Yearn Finance Price Forecast: YFI eyes consolidation after quick surge

- Yearn Finance price reaches target, needs to release overbought condition.

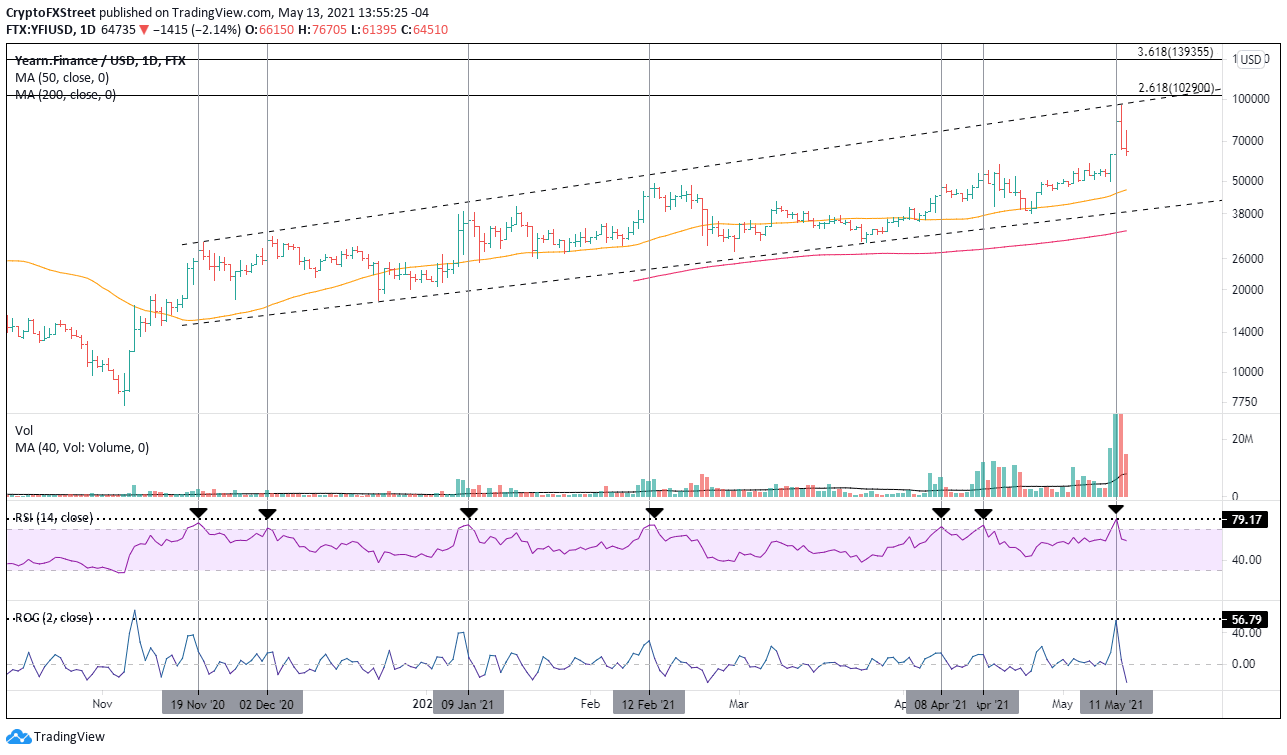

- Registers best 2-day rally since the ascending broadening channel began in November 2020.

