XRP Price Prediction: Ripple prepares for a 35% liftoff

- XRP price is looking for a base to kick-start an uptrend to $1 and collect the liquidity resting above it.

- This uptrend might come after a brief retracement to $0.756, where bulls are likely to come back.

- A six-hour candlestick close below $0.680 will invalidate the bullish thesis.

XRP price has two crucial liquidity zones that market makers need to choose between. The most likely scenario will be a bullish move that collects the buy-stop liquidity.

XRP price to breakout soon

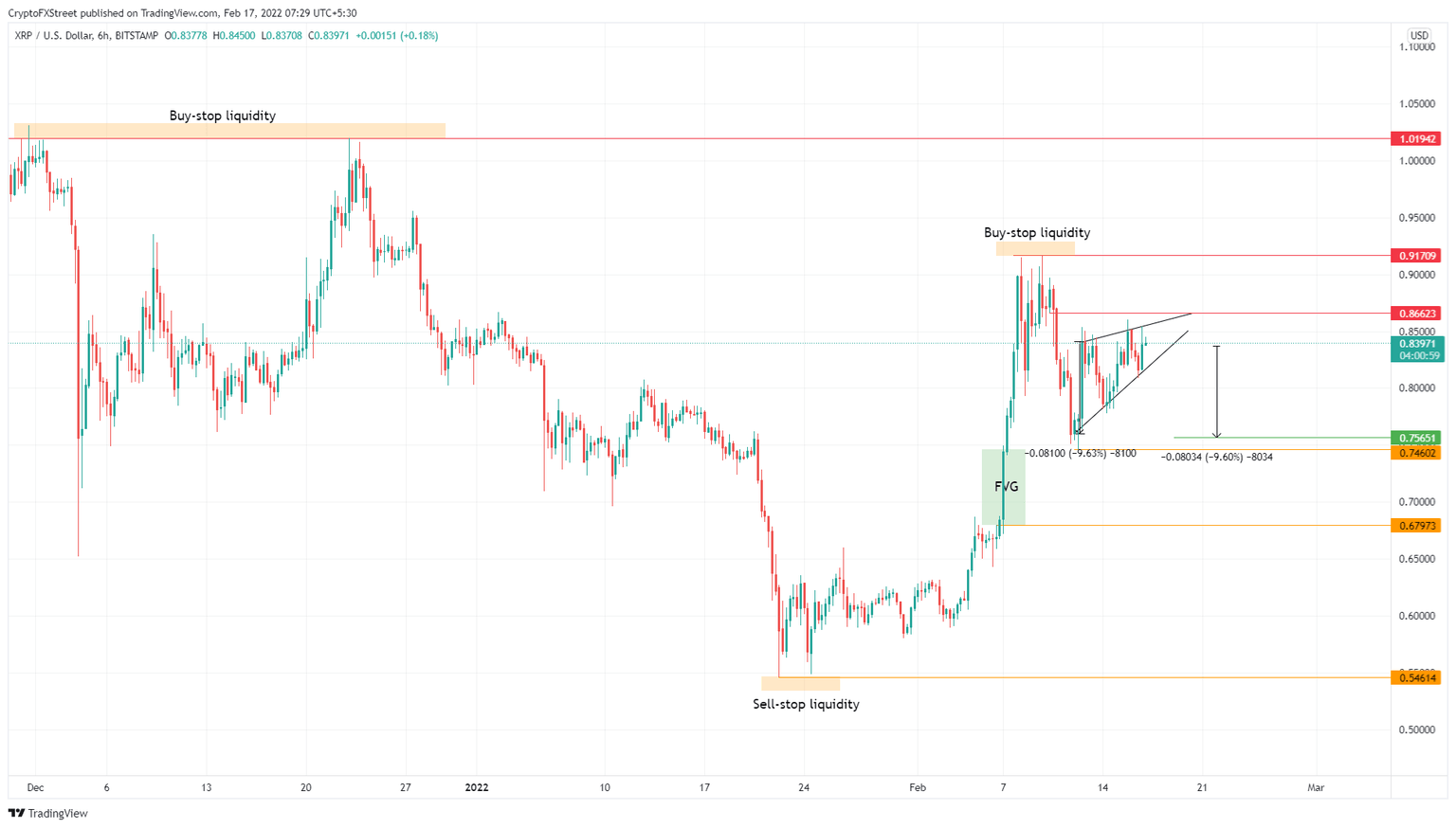

XRP price has formed two higher highs and three higher lows since February 12. Connecting these swing points using trend lines reveals a rising wedge formation. This technical formation forecasts a 9.6% downswing to $0.756, obtained by measuring the distance between the first swing high and swing low and adding it to the breakout point at $0.836.

Therefore, investors can expect the XRP price to break down to $0.756, where sidelined buyers can step in and accumulate. The resulting upswing will be the key in triggering Ripple to slice through the $0.866 hurdle and make its way to the first liquidity pool above $0.917.

Cleaning this zone will allow the market makers to push the remittance token to $1 and clear the buy-stop liquidity resting above it. This move, in total, would constitute a 35% gain for XRP price and is likely where the local top will form.

XRP/USDT 6-hour chart

While things are looking up for XRP price, a breakdown of the $0.756 support level will likely knock the remittance token to $0.679 in a bid to fill the fair value gap (FVG). An unlikely scenario is where Ripple tags the $0.679 barrier before triggering an uptrend.

However, if XRP price produces a six-hour candlestick close below $0.679, it will invalidate the bullish thesis and suggest that market makers are likely to push the altcoin to $0.546 for the sell-stop liquidity.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.