Apple (AAPL) Stock Price and Forecast: Three reasons why Apple stock will fall on Thursday

- Apple is just short of new all-time highs on Wednesday.

- AAPL has rallied from the low $120s in a strong move.

- Big tech FAANG stocks have been setting all-time highs.

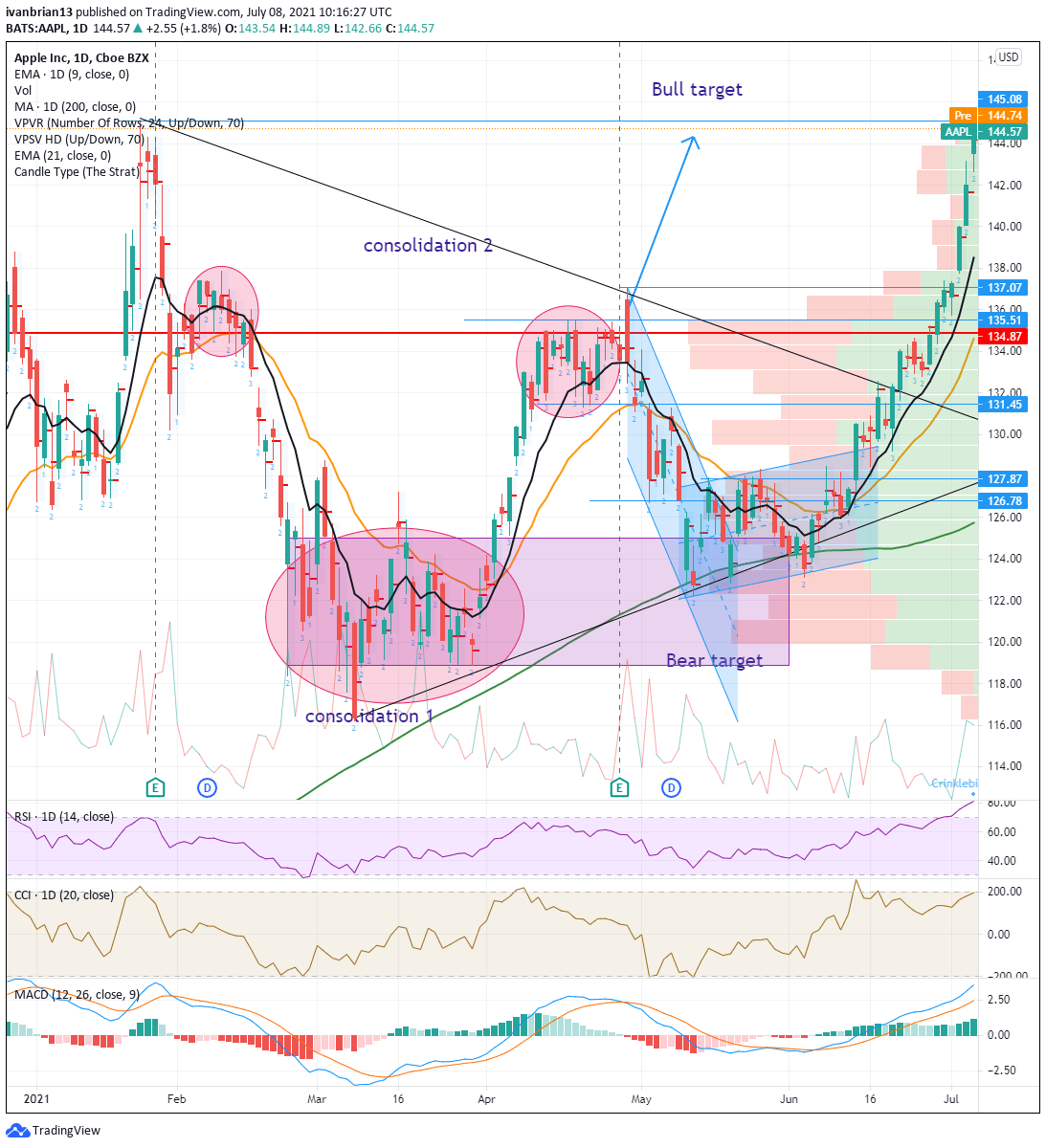

Apple stock more or less hit our target of fresh all-time highs on Wednesday, but what is 16 cents between friends? You should be our friend as we have been calling this one higher for some time. On June 23 FXStreet first mentioned taking out record highs (see here), calling the support base at $122 since early June. The move accelerated once AAPL stock broke above $135 and then $137 as the volume profile thinned out above these levels. The acceleration though has now sent AAPL into overbought territory on the Relative Strength Index (RSI), and this corresponds with the Nasdaq and S&P 500 both also being overbought, according to the RSI. It should be noted that the RSI being overbought does not mean prices have to fall in order for the RSI to go back down. The RSI is concerned with the relative speed of the move. If prices slow or consolidate, the RSI will fall. However, it is a good indicator that things have become stretched.

Apple key statistics

| Market Cap | $2.41 trillion |

| Enterprise Value | $2.1 trillion |

| Price/Earnings (P/E) | 32 |

|

Price/Book | 37 |

| Price/Sales | 9 |

| Gross Margin | 0.4 |

| Net Margin | 0.23 |

| EBITDA | $100 billion |

| Average Wall Street rating and price target | Buy $159 |

Why is Apple stock falling today?

A few reasons spring to mind that are not new, but the market has chosen to focus on them now that it has run out of steam. The narrative is always framed to meet the price action. The overall market is weak on Thursday, with European markets sharply lower as investors fret over the new Delta variant of COVID-19. This has been known for some time. Europe is overtaken with it, Japan has declared a state of emergency, and Australia has gone into regional lockdowns.

As earnings season approaches (next week), investors are becoming nervous that the record-breaking performance in Q1 2021 can be matched. In fairness, the comparison is going to be a tough one. In Q1 2021 Apple beat analyst expectations by 42%, Facebook (FB) by 40%, GOOGL by 67% and AMZN by 65%. Therefore, a repeat performance will be difficult.

AAPL stock has witnessed seven straight-up sessions. Nothing goes up forever, so a period of retraction is inevitable. This as mentioned has pushed the RSI into overbought territory.

Apple stock forecast

The trend is still protected as long as Apple remains above $135 to $137. Above here is where the move really accelerated due to the lack of volume. The lack of volume though means a fall can also quickly accelerate but should be held back toward $135 as volume increases at this level. This is our short to medium-term support zone. Buying the dip with an appropriate stop can be used here, but a break lower means the bullish theme is finished for now.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637613356101304465.png&w=1536&q=95)