Zilliqa Price Prediction: ZIL is one step away from a 55% upswing

- Zilliqa price is traversing a continuation pattern after a 120% rally.

- A decisive close above $0.14 would signal the end of the ongoing stagnation period and lead to a 55% breakout.

- The bullish outlook will remain intact as long as the $0.13 support holds.

Zilliqa price moved sideways for most of January but saw 120% gains in February’s first two weeks. Now, ZIL consolidates in a bull pennant awaiting for another leg up.

Zilliqa price squeeze will be followed by a volatile breakout

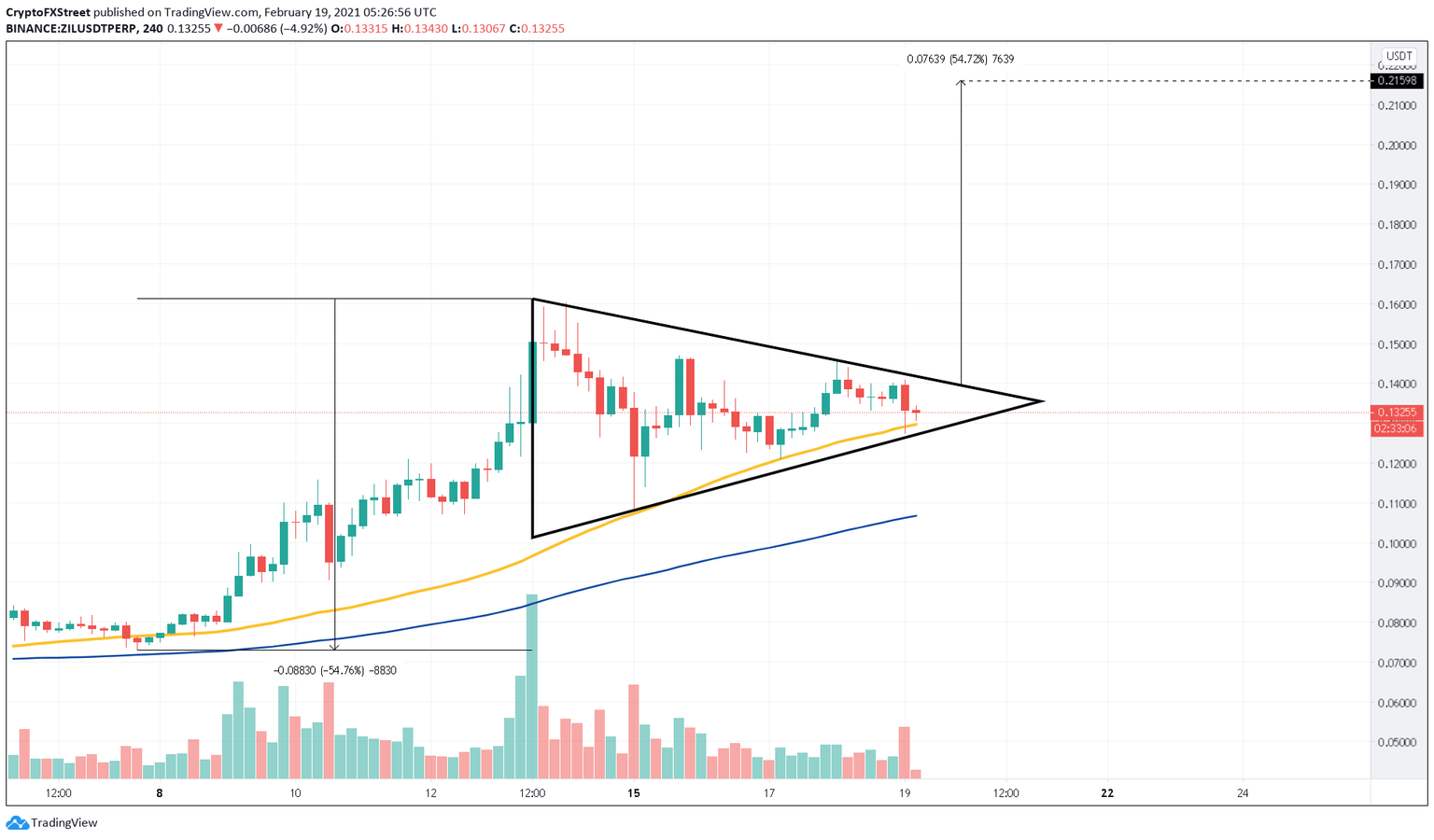

Zilliqa price rose approximately 120% between February 1 and February 8 to hit a high of $0.16. An exhaustion of bullish momentum led to a temporary reversal that saw ZIL developed a series of lower highs and higher lows.

Joining the swing highs and lows with a trendline appears to form a bull pennant.

Like bull flag patterns, the price rally that precedes the pennants is known as the flag pole. By adding the length of this flag pole to the breakout point, it provides a target for the direction of the trend.

For Zilliqa price, a 55% upswing measured from the resistance at $0.14 yields $0.21 as a potential target.

Adding credence to the bullish outlook is ZIL’s bounce from the 50 four-hour moving average (MA).

This support level has absorbed the selling pressure seen during the last three downswings and it will be a credible foothold for ZIL to start its new uptrend.

While everything looks bullish for Zilliqa price, investors should note that slicing through the 50 four-hour MA around the $0.13 support level will invalidate the bullish outlook.

Mounting selling pressure here would likely lead to a correction to the 100 four-hour MA at $0.10.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.