XRP price flashes multiple buy signals as Trump pauses tariffs, escalates trader war with China

- XRP reclaims the crucial $2 level as President Trump makes a classic U-turn on reciprocal tariffs.

- Massive liquidations hit short-position traders as cryptocurrencies rebounded on Thursday.

- A spike in open interest per Coinglass data signals heightened activity and growing bullish sentiment.

Ripple (XRP) stabilizes above $2.0020 on Thursday after gaining 14% in the past 24 hours. The cross-border money transfer token trades at $2.0007 at the time of writing, suggesting growing bullish sentiment across global markets. Traders quickly regained interest in the crypto market amid surging open interest, per Coinglass data. Higher support is expected to bolster XRP's bullish outlook going into the weekend.

XRP recovery liquidates short traders

XRP price rebound from the Monday low signifies the resilience of the crypto market, considering over $1 billion was wiped off the market in liquidations at the start of the week. Trump’s incessant push for reciprocal tariffs had squeezed market liquidity, leaving most investors paralyzed.

However, the President made a stunning U-turn on Wednesday, less than 24 hours after the announced tariffs kicked in, extending relief to dozens of countries and handing global markets a new lifeline, as reported by FXStreet. The relief traversed Asian markets on Thursday, including Chinese stocks, despite Trump escalating the tariff war with China.

Cryptocurrencies generally recovered in the late American session on Wednesday and into the Asian session on Thursday. Bitcoin hit a daily high of $83,541 before correcting to $82,433 at the time of writing.

Altcoins, led by the most prominent smart contracts token, Ethereum (ETH), responded positively to the new lifeline, which has been increasing from the persistent dips since April 2. Ether has gained 13.7% to hover at $1,613, while BNB soars to trade at $574 in the late Asian session.

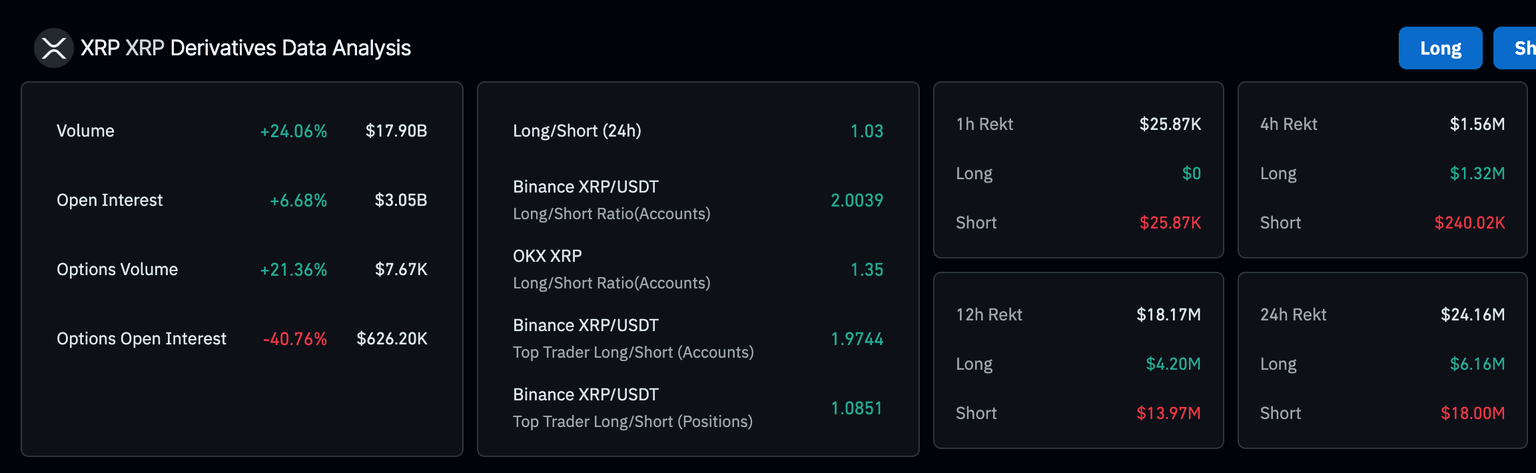

According to Coinglass data, the international money transfer token has posted an impressive 6.68% increase in derivatives open interest (OI) to $3.05 billion. Meanwhile, the XRP options volume rallied 21.36% to $7,670.

Following the massive liquidations on Monday, which battered long-position traders the most, President Trump’s tariff U-turn caught short-position traders by surprise, liquidating $18 million. $24.16 million has been liquidated in the last 24 hours, implying that $6.16 million in long positions had been forcefully closed.

XRP derivatives analysis data | Source: Coinglass

A spike in OI implies that the number of outstanding contracts or options is increasing, which translates to a spike in the inflow of money. It signals heightened activity and a growing bullish sentiment. Therefore, if this trend continues in the next few days, XRP may gain momentum above $2.0000 and increase the chances of a breakout to the next key resistance at $2.5000.

