XRP Price Prediction: Ripple bulls resurface but lack conviction

- XRP price has seen a sharp recovery after the massive crash on Wednesday’s trading session.

- Ripple will turn bulls if it produces a 4-hour candlestick close above the demand zone extending from $0.942 to $1.172

- Failing to do so will lead to range-bound moves or a downtrend if the selling pressure increases.

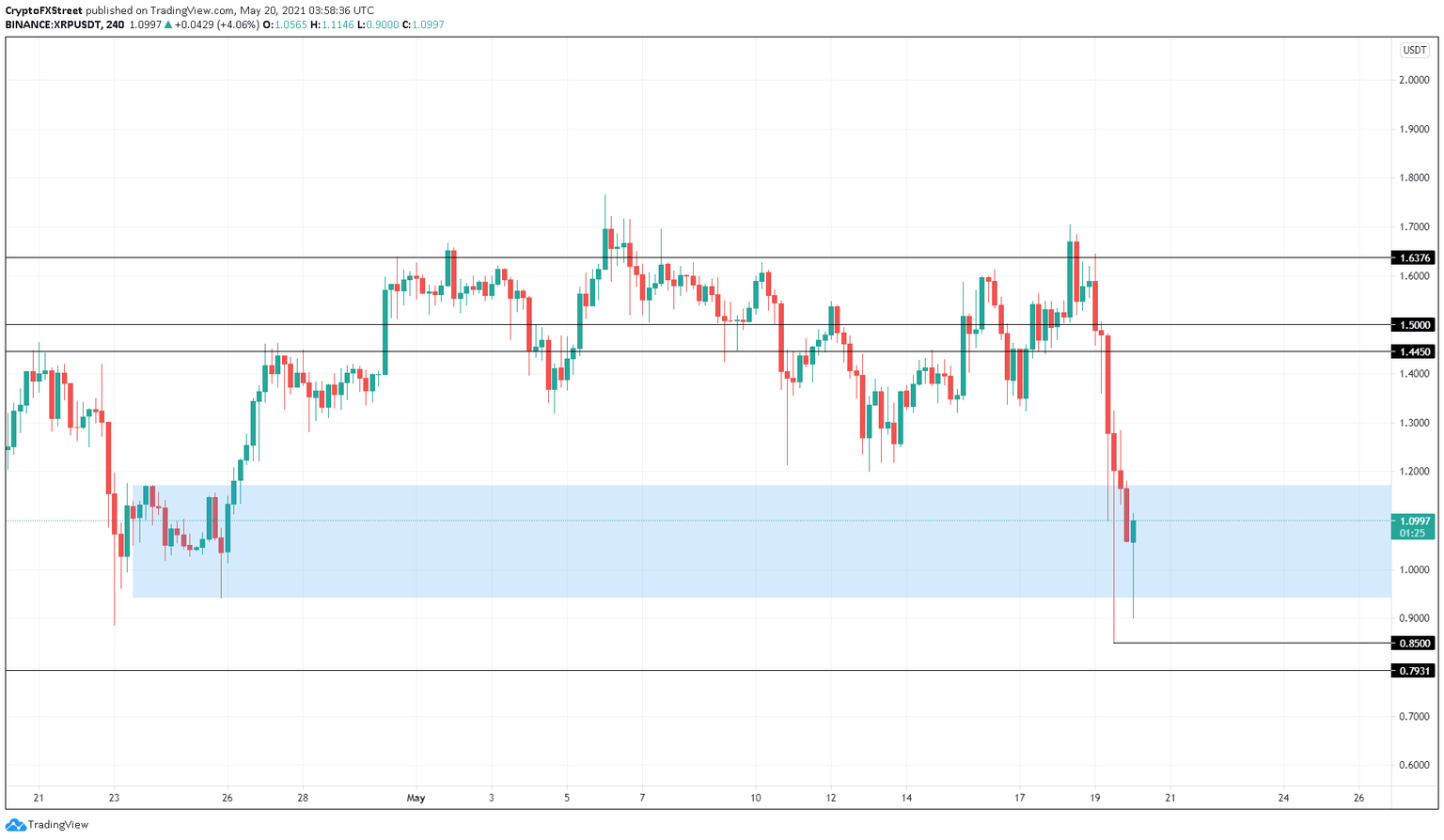

XRP price is trading inside a broad demand area after recovering from the flash crash on Wednesday. While this is a good sign, the bullish outlook still needs confirmation.

XRP price hints at recovery

XRP price is trading at $1.10 after recovering nearly 20% from its recent bottom at $0.90. While this uptrend seems bullish, a confirmation of a potential upswing will arrive after Ripple produces a decisive 4-hour candlestick close above the support area ranging from $0.942 to $1.172.

