XRP Price Prediction: Ripple recovery halts as crypto markets tumble

- XRP price was on a steady road to recovery but reversed quickly after Elon Musk’s tweets.

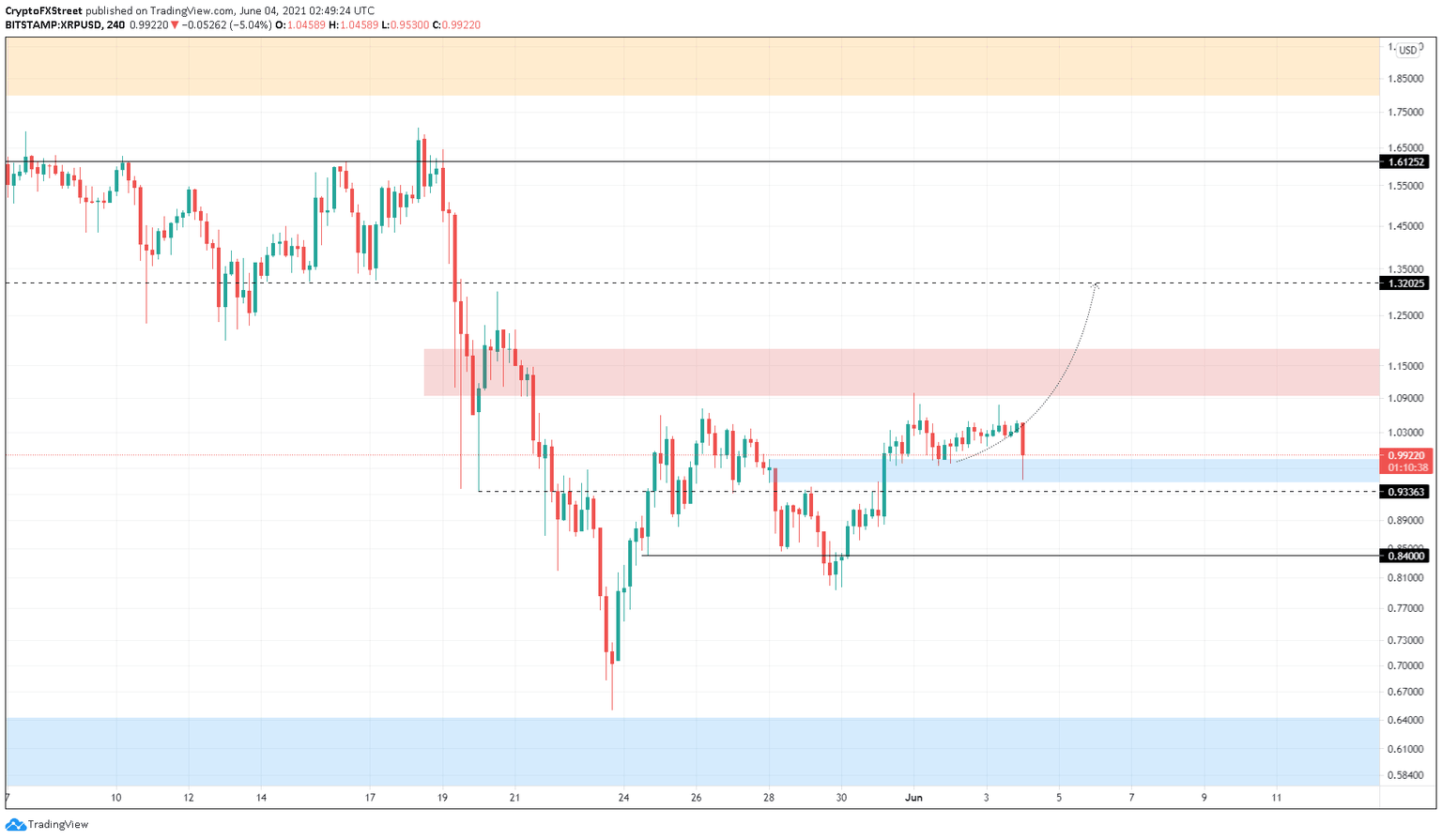

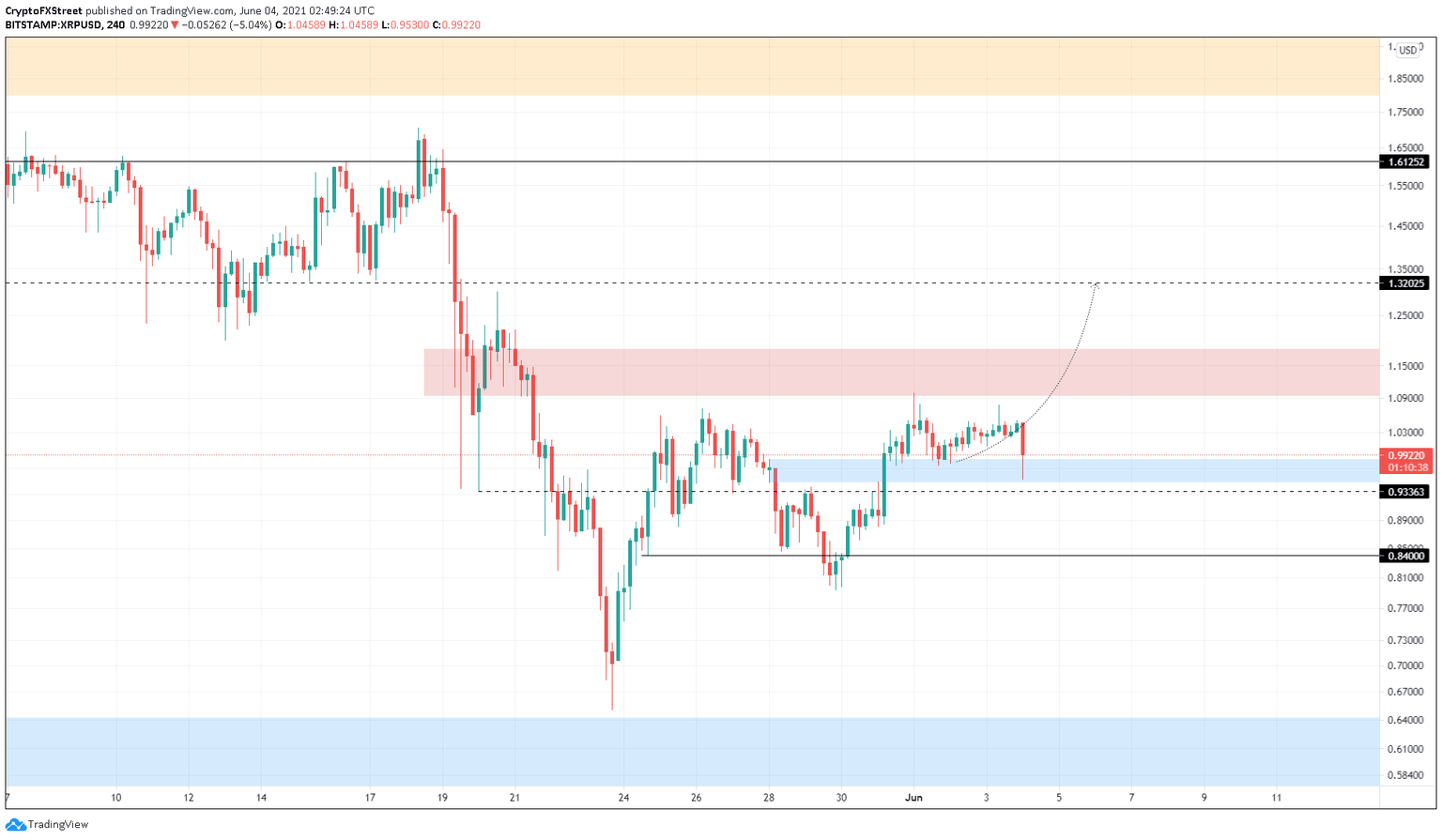

- Ripple is currently finding support on the recently flipped supply zone, ranging from $0.949 to $0.985.

- A decisive close below $0.934 will invalidate the bullish outlook and potentially trigger a downtrend.

XRP price dropped sharply as it pierced the immediate demand zone. While the uptrend seems to be in jeopardy, it can be revived if Ripple manages to close above the said support area.

XRP price retains its optimism

XRP price dropped roughly 8% from $1.046 to $0.953 in a single four-hour candlestick. This downswing was being attributed to Tesla CEO Elon Musk, who tweeted in reference to Bitcoin.

