EUR/USD Price Analysis: Extends recovery above 1.0660 as investors’ risk-taking capacity improves

- EUR/USD has rebounded above 1.0660 as the risk appetite of the market participants has improved.

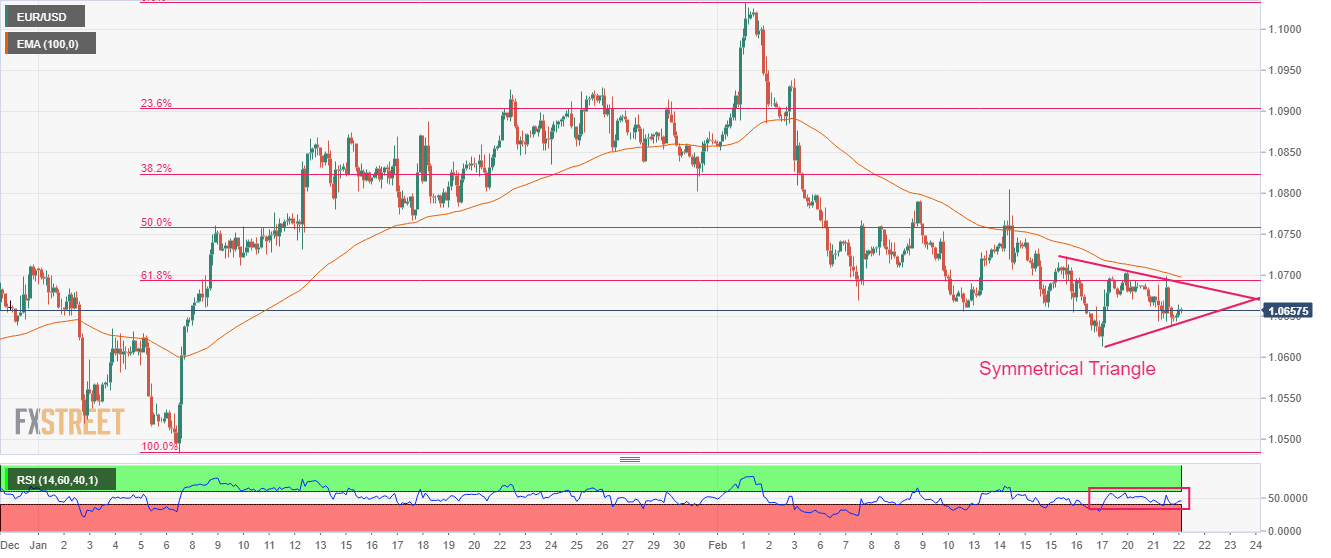

- The formation of the Symmetrical Triangle below the 61.8% Fibo retracement is indicating a volatility contraction.

- ECB Lagarde has confirmed the continuation of the 50 bps interest rate hike ahead.

The EUR/USD pair has sensed a buying interest after dropping to near 1.0640 in the Asian session. The major currency pair has rebounded as the risk appetite of the market participants has improved. The US Dollar Index (DXY) is struggling to recover after a corrective move amid a rebound in the risk-on mood, however, it would be early considering the positive risk impulse extremely solid as investors are awaiting the release of the Federal Open Market Committee (FOMC) minutes.

S&P500 futures have some decent gains in the Asian session after an intense sell-off on Tuesday. Long weekend-inspired volatility and upbeat preliminary United States S&P PMI figures were sufficient to force investors to dump US stocks.

On the Eurozone front, European Central Bank (ECB) President Christine Lagarde clearly announced “Headline inflation has begun to slowdown but reiterated that they intend to raise the key rates by 50 basis points (bps) at the upcoming policy meeting. She also cited that the central bank is not seeing a wage-price spiral in the Eurozone.

EUR/USD is continuously facing barricades around the 61.8% Fibonacci retracement (placed from January 6 low at 1.0483 to February high at 1.1033) at 1.0693. The formation of the Symmetrical Triangle chart pattern is indicating a volatility contraction in the asset.

The 100-period Exponential Moving Average (EMA) at around 1.0700 will continue to act as a major barricade for the Euro bulls.

Meanwhile, the Relative Strength Index (RSI) (14) is on the verge of slipping into the bearish range of 20.00-40.00. An occurrence of the same will trigger a downside momentum.

A decisive downside move below February 17 low at 1.0613 will drag the asset toward December 22 low at 1.0573. A slippage below the latter will extend the downside toward January 6 low at 1.0483.

In an alternate scenario, a break above February 16 high at 1.0722 will drive the asset toward 50% Fibo retracement at 1.0758, followed by February 14 high around 1.0800.

EUR/USD two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.