EUR/USD dives to near three-week low ahead of Eurozone inflation and Fed policy

- EUR/USD falls to near 1.0800 ahead of crucial Eurozone/US events.

- The ECB may cut interest rates two more times this year.

- The Fed is expected to openly endorse rate cuts in September.

EUR/USD drops to near 1.08000 in Monday’s American session as the US Dollar (USD) rises, with investors focusing on the Federal Reserve’s interest rate decision. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, jumps to near 104.50. The Fed is expected to leave interest rates unchanged in the range of 5.25%-5.50%. Therefore, investors will keenly focus on the monetary policy statement and Fed Chair Jerome Powell’s press conference to get fresh cues about rate cuts.

Market experts see the Fed communicating openly about rate cuts in the September meeting amid significant progress in inflation declining towards the bank’s target of 2% and rising risks to the labor market. Fears of inflation remaining persistent have waned as input prices have decelerated significantly in the last quarter. Flash United States (US) Q2 GDP report showed that the Price Index decelerated at a faster pace to 2.3% from the estimates of 2.6% and the prior release of 3.1%.

Also, sticky US core Personal Consumption Expenditures Price Index (PCE) data for June failed to dash expectations of Fed rate cuts in September. Monthly core PCE inflation grew at a higher pace of 0.2% from expectations and the prior release of 0.1%, with annual figures growing steadily by 2.6%.

This week, investors will also focus on a slew of economic data such as JOLTS Job Openings for June, ADP Employment Change, ISM Manufacturing Purchasing Managers Index (PMI), and Nonfarm Payrolls data for July.

Daily digest market movers: EUR/USD tumbles ahead of key economic events

- EUR/USD weakens to near 1.0800 in Monday’s European session. The major currency pair declines amid uncertainty ahead of the Eurozone preliminary Harmonized Index of Consumer Prices (HICP) for July and the Federal Reserve’s (Fed) monetary policy announcement on Wednesday.

- The Eurozone inflation data will indicate whether market expectations for two more rate cuts by the European Central Bank (ECB) this year are appropriate. A few ECB policymakers are comfortable with speculation of two more rate cuts amid a dismal economic outlook and confidence that price pressures are on track to return to the desired rate of 2% next year. Annually, headline and core HICP, which excludes volatile items like food, energy, alcohol, and tobacco, are estimated to have decelerated to 2.3% and 2.8%, respectively.

- Admitting to slower demand in the Eurozone’s largest nation, German Finance Minister Christian Lindner announced tax relief for corporations and households to spur spending and investment.

- Before the Eurozone inflation data, investors will focus on the preliminary Eurozone Q2 Gross Domestic Product (GDP) and inflation data of Germany and Spain, which will be published on Tuesday.

Technical Analysis: EUR/USD skids to near 1.0800

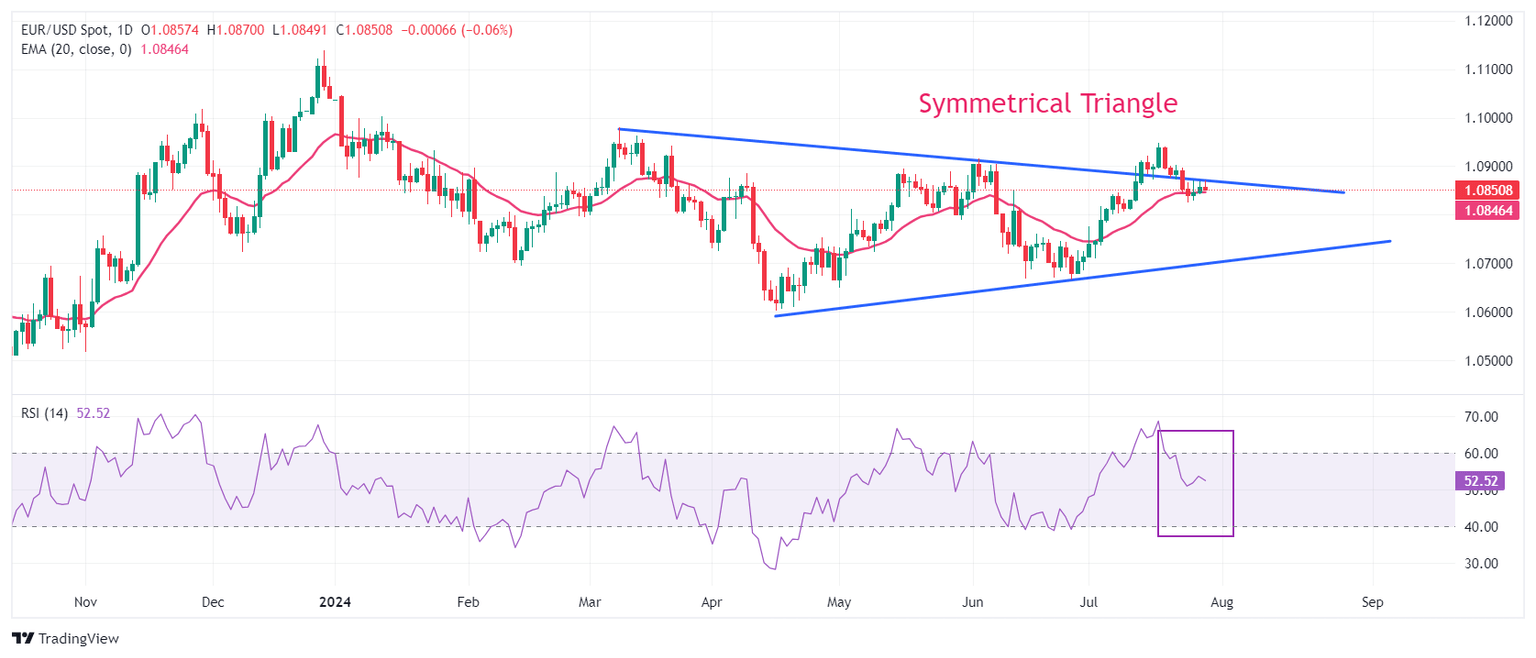

EUR/USD dips to near 1.0800. The shared currency pair remains inside a Symmetrical Triangle formation on a daily timeframe after failing to hold the breakout. The major currency pair extends its downside below the 20-day Exponential Moving Average (EMA), which trades around 1.0840. The shared currency pair could slide further towards round-level supports near 1.0800 and 1.0700.

The 14-day Relative Strength Index (RSI) returns within the 40.00-60.00 range, suggesting the bullish momentum has faded.

On the upside, the round-level resistance of 1.0900 will be a key barrier for the Euro bulls.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.