XRP about to flash a buy signal

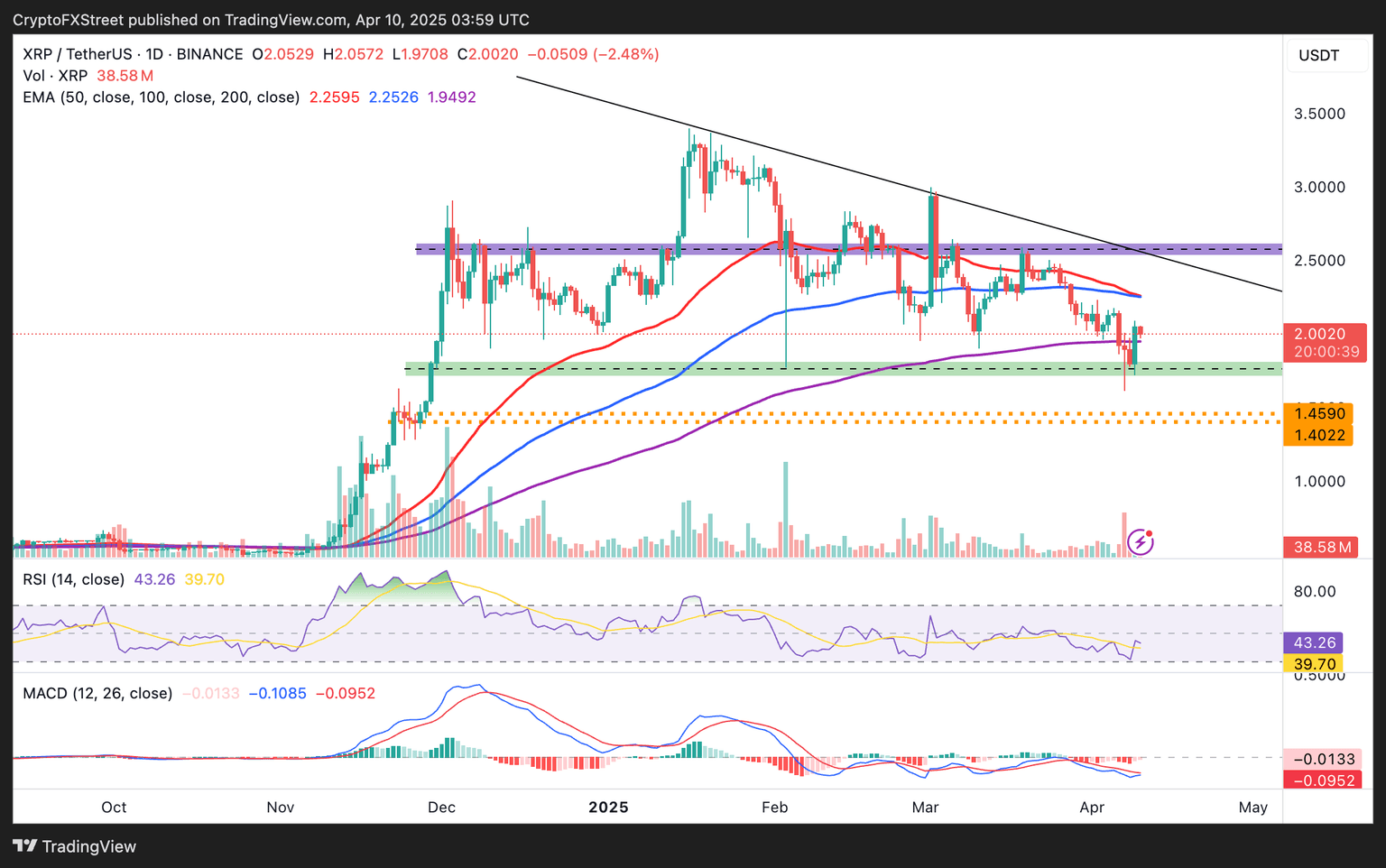

The recovery from the Monday low of $1.6128 to highs above $2.0000 in the last 24 hours makes XRP attractive to long traders, especially with the Moving Average Convergence Divergence (MACD) indicator’s likelihood of sending a buy signal. However, a daily close above $2.0000 will protect these gains and possibly encourage traders to seek more exposure to XRP. Traders may want to watch out for the MACD line (blue) crossing above the signal line (red) to validate the uptrend.

XRP/USD daily price chart

The 200-day Exponential Moving Average (EMA) is slightly below the $2.0000 level at $1.9485. Holding above this second immediate support would further affirm the bullish grip.

Still, the ever-looming macroeconomic risk tied to President Trump’s unpredictable tariff policy remains a concern. It’s shifting constantly, leaving traders on edge and pushing them to make smarter moves—like using dollar-cost averaging or other risk management tools to safeguard their capital.

Declines below the support shown in green may open the door to losses targeting the dotted lines around $0.4500, an area last tested in November 2024.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren