Zilliqa price stabilizes before ZIL retests $0.12

- Zilliqa price attempts to form support after a major pullback from a prior rally.

- The weekly chart warns of further downside pressure if bulls fail capitalize on last week’s close.

- Upside potential is likely limited to the $0.12 value area.

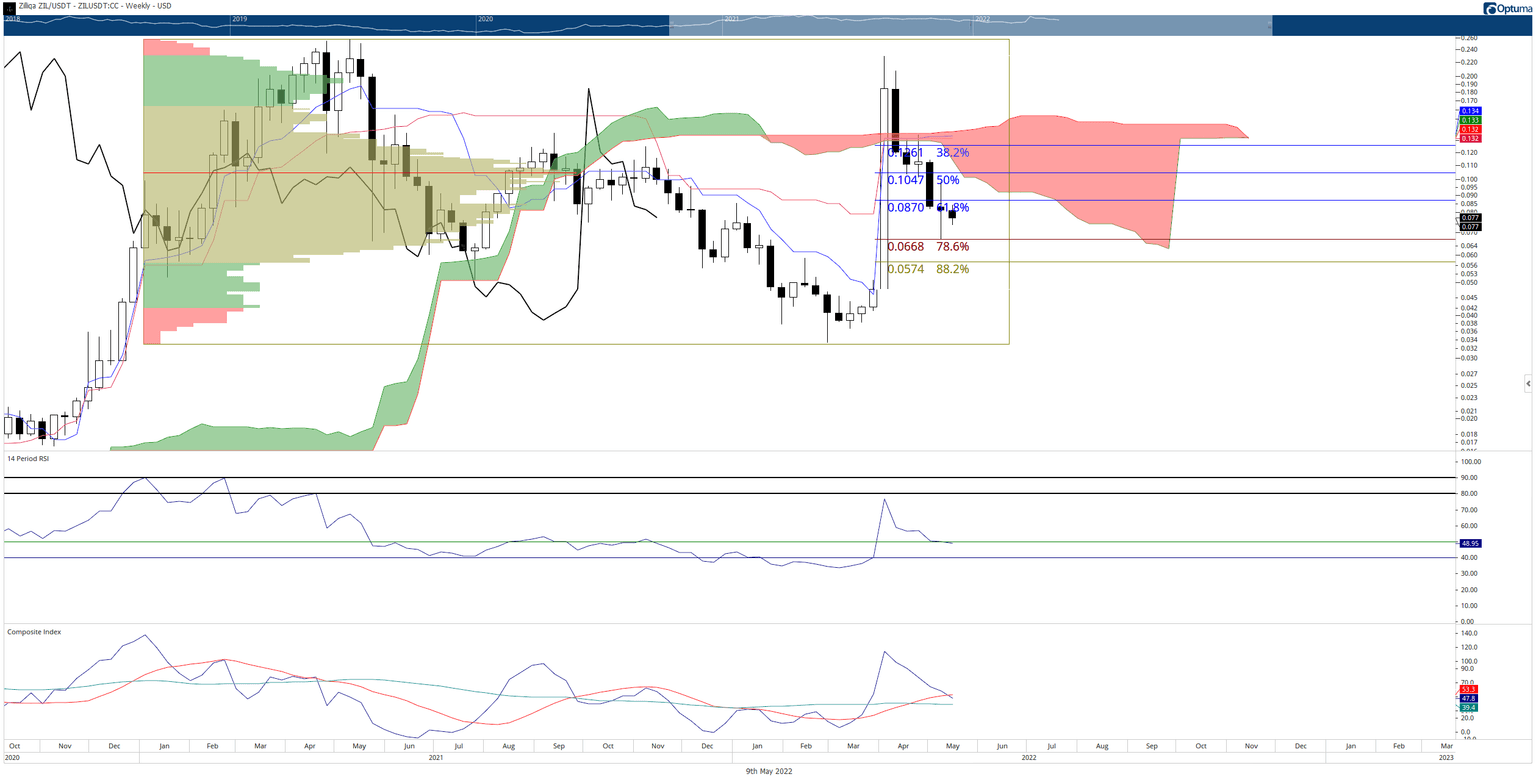

Zilliqa price is coming off a deep pullback from the massive 500% rally in March. Last week’s weekly candlestick showed a historically bullish reversal pattern, but follow-through is necessary to confirm that pattern.

Zilliqa price struggles to hold $0.07

Zilliqa price, like the rest of the cryptocurrency market, is facing a continued sell-off. Despite last Monday’s (May 2, 2022) nearly 38% price spike, buyers have been unable or unwilling to capitalize on that move. Bears are very close to eliminating the entirety of that gain.

One piece of positive data for bulls is the candlestick pattern that developed on the weekly chart. The pattern is a Gravestone Doji - an extremely powerful bullish reversal signal when it appears at the bottom of a swing. It also fulfills the criteria for a Spinning Top or Shooting Star. Regardless of the naming, the structure is very bullish when it forms at the bottom of a swing.

However, follow-through is necessary to confirm a bullish reversal. Thus far, Zilliqa price is showing difficulty maintaining a level above last week’s open.

One other piece of technical information that may terminate any further near-term selling pressure is the massive gaps between the bodies of the candlesticks and the Tenkan-Sen. Within the Ichimoku system, the body of the candlesticks and the Tenkan-Sen like to move in tandem. Therefore, a mean reversion is almost a certainty when there is a major gap between the two.

ZIL/USDT Weekly Ichimoku Kinko Hyo Chart

In the event of any relief rally or broader corrective move, Zilliqa price will likely return to the critical $0.12 value area. $0.12 contains the 38.2% Fibonacci retracement, the bottom of the weekly Ichimoku Cloud (Senkou Span A), and the weekly Tenkan-Sen.

If selling Zilliqa price continues to experience broader selling pressure, then a return to the $0.04 value area is the next major level of support.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.