AUDUSD Price Analysis: A deceleration opens risk of a break to 0.6650 and below

- AUDUSD bears are lurking below 0.6750 for the open.

- 0.6620 and 0.657 are guarding the 0.6550 target area.

As per the prior analysis heading towards the final sessions for the week, AUDUSD Price Analysis: Bears hold the fort at a 50% mean reversion, the price indeed was held off by the bears for a test into the 0.64 figure and a touch below as follows:

AUDUSD prior analysis

The analysis explained that the bears were still in play on the hourly chart while below the 50% mean reversion level. There were prospects of a downside extension to test 0.6400 the figure as illustrated above, unfolding as follows:

AUDUSD outlook

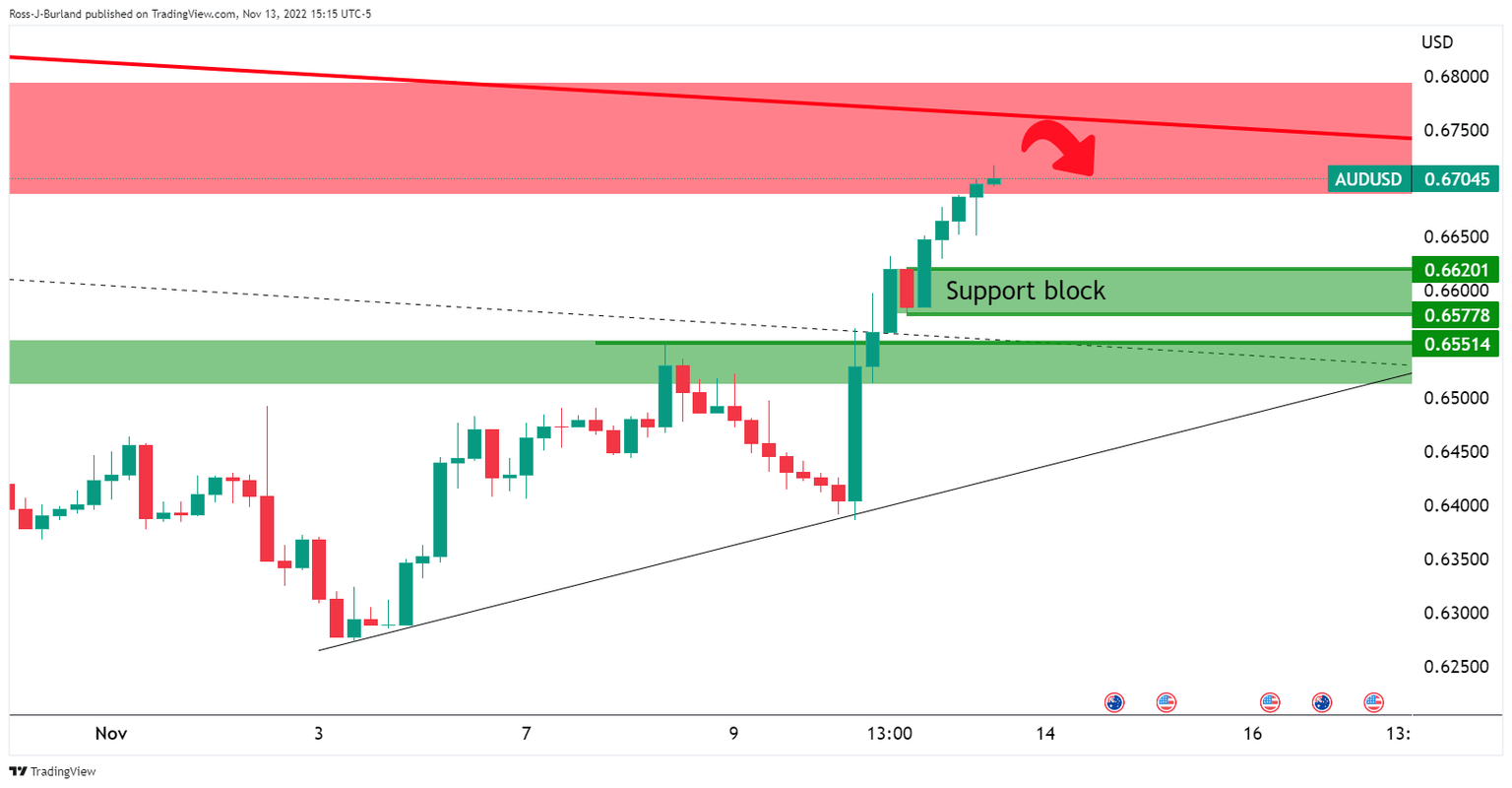

AUDUSD weekly chart

From a weekly perspective, the price is meeting a critical area of resistance and the downside is up for grabs in the open. While there are prospects of a move higher, deeper into the resistance, any deceleration in the correction could be an opportunity for the bears for the opening sessions this week.

