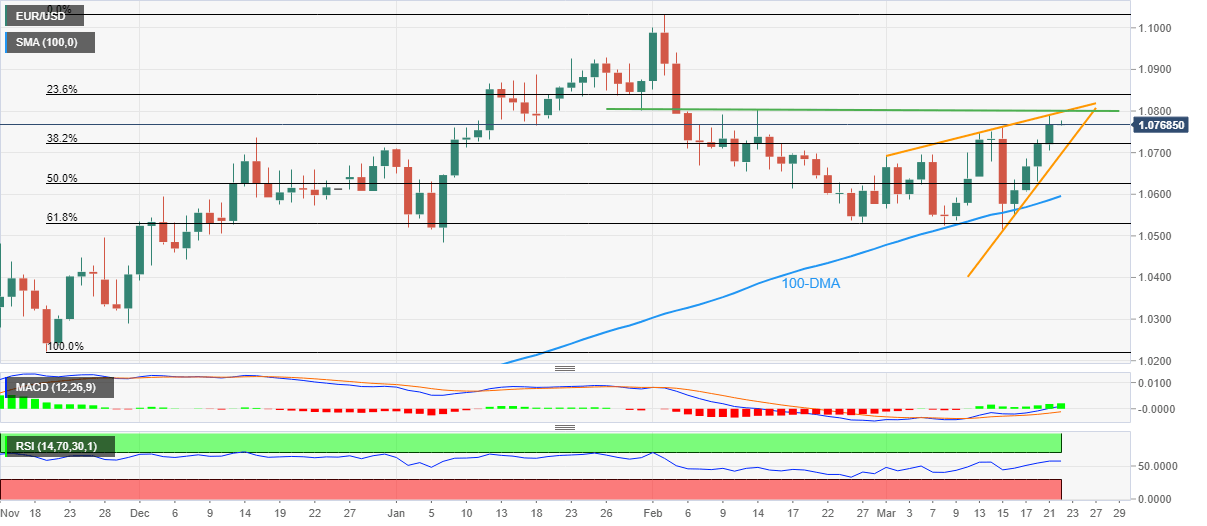

EUR/USD Price Analysis: Monthly triangle teases momentum traders near 1.0780 ahead of Fed

- EUR/USD struggles for clear directions around five-week high inside short-term ascending triangle.

- Sustained trading above 100-DMA, upbeat oscillators favor four-day uptrend but pre-Fed anxiety challenges traders.

- Mid-February high adds strength to 1.0800 upside hurdle; Euro sellers can return on 1.0700 break.

EUR/USD treads water around 1.0770-80 as pre-Fed anxiety intensifies during early Wednesday. Adding strength to the cautious mood could be a speech from European Central Bank (ECB) President Christine Lagarde, as well as an ascending triangle formation established since March 01.

Also read: EUR/USD aptly portrays pre-Fed anxiety below 1.0800, ECB’s Lagarde eyed

It should be noted, however, that the Euro pair’s successful rebound from the 100-DMA joins the bullish MACD signals and upbeat RSI (14) line, not overbought, to keep the buyers hopeful.

That said, the area between 1.0800 and 1.0700 currently restricts the EUR/USD pair’s moves. Adding strength to the 1.0800 hurdle is the late January low and February 14 swing high. Hence, the EUR/USD pair buyers have a tough run to the north.

On the contrary, a downside break of the 1.0700 support can quickly drag the quote toward the 100-DMA support level surrounding 1.0595.

Though, the 61.8% Fibonacci retracement level of the EUR/USD pair’s run-up between late last November and early February, around 1.0530, can test the bears afterward.

Meanwhile, a successful break of the 1.0800 resistance confluence won’t hesitate to aim for January’s high of near 1.0930 before targeting the Year-To-Date (YTD) high marked in February around 1.1035.

EUR/USD: Daily chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.