Crude Oil sees rally halts on the back of OPEC+ report dragging Oil prices lower

- Oil prices are for failing to hold on this week's winning streak.

- The EIA report from Wednesday showed Cushing Crude Supply fell to a seven-year low.

- The US Dollar Index trades stronger after the European Central Bank interest-rate decision failed to convince markets.

Crude Oil sees its attempts for booking a fourth straight day of gains failing, after a 2.5% price increase on Wednesday. The earlier surge came after the weekly report from the Energy Information Administration (EIA) revealed that US stockpiles at Cushing plunged to just 22.9 million barrels, the lowest level since 2007. Meanwhile, Oil traders focus back on the latest forecasts from OPEC, which downwardly revised global Oil demand by 210,000 barrels per day. .

The US Dollar Index (DXY) – which measures the performance of the US Dollar (USD) against a basket of currencies – is trading stronger after the European Central Bank (ECB) released its last policy decision for 2024, with an interest rate cut of 25 basis points, lowering the policy rate to 3%. In the US, Wednesday’s Consumer Price Index (CPI) data appeared to be enough for traders to raise bets on a rate cut for the Federal Reserve meeting next week.

At the time of writing, Crude Oil (WTI) trades at $69.11 and Brent Crude at $72.60.

Oil news and market movers: OPEC+ report sluggish

- The Energy Information Administration (EIA) report on Wednesday revealed that stockpiles at Cushing, Oklahoma, plunged by the most since early September after a 1.3 million barrel drawdown. That brings them to just 22.9 million barrels, their lowest seasonal level since 2007. Lower imports from Canada probably contributed to the draw, Bloomberg reports.

- In its monthly report, The Organization of Petroleum Exporting Countries (OPEC) chopped projections for consumption growth in 2024 by 210,000 barrels a day to a total of 1.6 million barrels a day, Reuters reports. This means that OPEC has slashed its projections by 27% since July.

- Russian Oil company Rosneft has agreed to supply about 500,000 bpd of crude to Indian refiner Reliance, Reuters reports, citing three people familiar with the matter.

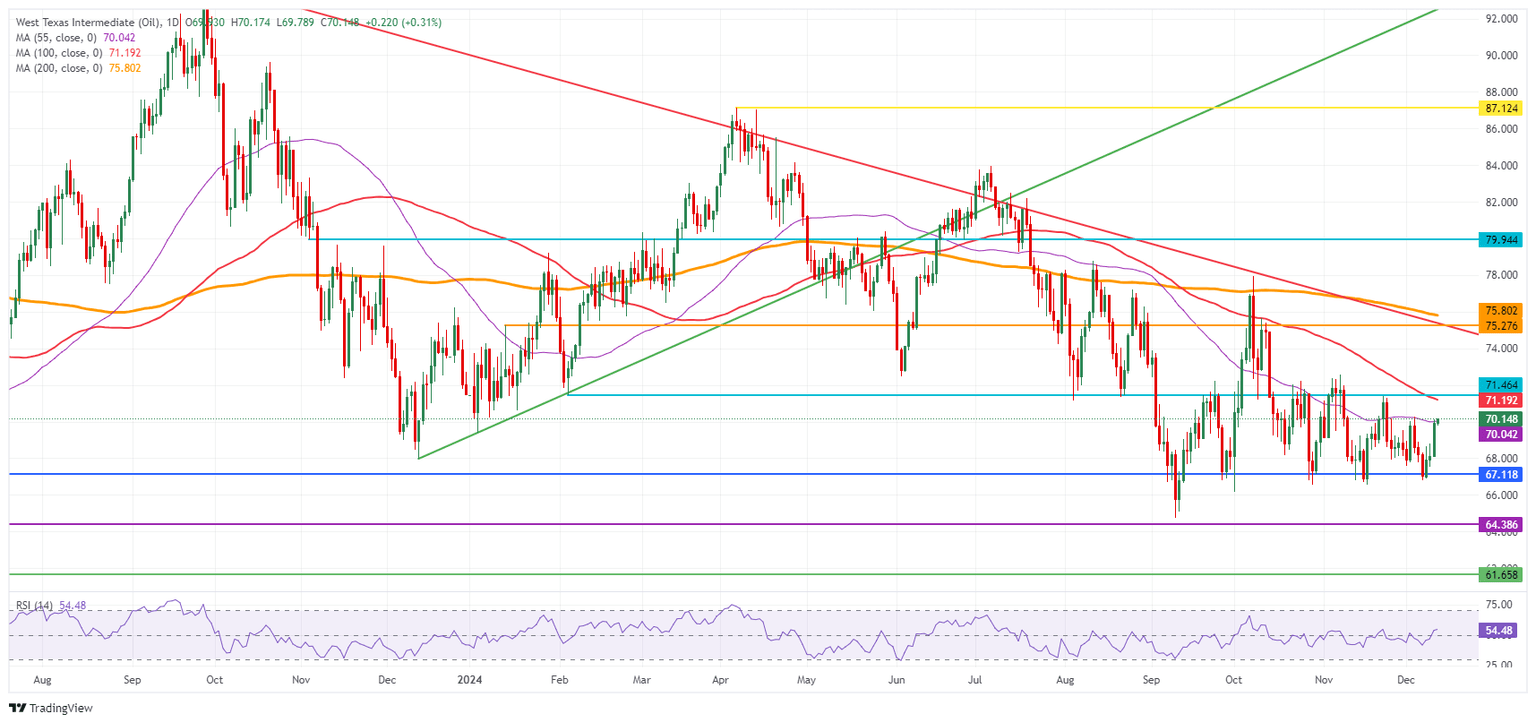

Oil Technical Analysis: Rally short lived

Crude Oil price popped higher as volumes start to diminish going into the year-end. Such a spike can happen when markets like the commodity sector are starting to see thinner volumes being traded. Should another leg higher take place this Thursday, the $71.50 level and beyond can not be ruled out before Christmas.

The 55-day Simple Moving Average (SMA) at $70.04 is being tested and needs to see a hold and daily close above it in order to become support. Further up, $71.46 and the 100-day SMA at $71.19 will act as thick resistance. In case Oil traders can plough through that level, $75.27 is up next as a pivotal level.

On the downside, it is too early to see if that 55-day SMA will act as support at $70.04. That means that $67.12 – a level that held the price in May and June 2023 – is still the first solid support nearby. In case that breaks, the 2024 year-to-date low emerges at $64.75 followed by $64.38, the low from 2023.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.