AUDUSD daily chart

With the price in resistance, as it stands, a support zone around 0.6550 is eyed as a downside target while on the front side of the bearish trend.

AUDUSD H4 chart

The 4-hour chart shows the support block located at 0.6620 and 0.6577, guarding the 0.6550 target area.

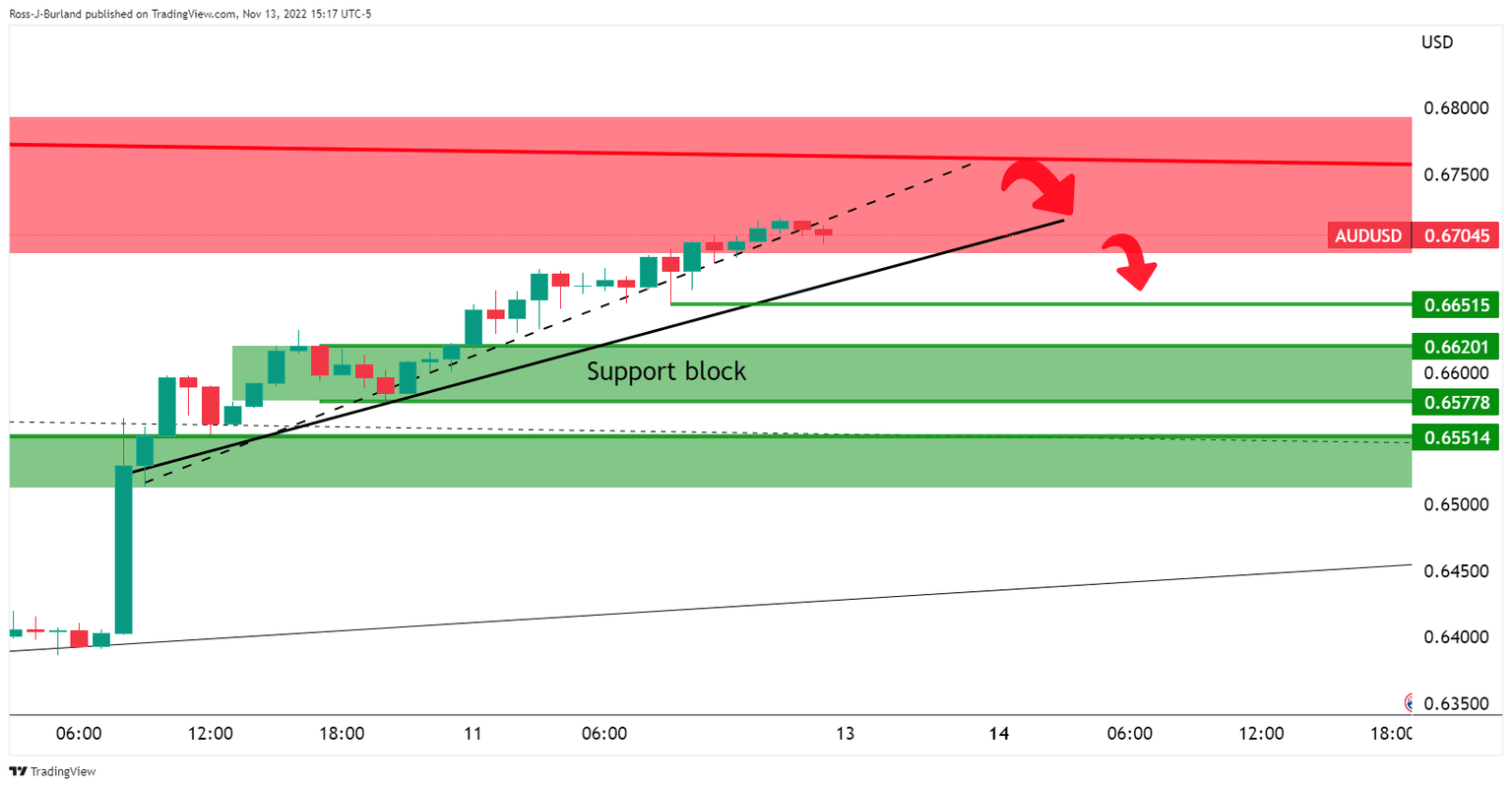

AUDUSD H1 chart

The price is decelerating on the hourly chart on the break of the micro trendline and hourly close below it. However, there is some way to go until the 0.6650s below the next support line, although bears will be lurking in the open this week while the price remains below 0.6750, tempted to face tests above.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.