XRP Price Prediction: Ripple eyes 30% advance despite stiff resistance levels

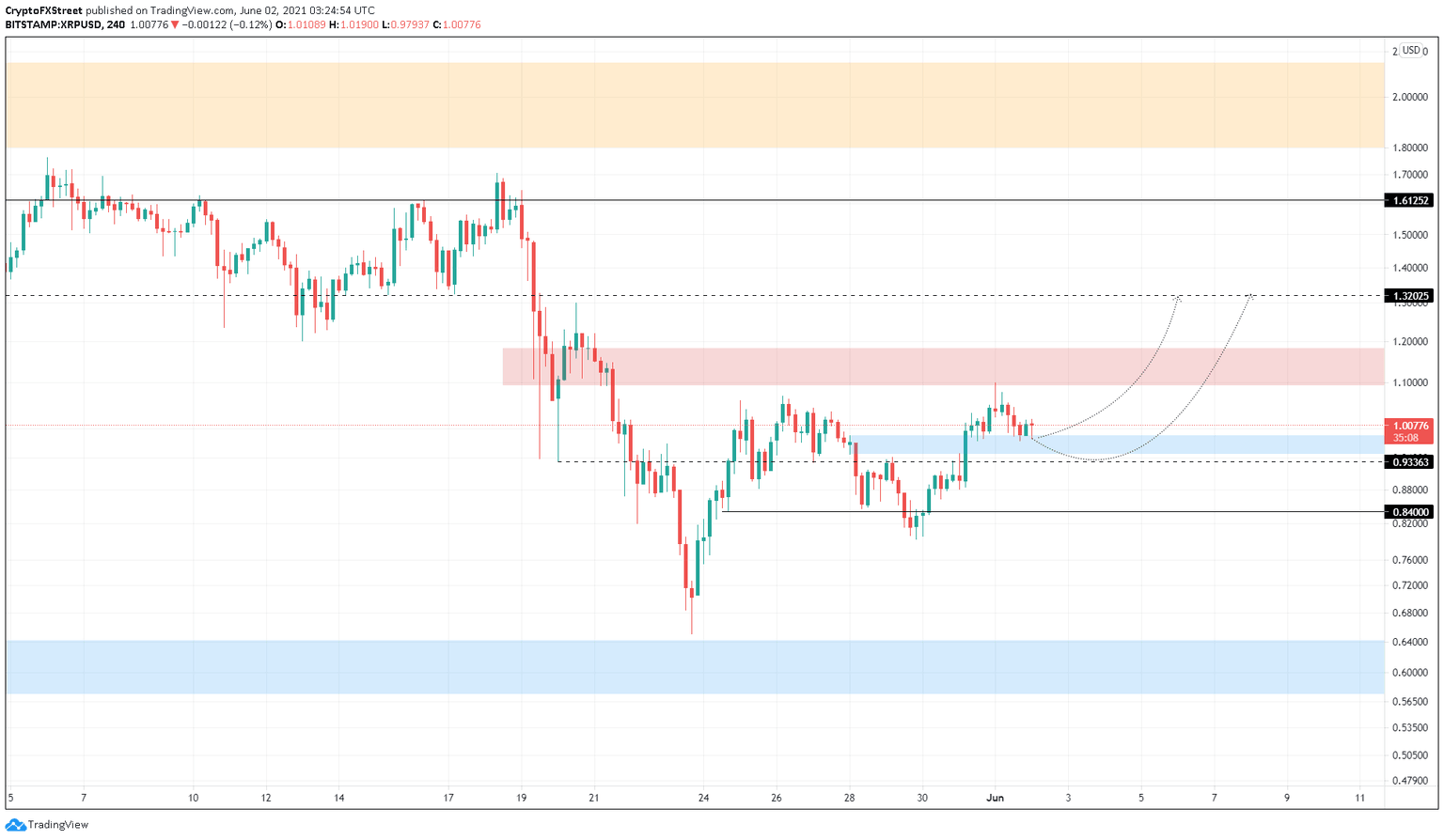

- XRP price has bounced off a demand zone extending from $0.948 to $0.985, signaling a potential move higher.

- A decisive 4-hour candlestick close above $1.183 will signal the start of an upswing.

