1.0500 on Friday as the Hamburg Commercial Bank (HCOB) reported that the Eurozone preliminary Composite Purchasing Managers' Index (PMI) grew in January after shrinking in the last two months. Flash HCOB PMI report, compiled by S&P Global, showed that overall business activity expanded. The Composite PMI rose to 50.2 from 49.6 in November. Economists expected the PMI to continue to decline but at a slower pace to 49.7.

“The kick-off to the new year is mildly encouraging. The private sector is back in cautious growth mode after two months of shrinking. The drag from the manufacturing sector has eased a bit, while the services sector continues to grow moderately. Germany played a major role in improving the eurozone economy, with the composite index jumping back into expansionary territory. In contrast, France's economy remained in contraction,” Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said.

The report also showed robust labor demand and new business in the services sector. Meanwhile, the manufacturing sector continues to experience layoffs and declining new orders.

Upbeat Eurozone PMI has improved the appeal of the Euro (EUR) in the near term but is unlikely to fix its weak broader outlook on the back of firm European Central Bank (ECB) dovish bets. The ECB is all set to cut its Deposit Facility rate by 25 basis points (bps) to 2.75% on Thursday and will continue to follow the process in the next three policy meetings as officials are confident that inflationary pressures will sustainably return to the desired rate of 2%.

US Dollar PRICE Today

The table below shows the percentage change of the US Dollar (USD) against listed major currencies today. The US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.57% | -0.47% | 0.20% | -0.22% | -0.40% | -0.53% | -0.06% | |

| EUR | 0.57% | 0.09% | 0.79% | 0.35% | 0.17% | 0.03% | 0.50% | |

| GBP | 0.47% | -0.09% | 0.70% | 0.26% | 0.07% | -0.06% | 0.40% | |

| JPY | -0.20% | -0.79% | -0.70% | -0.44% | -0.63% | -0.76% | -0.29% | |

| CAD | 0.22% | -0.35% | -0.26% | 0.44% | -0.19% | -0.31% | 0.15% | |

| AUD | 0.40% | -0.17% | -0.07% | 0.63% | 0.19% | -0.12% | 0.31% | |

| NZD | 0.53% | -0.03% | 0.06% | 0.76% | 0.31% | 0.12% | 0.45% | |

| CHF | 0.06% | -0.50% | -0.40% | 0.29% | -0.15% | -0.31% | -0.45% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Daily digest market movers: EUR/USD advances as Trump dials back tariff hikes on China

- EUR/USD strengthens as the US Dollar (USD) risk-premium has diminished significantly. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, is down near 0.6% on Friday and posts a fresh five-week low near 107.45. The USD’s risk-premium has eased significantly as United States (US) President Donald Trump has signaled that he could reach a deal with China without using tariffs.

- The Dollar has gained almost 10% since October, partly due to market expectations that President Trump would impose lethal tariffs on its trading partners soon after returning to the White House. During the election campaign, Trump commented that if he won, he would impose 60% tariffs on China and 25% on other North American economies.

- President Trump said in an interview with Fox News on Thursday that he had a friendly conversation with Chinese leader Xi Jinping and could reach a deal over trade practices. Trump added that he would rather not use tariffs against China but called tariffs a "tremendous power," Reuters report.

- In addition to Trump’s assumption of tariff relaxation on China, his endorsement of immediate interest rate cuts in his comments at the World Economic Forum (WEF) in Davos on Thursday has also sent the US Dollar on the back foot.

- Going forward, the major trigger for the US Dollar will be the Federal Reserve’s (Fed) monetary policy, which will be announced on Wednesday. The Fed is almost certain to keep interest rates unchanged in the range of 4.25%-4.50%. Investors will pay close attention to Fed Chair Jerome Powell’s conference to determine whether officials agree with President Trump's views.

