EUR/USD recovers losses as soft US PCE inflation weighs on US Dollar

- EUR/USD reverses intraday losses on softer-than-expected US PCE inflation report for August.

- Flash French CPI (EU norm) and Spain's HICP fell below 2% year-on-year in September.

- Softer-than-expected inflation data from France and Spain has prompted ECB rate cut bets in October.

EUR/USD recovers the majority of its intraday losses and returns above 1.1150 in Friday’s New York session. The major currency pair pares losses as the US Dollar (USD) falls back after the release of the United States (US) Personal Consumption Expenditures Price Index (PCE) for August, which indicated that inflation remains on track to return to bank's target of 2%.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, retreats to near 100.40 and declines toward the key support of 100.20. The report showed that the annual PCE inflation grew by 2.2%, slower than estimates of 2.3% and July's print of 2.5%. The core inflation, which excludes volatile food and energy prices, rose expectedly by 2.7% year-on-year from 2.6% in June. Month-on-month inflation data grew by 0.1%.

Signs of further slowdown in inflationary pressures would prompt market expectations for the Fed to reduce interest rates further in the last quarter of this year. Currently, financial markets seem to be confident that the Fed will cut interest rates for the second straight time in November as inflation is on track to return to the bank’s target of 2% and policymakers are concerned over growing risks to labor demand. However, traders remain equally split over the potential rate cut size between 25 and 50 bps, according to the CME FedWatch tool.

Next week, investors will focus on Fed Chair Jerome Powell’s speech on Monday, a slew of labor market data, and the ISM Purchasing Managers’ Index (PMI) to project the next move in the US Dollar.

Daily digest market movers: EUR/USD pares losses despite soft French, Spain inflation weighs on Euro

- EUR/USD pares some losses in European trading hours as the US Dollar falls back. While the Euro's (EUR) performance against other major peers remains weak after the release of the flash French Consumer Price Index (CPI) (EU Norm) and the Spain Harmonized Index of Consumer Prices (HICP) data showed that price pressures grew at a slower-than-expected pace in September.

- A sharp deceleration in French and Spanish inflationary pressures has prompted market expectations for the European Central Bank (ECB) to cut interest rates again in the October meeting. This would be the third interest rate cut by the ECB in its current policy-easing cycle, which started in June. The ECB reduced interest rates again in September after leaving them unchanged in July.

- Annual CPI in France grew at a pace of 1.5%, sharply lower than estimates of 1.9% and the former release of 2.2%. On month, price pressures deflated at a robust pace of 1.2%, faster than expectations of 0.8%. In Spain, the annual HICP rose by 1.7%, slower than estimates of 1.9% and from 2.4% in August. On month, the HICP declined by 0.1%, which was expected to remain flat.

- Going forward, investors will focus on the preliminary German and Eurozone HICP data for September, which will be published on Monday and Tuesday, respectively.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the British Pound.

| EUR | USD | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| EUR | -0.02% | 0.09% | -1.55% | 0.05% | -0.48% | -0.54% | -0.49% | |

| USD | 0.02% | 0.10% | -1.54% | 0.10% | -0.48% | -0.52% | -0.50% | |

| GBP | -0.09% | -0.10% | -1.62% | -0.03% | -0.57% | -0.61% | -0.58% | |

| JPY | 1.55% | 1.54% | 1.62% | 1.65% | 1.09% | 1.04% | 1.10% | |

| CAD | -0.05% | -0.10% | 0.03% | -1.65% | -0.59% | -0.60% | -0.57% | |

| AUD | 0.48% | 0.48% | 0.57% | -1.09% | 0.59% | -0.03% | -0.01% | |

| NZD | 0.54% | 0.52% | 0.61% | -1.04% | 0.60% | 0.03% | 0.03% | |

| CHF | 0.49% | 0.50% | 0.58% | -1.10% | 0.57% | 0.00% | -0.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Technical Analysis: EUR/USD bounces back to near 1.1200