- However, a breakdown of the support level at $0.834 will invalidate the bullish outlook.

XRP price has witnessed a fresh bounce off a crucial demand zone, indicating a bounce from this barrier could kick-start an upswing. The immediate overhead barrier might hinder this rally.

XRP price sparks a new rally

XRP price has surged 38% from May 29, flipping a supply zone ranging from $0.948 to $0.985 into a demand zone. A retest of this support area reveals that an upswing seems likely.

While this development is bullish, hurdles for Ripple are not over yet. The supply barrier extending from $1.094 to $1.183 will be critical in deciding if XRP price will head higher or consolidate.

Therefore, the bulls need to produce a decisive 4-hour candlestick close above $1.183 to confirm a continuation of the uptrend. In that case, Ripple might surge 11.5% to tag its intended target at $1.320.

All in all, this run-up would measure 30% from the current position around $1.

XRP/USD 4-hour chart

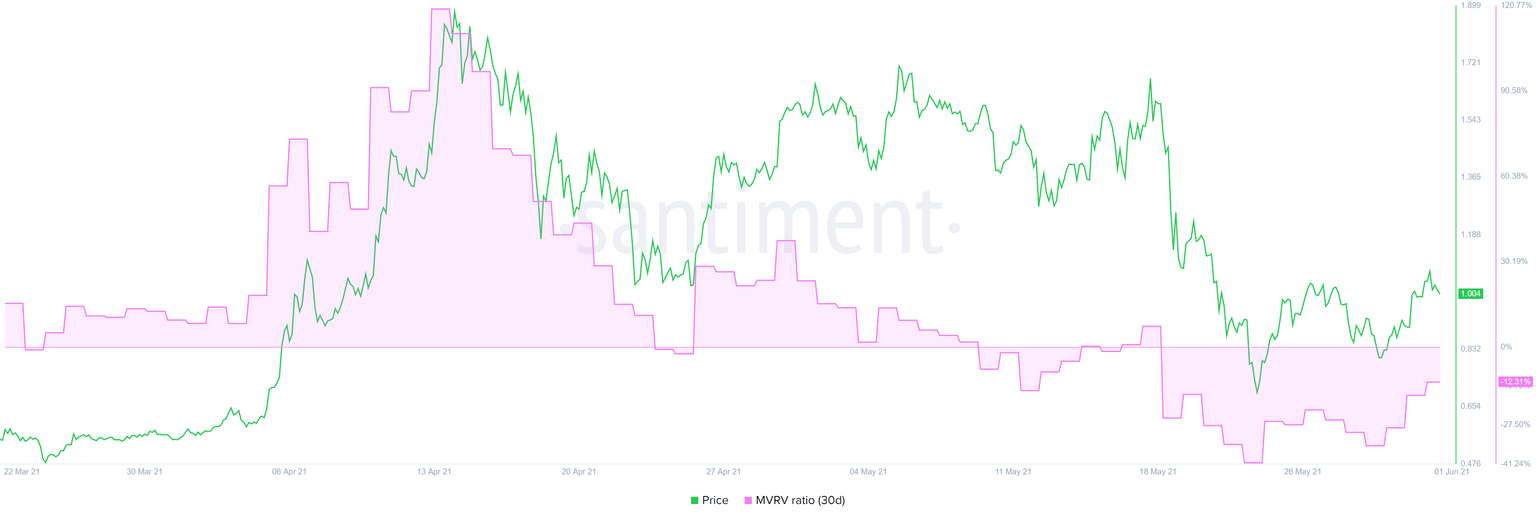

Supporting this 30% run-up in XRP price is the 30-day Market Value to Realized Value (MVRV) model from Santiment, which is in the “opportunity zone” at -12.31%.

This fundamental index is used to measure the profit/loss of the investors that purchased XRP in the past month. A negative value represents that the short-term holders are selling at a loss, providing an opportunity for the long-term holders to accumulate.

XRP 30-day MVRV chart

Therefore, investors need to keep a close eye on the XRP price bounce that takes off from $0.985. While things seem to be looking up for the remittance token, investors need to be mindful of a breakout below $0.84. Such a move would invalidate the bullish thesis and trigger a 5% downswing to $0.793.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.