AUD/USD rises amid weak ISM PMI, ahead of Aussie’s data

- AUD/USD rises to 0.6693, buoyed by weaker US business activity data and falling Treasury yields.

- ISM Manufacturing PMI dips to 48.7, signaling contraction, while S&P Global PMI shows slight recovery.

- Upcoming US Nonfarm Payrolls report and Australian economic data could influence AUD/USD direction.

The Australian Dollar registered gains of 0.55% versus the Greenback on Monday and opened Asian Tuesday’s session with renewed strength amid falling US yields. Expectations that the Federal Reserve would ease policy in 2024 were fueled by a weaker-than-expected US business activity report. The AUD/USD trades at 0.6693, virtually unchanged.

Aussie Dollar up as US yields drop and undermine the buck

US data was the driver of the day. The Institute for Supply Management (ISM) reported that business activity in the manufacturing sector slowed in May for the third straight month. The ISM Manufacturing PMI decreased from 49.2 to 48.7 for the second straight reading at contractionary ground and below the consensus of 49.6.

Other data from S&P Global highlighted a recovery for the same sector, with the Manufacturing PMI expanding from 50 to 51.3, which is above estimates of 50.9.

The AUD/USD advanced due to overall US Dollar weakness, undermined by lower US Treasury yields. The US 10-year Treasury bond yields plunged eleven basis points to 4.392%, while the US Dollar Index (DXY) dove 0.5% to 104.07. However, US data ahead could change the pair's direction as the release of the US Nonfarm Payrolls report looms.

Fed funds rate futures estimate just 32 basis points of interest rate cuts in 2024, according to data from the Chicago Board of Trade (CBOT).

On Australia’s front, the schedule will feature Company Gross Profits and Business Inventories for the first quarter of 2024, on QoQ figures, along with the Current Account for the same period and the final Retail Sales report for April. month.

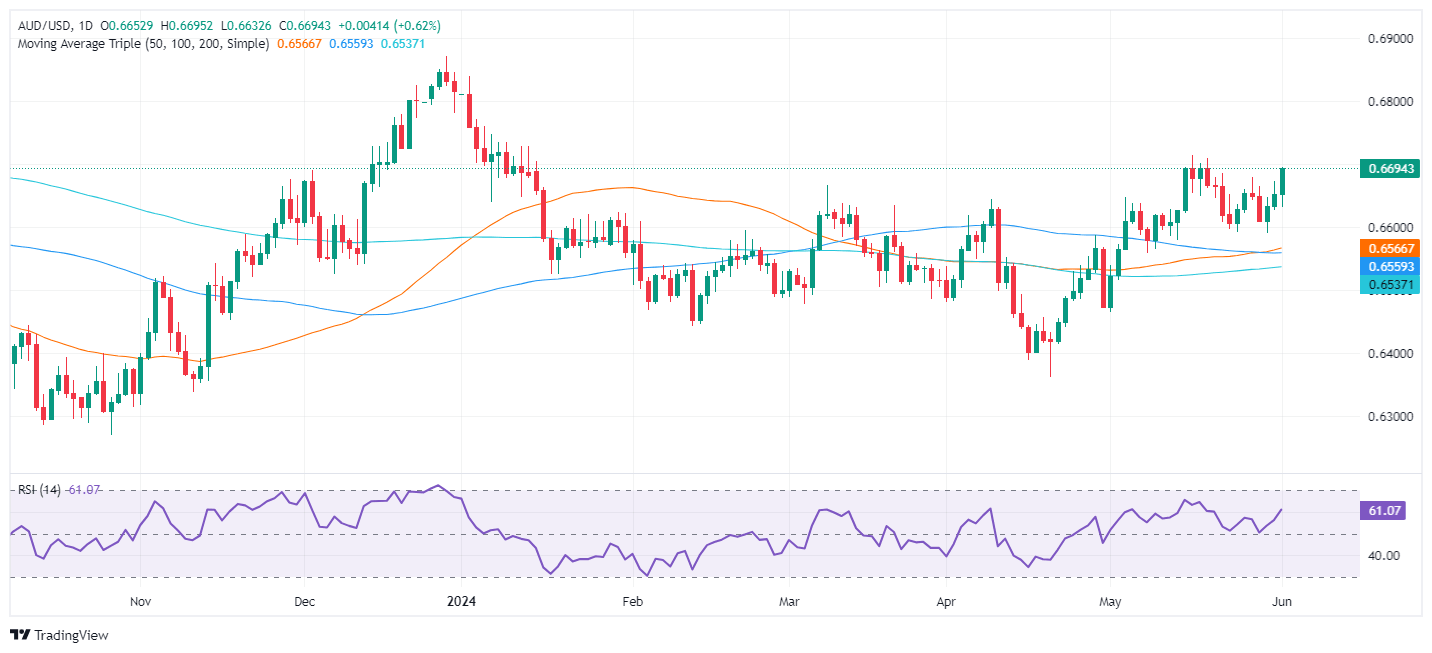

AUD/USD Price Analysis: Technical outlook

From a technical perspective, a ‘double bottom’ chart pattern looms, which could pave the way to test 0.6750 and beyond. However, to confirm its validity, buyers must crack the latest cycle high of 0.6714 before reaching 0.6750 and the 0.6800 figure. Otherwise, if sellers moved in and kept prices below 0.6700, look for a retest of the 0.6600 figure.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.