EUR/USD posts fresh seven-month high above 1.1000 on soft US inflation report

- EUR/USD refreshes a seven-month high as the US Dollar remains on the backfoot.

- An expected decline in the US CPI report for July limits the upside in the US Dollar.

- The Euro gains on expectations that the ECB will cut interest rates more gradually.

EUR/USD posts a fresh seven-month high at 1.1035 in Wednesday’s New York session. The major currency pair gains as the US Dollar (USD) remains on backfoot after the United States (US) Consumer Price Index (CPI) report for July showed that price pressures remained in line with market expectations. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, hovers near a fresh weekly low of 102.30.

The US CPI repot showed that monthly headline and core inflation, which strips of volatile food and energy items, rose by 0.2%, as expected. Annual headline CPI rose at a slower pace of 2.9% from the estimates and June's reading of 3%. In the same period, the core CPI decelerated to 3.2%, as expected, from the former reading of 3.3%.

On interest rate guidance, Atlanta Federal Reserve (Fed) Bank President Raphael Bostic said on Tuesday that recent developments have increased the Fed's confidence that inflation will return to 2%, but he wants a little more evidence to endorse interest rate cuts. An expected decline in US inflation data would boost policymakers' confidence that inflation is on track to return to the desired rate of 2%.

However, market expectations for the Federal Reserve (Fed) to cut interest rates aggressively in September have eased. Currently, the CME FedWatch tool shows that traders price in a 415% chance for a 50 basis point (bp) rate reduction in September, down from 54.5%, recorded before the release of the inflation report.

The US Dollar was already on the backfoot due to a softer-than-expected US Producer Price Index (PPI) report for July. Headline and core PPI, softened on a monthly as well as annual basis. This suggests that producers are losing pricing power due to deteriorating demand conditions.

Daily digest market movers: EUR/USD's strength is backed by firm Euro

- EUR/USD clings to gains above 1.1000 in Wednesday’s New York session. The major currency pair is upbeat due to the outperformance of the Euro (EUR) against its major peers. The Euro performs strongly on expectations that the European Central Bank (ECB) will cut its key borrowing rates further, although in a gradual manner.

- The ECB started its policy-easing cycle in June after officials gained confidence that price pressures will return to bank’s target of 2% in 2025. However, policymakers continued to refrain from committing a pre-defined interest-rate cut approach as they worry that an aggressive expansionary monetary policy stance could re-accelerate inflation again.

- A Reuters poll carried out between August 8-13 showed that over 80% of respondents expect the ECB to cut interest rates two more times this year, one in September and the other in December.

- On the economic front, the Eurostat has released revised estimates of flash Q2 Gross Domestic Product (GDP). The report showed that the Eurozone economy expanded by 0.3%, in line with flash figures and the growth rate recorded in the first quarter of this year.

Euro Price Today:

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the New Zealand Dollar.

| EUR | USD | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| EUR | 0.25% | 0.38% | 0.45% | 0.23% | 0.28% | 1.29% | 0.00% | |

| USD | -0.25% | 0.13% | 0.21% | -0.01% | -0.02% | 1.06% | -0.24% | |

| GBP | -0.38% | -0.13% | 0.09% | -0.13% | -0.10% | 0.93% | -0.34% | |

| JPY | -0.45% | -0.21% | -0.09% | -0.20% | -0.19% | 0.83% | -0.39% | |

| CAD | -0.23% | 0.00% | 0.13% | 0.20% | 0.00% | 1.05% | -0.19% | |

| AUD | -0.28% | 0.02% | 0.10% | 0.19% | -0.01% | 1.00% | -0.25% | |

| NZD | -1.29% | -1.06% | -0.93% | -0.83% | -1.05% | -1.00% | -1.23% | |

| CHF | -0.01% | 0.24% | 0.34% | 0.39% | 0.19% | 0.25% | 1.23% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