As Bitcoin price dipped lower, so did the entire market, including Ripple.

Despite this drawdown, XRP price has not slid below the lower trend line of an immediate demand zone at $0.948. In fact, Ripple is trading above the demand zone’s upper limit at $0.985, hinting that the investors are scooping up the remittance token at a discount.

If this bullish momentum continues, XRP price is likely to rally 10% to tag the supply zone ranging from $1.094 to $1.183.

A decisive close above $1.183 will indicate the resurgence of buyers that could allow the bulls to continue the ascent up to $1.32.

XRP/USD 4-hour chart

Adding credence to the bullishness of XRP is the 30-day Market Value to Realized Value (MVRV) model. The fundamental index which is used to measure the average profit/loss of the investors who purchased XRP in the past month, shows that the remittance token is in an opportunity zone at -11.16%.

The negative value implies that the short-term holders are selling, providing an opportunity for the long-term investors to accumulate.

XRP 30-day MVRV chart

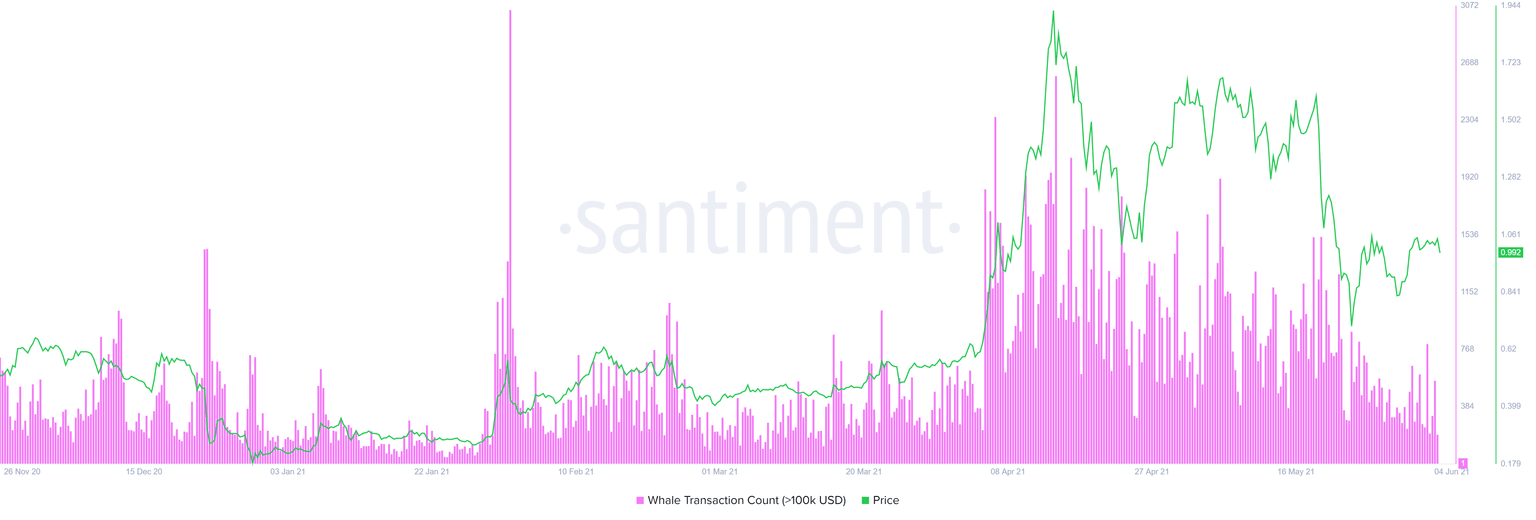

Moreover, whale transactions, transfers worth $100,000 or more has dropped from 803 to 196 between June 2 and June 3. Typically, a spike in this metric coincides with local tops. Therefore, the 75% decline indicates that whales are not looking to book profits or reallocate their holdings any time soon.

XRP whale transaction count

From a technical and an on-chain perspective, XRP price seems to be in the safe zone for now. However, a potential spike in selling pressure that slices through $0.934 will suggest that the bulls are weakened.

If XRP price slashes the immediate support level at $0.934, it will invalidate the bullish outlook and trigger a 10% sell-off to $0.84.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.