In that case, XRP price will be primed for a 23% ascent to $1.445, the first area of interest. Following the breach of this ceiling, the remittance token could rally another 4% to tag $1.50.

If the buying pressure persists after this rally, a 9% bull rally will place Ripple at $1.638.

XRP/USDT 4-hour chart

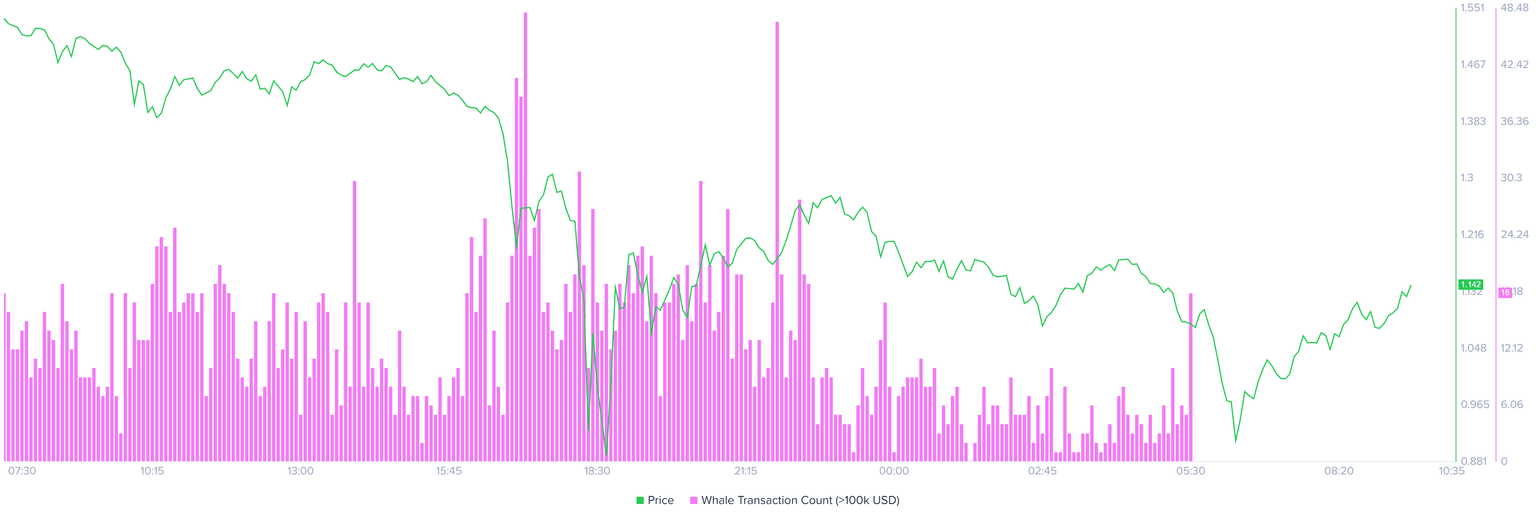

Supporting this bullish narrative is the reduction in whale transactions worth $100,000 or more. The metric has seen a considerable decline from 128 to 18 between May 19 and May 20. This 86% decline indicates that whales are done selling XRP, suggesting that a downswing is unlikely.

Since the sellers are virtually absent, minor buying pressure will be enough to push XRP price above $1.172, confirming the start of a new uptrend.

