AUD/USD downside compelling for the days ahead

- AUD/USD downside expectations as the markets buy into the US dollar.

- The FOMC and domestic CPI data will be the focus for the week ahead.

AUD/USD is starting the week off flat in a quiet beginning to what is expected to bring plenty of actin considering what is at stake in the Federal Open Market Committee.

At the time of writing, AUD/USD is trading at 0.7363 and between a 6 pip range in early Asia.

With risk sentiment volatile, AUD/USD has moved below the 0.7400 level for the first time since late 2020.

A correction in iron ore prices has also been a thorn in the side of the currency that had benefitted from strong prices earlier in the year.

There is nothing domestic of note on the calendar for today but the week’s main event in Australia is the release of the second-quarter inflation figures.

However, the Reserve Bank of Australia is particularly dovish at the moment and It is not likely that one high inflation reading is going to be enough to generate a U-turn in their tone.

However, covid risks are problematic for the currency. Sydney is reported to announce an extended lockdown today until mid-September. Continuing lockdown restrictions were imposed on Greater Sydney four weeks ago, so it is not a new development to cause too much disruption in forex.

Instead, all eyes will be on the US dollar.

The greenback has benefitted the most so far and since June when FX volatility picked up and the currency would be expected to remain firm into Wednesday’s FOMC meeting.

The Federal Reserve will have to deal with the reality of above-trend growth and higher than first expected inflationary pressures.

The Fed will be expected to indicate that tapering should emerge in 4Q this year, with the possibility of a first hike coming in 4Q22.

If 2Q21 GDP growth – expected at 8-9% quarter-on-quarter annualized – plus also June readings for personal consumption and the PCE deflator, all arrive strong, the US dollar should continue to gain.

Subsequently, this could weigh on the commodity-fx for the weeks ahead, particularly the Aussie.

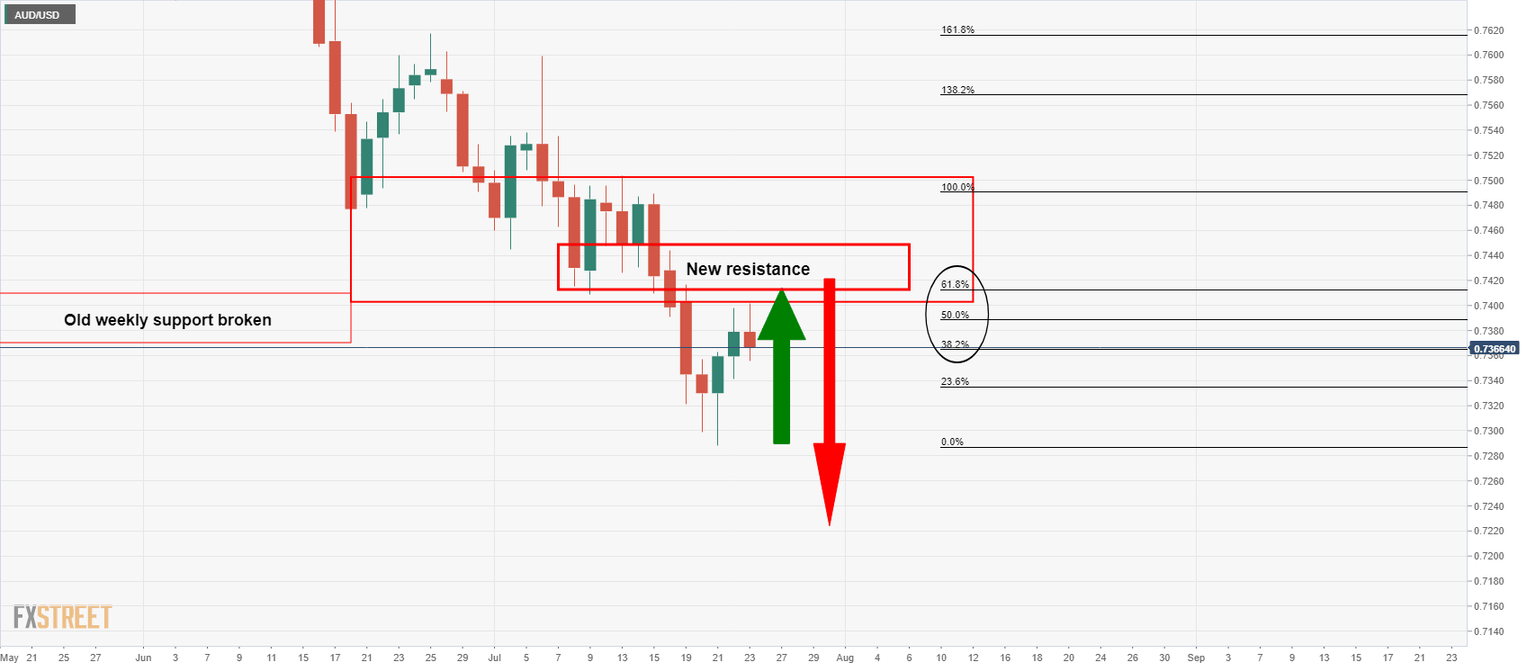

AUD/USD technical analysis

Chart of the Week: Commodity-FX in focus, bears in control

As per the above analysis, ''from a daily perspective, the price has corrected 50% of the prior daily bearish impulse near 0.7390 and bears are looking for an imminent optimal short entry point on the lower time frames:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.