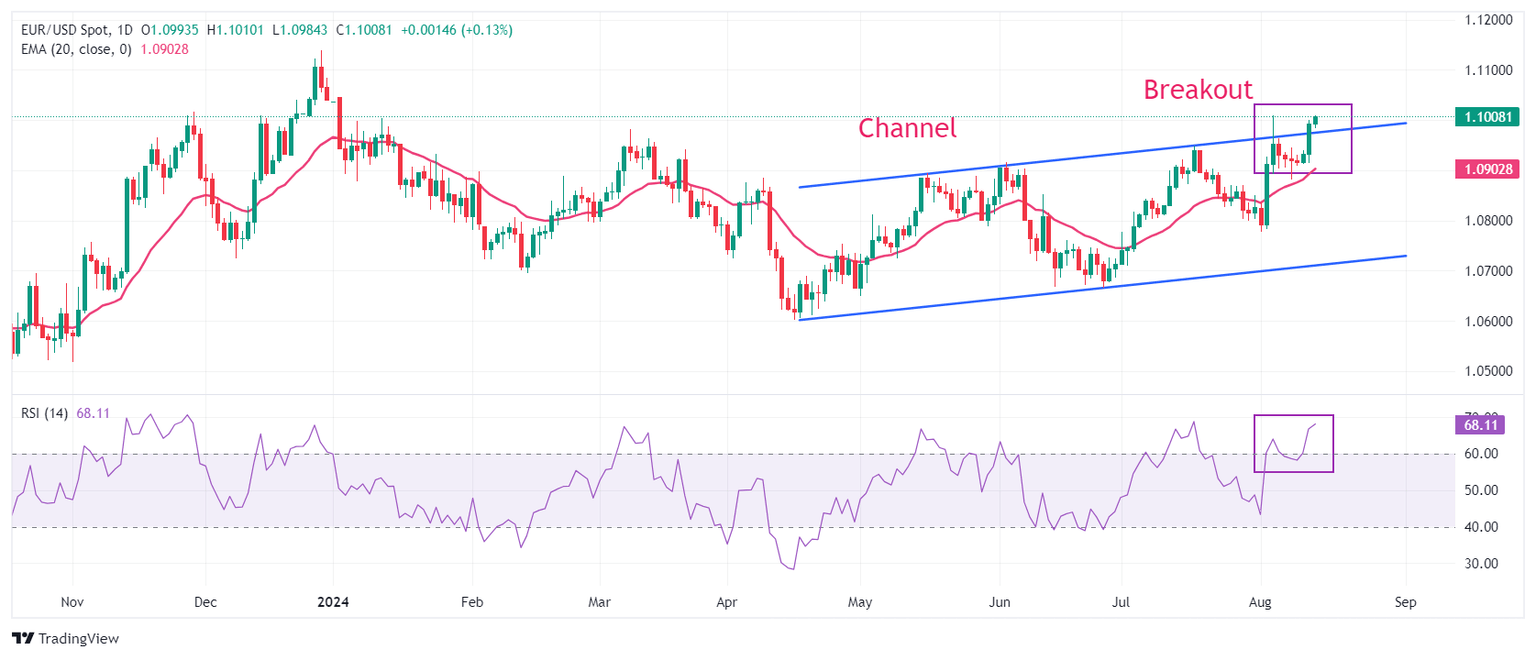

Technical Analysis: EUR/USD appears as stabilized above 1.1000

EUR/USD posts a fresh seven-month high above 1.1000. The major currency pair strengthens after a breakout of the Channel formation on a daily time frame. The upward-sloping 20-day Exponential Moving Average (EMA) near 1.0900 suggests that the near-term outlook of the shared currency pair is bullish.

The 14-day Relative Strength Index (RSI) jumps into the 60.00-80.00 range, indicating that the momentum has leaned to the upside.

On the upside, the August 10, 2023, high at 1.1065 and the round-level resistance of 1.1100 will act as a major barricade for the Euro bulls.

Alternatively, a downside move below August 1 low at 1.0777 would drag the asset toward February low near 1.0700. A breakdown below the latter would expose it to the June 14 low at 1.0667.

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Wed Aug 14, 2024 12:30

Frequency: Monthly

Actual: 3.2%

Consensus: 3.2%

Previous: 3.3%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.