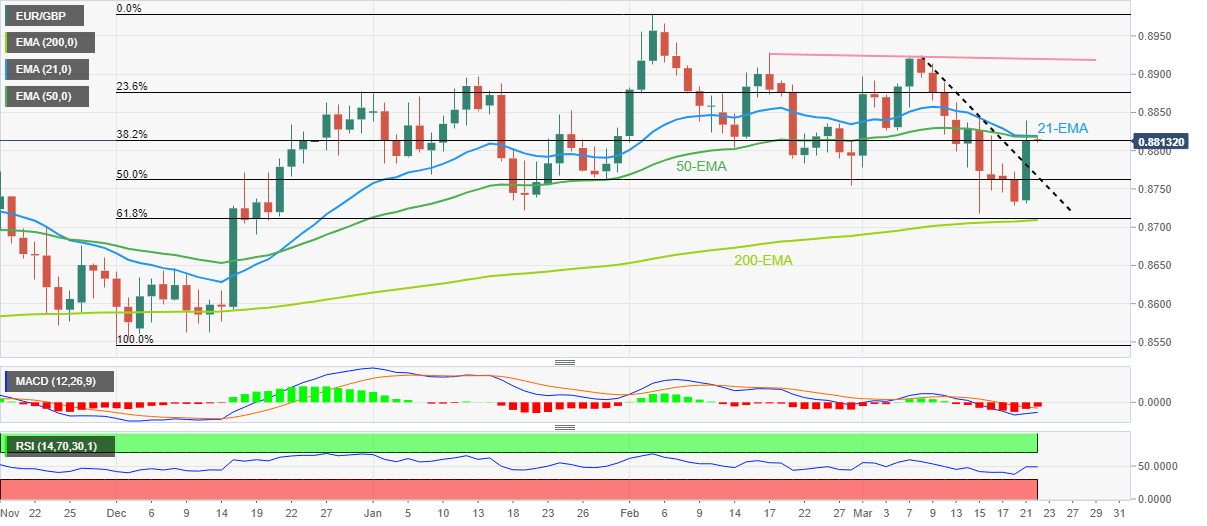

EUR/GBP Price Analysis: Key EMA confluence prods bulls around 0.8820 hurdle

- EUR/GBP retreats from the key EMA convergence after rising the most in three months.

- Steady RSI, easing bearish MACD signals keep buyers hopeful backed by a clear upside break of two-week-old trend line.

- 200-EMA, 61.8% Fibonacci retracement constitutes strong support to challenge bears.

EUR/GBP treads water around 0.8810-15, after rising the most in three months, as it braces for the key UK data/events during early Wednesday.

In doing so, the cross-currency pair retreats from the convergence of the 21-day and 50-day Exponential Moving Average (EMA).

However, the recent easing in the bearish bias of the MACD signals and steady RSI joins the EUR/GBP pair’s successful break of a two-week-old descending trend line to keep the buyers hopeful of crossing the 0.8820 resistance confluence.

Following that, a run-up towards the 0.8900 round figure can’t be ruled out.

However, a downward-sloping resistance line from mid-February, around 0.8920 by the press time, could challenge the EUR/GBP bulls afterward.

On the contrary, pullback moves gain importance only on breaking the previous resistance line, around 0.8765 at the latest.

Even so, a convergence of the 200-EMA and 61.8% Fibonacci retracement level of the EUR/GBP pair’s run-up from December 2022 to February 2023, around 0.8710, appears a tough nut to crack for the pair sellers.

To sum up, EUR/GBP is likely to grind higher but the upside momentum had multiple hurdles to crack.

EUR/GBP: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.