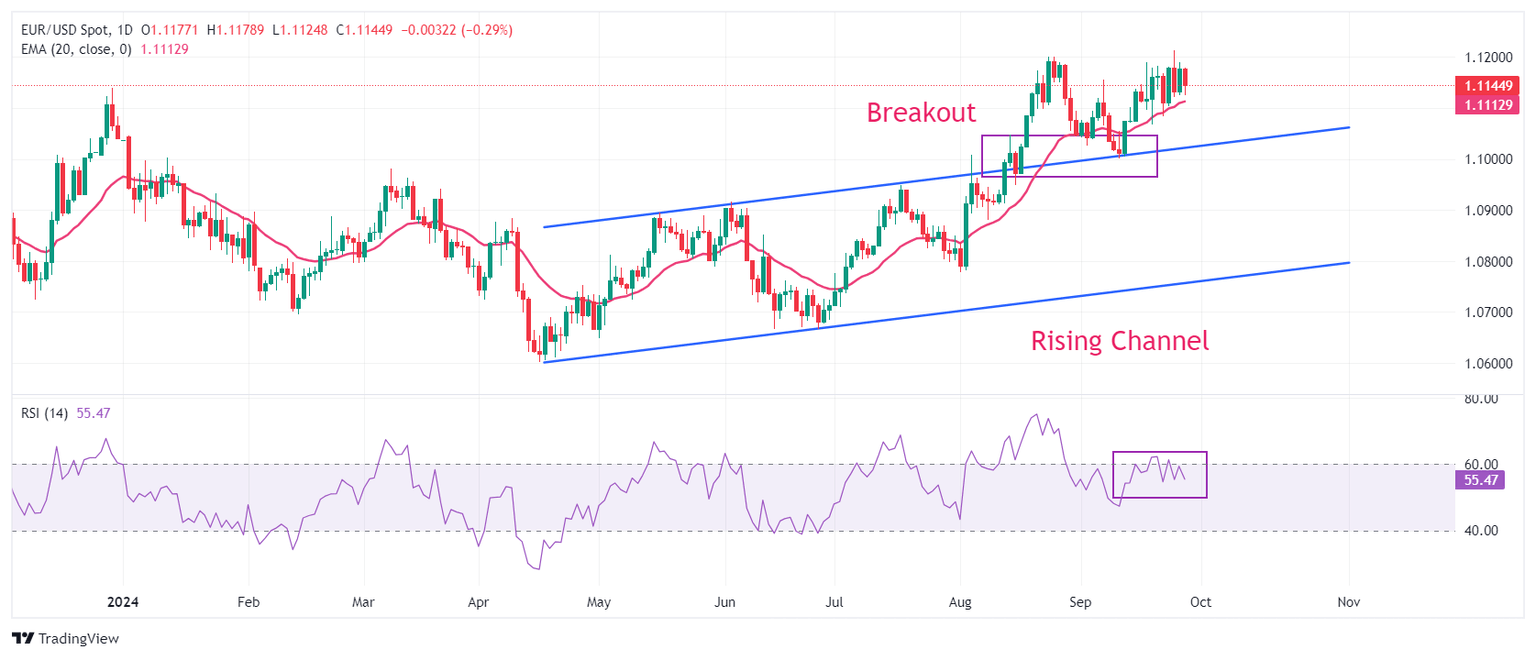

EUR/USD has consolidated in a 100-pip range since Tuesday as investors look for fresh Fed-ECB interest rate cues. The major currency pair remains firm as it holds the breakout of the Rising Channel chart pattern formed on a daily time frame near the psychological support of 1.1000.

The upward-sloping 20-day Exponential Moving Average (EMA) near 1.1110 suggests that the near-term trend is bullish.

The 14-day Relative Strength Index (RSI) edges lower below 60.00, suggesting momentum is weakening.

Looking up, a decisive break above the round-level resistance of 1.1200 will result in further appreciation toward the July 2023 high of 1.1276. On the downside, the psychological level of 1.1000 and the July 17 high near 1.0950 will be major support zones.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.