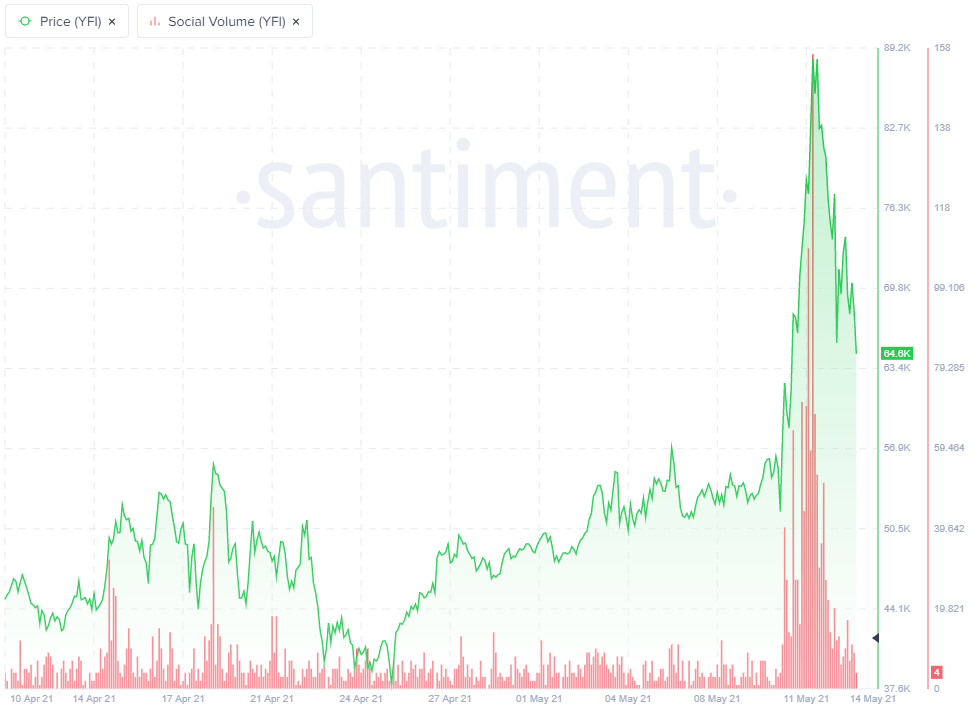

- YFI social volume rocketed to historical levels on Tuesday.

Yearn Finance price tagged the channel’s upper trend line yesterday, falling just short of $100,000 and 261.8% Fibonacci extension target at $102,900. The sharp reversal from the trend line marks a significant turning point for YFI that will shift price action to consolidation from the uptrend beginning at the April 25 low.

Yearn Finance price benefits from the tremendous growth in DeFi

YFI has lagged behind some of the other DeFi industry participants, such as AAVE and MKR, but the quick burst on Monday and Tuesday reversed a period of underperformance. The 78% gain in less than three days was a departure from the incremental journey Yearn Finance price had taken through the channel, but it does raise the concern that the quick surge was a blow-off top.

Yesterday’s sharp reversal in YFI was accompanied by the largest daily volume since inception, followed by historic levels of social media volume on Tuesday and the most overbought condition since September 2020 based on the daily Relative Strength Index (RSI). Combined, it solidifies the outlook for consolidation or even a greater decline.

An evolution in the consolidation will discover support at the April 19 high at $57,495, but it should prove temporary. Conversely, Yearn Finance price should find outstanding support at the 50-day simple moving average (SMA) at $46,534, and the consolidation should finalize at that point.

If YFI fails at the critical tactical moving average, the digital token is destined to test the channel’s lower trend line at $38,580. Any further selling pressure should be arrested at the 200-day SMA at $32,938.

YFI/USD daily chart

Yearn Finance price could rebound in the coming days, discarding the bearish messages of the charts. If so, the same obstacle persists as on Wednesday, the channel’s upper trend line currently at $95,985. The trend line will be reinforced by the psychologically important $100,000 and the 261.8% extension of September-November 2020 decline at $102,900. Only a resurgence in the broader DeFi space will carry Yearn Finance price higher and potentially to the 361.8% extension at $139,355.

The latest social volume metric published by Santiment shows a 720% jump at the May 11 high compared to the average range highs before May. The reading of 157 was a record high for YFI and demonstrated the euphoria that followed the surge on May 10-11. Such surges often coincide with important price tops.

The social volume metric compiles the number of mentions of a coin on 1000+ crypto social media channels, including Telegram groups, crypto subreddits, discord groups and private traders chats. It is a comprehensive survey, particularly of the retail investor ranks.

YFI social volume

Yearn Finance price is locked by the force of extreme technical and social volume readings. Still, the power of the DeFi sector momentum can limit the decline and allow YFI to consolidate before relaunching a rally that possibly extends beyond the channel’s upper trend line.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.