EUR/USD declines as ECB Lagarde acknowledges 50 bps rate cut was discussed

- EUR/USD weakens and slides below 1.0500 as the ECB cuts interest rates by 25 bps.

- The ECB refrained from committing a pre-defined interest rate cut path.

- No surprise in the US CPI data cemented Fed rate cut bets for next week’s meeting.

EUR/USD refreshes weekly low around 1.0470 in Thursday’s North American session after the European Central Bank (ECB) policy meeting in which the central bank reduced its Rate on Deposit Facility by 25 basis points (bps) to 3%, as expected. Similarly, the Main Refinancing Operations Rate was reduced by 25 bps to 3.15%. This was the third straight 25 bps interest rate cut by the ECB in a row and the fourth of the year.

Traders had already priced in 25 bps interest rate cut as Eurozone price pressures seem under control and the economy continues to deteriorate.

The Euro (EUR) is expected to remain under pressure due to dovish remarks from ECB President Christine Lagarde in the press conference. Lagarde acknowledged that officials discussed about reducing interest rates by 50 bps. She said, "Risks to growth are tilted to the downside" as "Trade friction (with the United States) could weigh on growth." The central bank continued to refrain from committing to any pre-defined rate cut path.

The ECB staff sees the headline inflation averaging 2.4% in 2024, 2.1% in 2025, 1.9% in 2026 and 2.1% in 2027. However, Lagarde mentioned, "US tariffs not incorporated into ECB projections."

On the political front, German Chancellor Olaf Scholz submitted a request for a no-confidence vote on December 16 to the President of the Bundestag, Bärbel Bas, a necessary precursor for holding elections on February 23, 2025, Euronews reported. German government collapsed after Scholz dismissed Finance Minister Christian Lindner, dissolving the three-party coalition.

Daily digest market movers: EUR/USD drops while US Dollar bounces back despite dovish Fed bets

- EUR/USD declines as the US Dollar (USD) recovers intraday losses and turns positive in Thursday’s North American session after the release of the US Producer Price Index (PPI) data for November and the Initial Jobless Claims data for the week ending December 6. The US Dollar Index (DXY), which tracks the Greenback value against six major currencies, climbs to near 106.80

- As measured by the PPI, headline producer inflation accelerated to 3% from the estimates and the prior release of 2.6%. The core PPI – which excludes volatile food and energy prices – rose by 3.4%, faster than expectations of 3.2% and the former reading of 3.1%. While traders have priced in a 25-bps interest rate reduction by the Federal Reserve (Fed) in the policy meeting on Wednesday, higher PPI would boost expectations of pausing the easing spell in January.

- According to the CME FedWatch tool, the probability for the Fed to reduce interest rates by 25 bps to 4.25%-4.50% next week has escalated to almost 99%d from 88% on Tuesday.

- Meanwhile, the US Initial Jobless Claims data has come in surprisingly higher than expected. Individuals claiming jobless benefits for the first time were 242K, lower than estimates of 220K and the prior release of 225K.

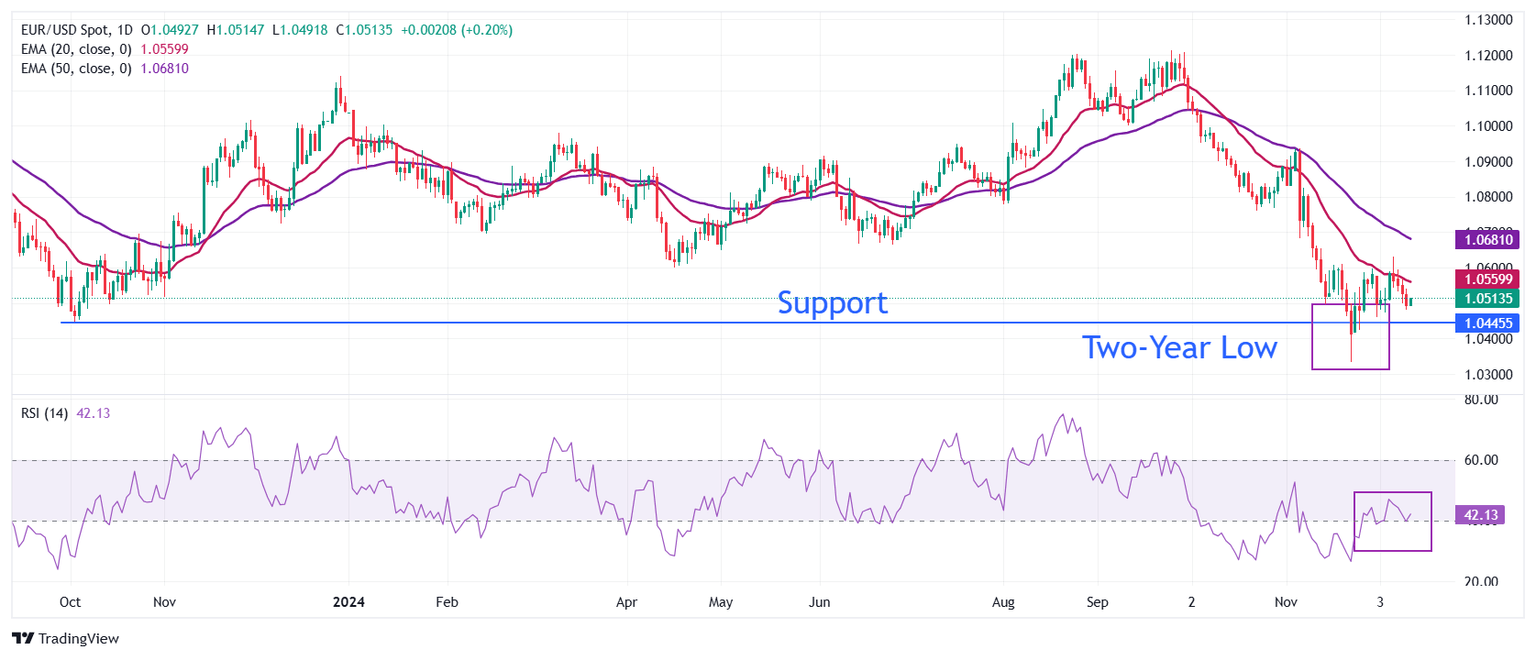

Technical Analysis: EUR/USD dips below 1.0500

EUR/USD falls below the psychological figure of 1.0500. The outlook of the major currency pair remains bearish as the 20-day EMA near 1.0560 acts as key resistance for the Euro (EUR) bulls.

The 14-day Relative Strength Index (RSI) wobbles near 40.00. Should the RSI fall below this level, a bearish momentum will trigger.

Looking down, the November 22 low of 1.0330 will be a key support. On the flip side, the 50-day EMA near 1.0680 will be the key barrier for the Euro bulls.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.