EUR/USD turns volatile as US Dollar advances after strong US Services PMI

- EUR/USD falls as US Dollar extends recovery after upbeat US ISM Services PMI report for May.

- The ECB is widely expected to deliver a rate-cut move with a data-dependent approach for the interest rate path.

- Normalizing US labor market conditions has boosted Fed rate-cut bets for September.

EUR/USD drops from 1.0880 in Wednesday’s New York session. The major currency pair falls amid caution ahead of the European Central Bank’s (ECB) interest rate decision, which will be announced on Thursday.

The ECB is widely anticipated to cut its Deposit Facility rate by 25 basis points (bps) to 3.75%. Therefore, investors will focus on the ECB’s guidance on the interest rate outlook to project the next move in the Euro.

Higher-than-expected increase in the Eurozone’s annual Harmonized Index of Consumer Prices (HICP) data, service inflation and Q1 Gross Domestic Product (GDP) suggest that price pressures could become persistent in the coming months. Therefore, ECB officials would prefer to remain data-dependent and push back expectations for subsequent rate cuts. Currently, financial markets expect that the ECB will cut interest rates at least twice this year.

Daily digest market movers: EUR/USD pays less attention to US ADP Employment data

- EUR/USD edges down from 1.0880 as the US Dollar index (DXY) rebounds after upbeat United States (US) Institute for Supply Management’s (ISM) Services Purchasing Managers Index (PMI) data for May. The Services PMI, which gauges the service sector activity that accounts for two-thirds of the economy, returns to expansion at a faster pace and jumps to 53.8 from the estimates of 50.8 and the prior release of 49.4. In the same period, the New Orders Index, which reflects forward demand, jumped to 54.1 from the former release of 52.2.

- In the early American session, the US ADP reported weak private payroll data for May. Number of job-seekers hired by private employers came in at 152K, lower than expectations of 173K and the former reading of 188K, downwardly revised from 192K. A slower hiring pace would deepen fears of normalizing labor market conditions. On Tuesday, the US JOLTS Job Opening report showed that job postings came in lower at 8.06 million in April, from the expectations of 8.34 million and the former release of 8.35 million.

- The perception of normalizing labor market conditions and the economy’s growth prospects have fuelled expectations that the Federal Reserve (Fed) will begin lowering interest rates from the September meeting. The CME FedWatch tool shows that the probability of a rate cut in the September meeting has increased to 65% from 47% a week ago.

- Later this week, the release of the US Nonfarm Payrolls (NFP) report for May will significantly influence market speculation about the Fed reducing interest rates from the September meeting.