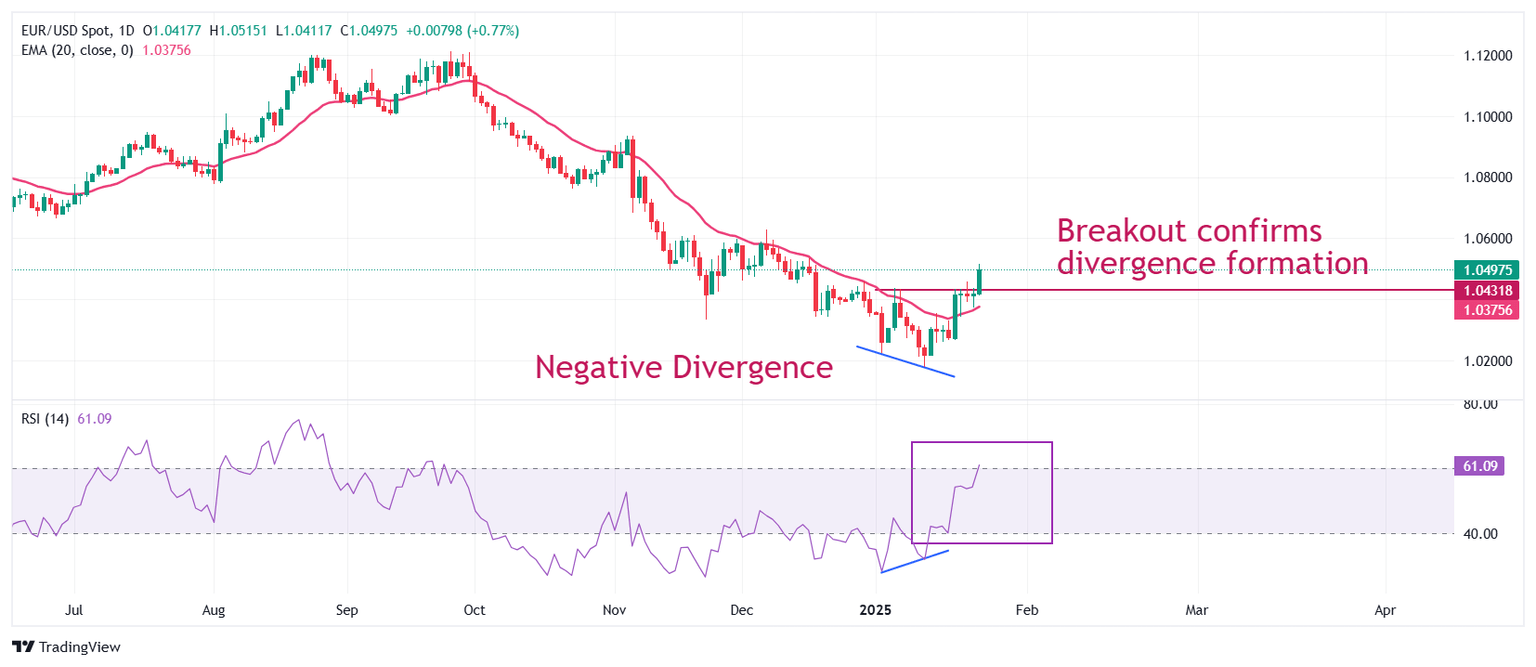

Technical Analysis: EUR/USD strengthens on negative divergence

EUR/USD posts a fresh monthly high near 1.0500 on Friday. The major currency pair strengthens after breaking above the 50-day Exponential Moving Average (EMA), which trades around 1.0456, on Monday. The pair has continued attracting bids since declining to an over-two-year low of 1.0175 on January 13.

The pair has entered the path of a bullish reversal after a breakout of the January 6 high of 1.0430, which has confirmed a divergence in the asset’s price and the 14-day Relative Strength Index (RSI). On January 13, the RSI formed a higher low, while the pair made lower lows.

Looking down, the January 20 low of 1.0266 will be the key support zone for the pair. Conversely, the December 6 high of 1.0630 will be the key barrier for the Euro bulls.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.