Technical Analysis: EUR/USD stays below 1.0900

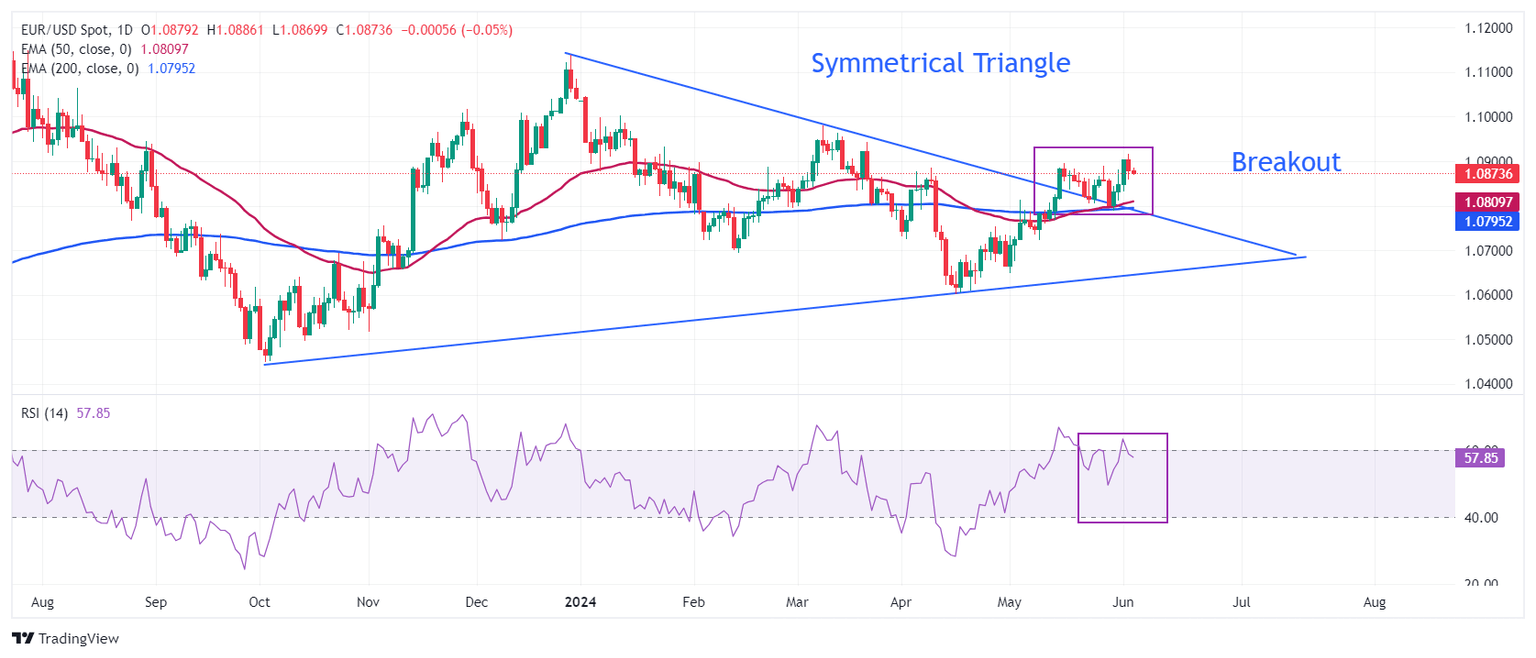

EUR/USD hovers around 1.0880 ahead of crucial US economic data. The major currency pair trades inside Tuesday’s trading range. The near-term outlook of the pair remains firm due to the Symmetrical Triangle breakout on a daily timeframe and upward-sloping 50-day Exponential Moving Average (EMA), which trades around 1.0800.

The 14-period Relative Strength Index (RSI) has slipped into the 40.00-60.00 range, suggesting that the momentum, which was leaned toward the upside, has faded for now.

The major currency pair is expected to extend its upside towards the March 21 high, around 1.0950, and the psychological resistance of 1.1000 if it breaks above the round-level resistance of 1.0900 decisively. However, a downside move below the 200-day EMA at 1.0800 could push it into the bearish trajectory.

Economic Indicator

ISM Services PMI

The Institute for Supply Management (ISM) Services Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US services sector, which makes up most of the economy. The indicator is obtained from a survey of supply executives across the US based on information they have collected within their respective organizations. Survey responses reflect the change, if any, in the current month compared to the previous month. A reading above 50 indicates that the services economy is generally expanding, a bullish sign for the US Dollar (USD). A reading below 50 signals that services sector activity is generally declining, which is seen as bearish for USD.

Read more.Last release: Wed Jun 05, 2024 14:00

Frequency: Monthly

Actual: 53.8

Consensus: 50.8

Previous: 49.4

Source: Institute for Supply Management

The Institute for Supply Management’s (ISM) Services Purchasing Managers Index (PMI) reveals the current conditions in the US service sector, which has historically been a large GDP contributor. A print above 50 shows expansion in the service sector’s economic activity. Stronger-than-expected readings usually help the USD gather strength against its rivals. In addition to the headline PMI, the Employment Index and the Prices Paid Index numbers are also watched closely by investors as they provide useful insights regarding the state of the labour market and inflation.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.