XRP whale transaction chart

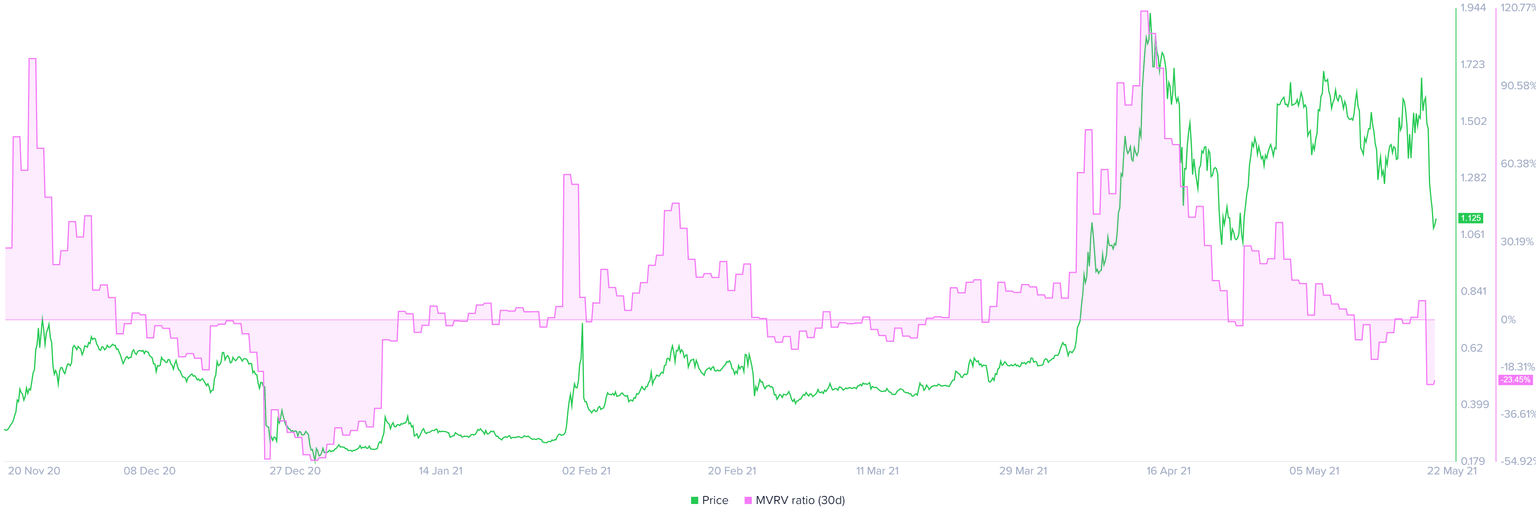

Additionally, the 30-day Market Value to Realized Value (MVRV) has dipped to -24%, representing that the short-term sellers are booking profits. This decline into the negative territory is considered as an ‘opportunity zone’ as it allows long-term holders to accumulate.

XRP MVRV chart

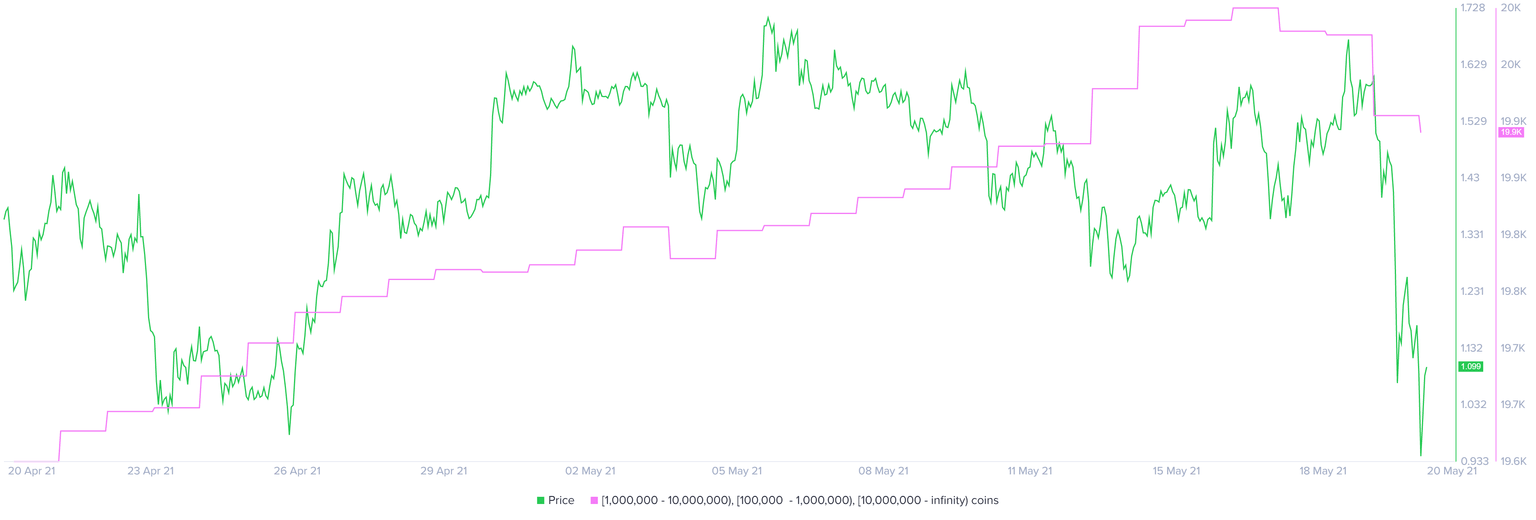

While Ripple seems to be recovering after a disastrous crash, things could quickly turn awry if bears restart their selling spree. Supporting this pessimistic scenario is the sharp decline in the number of whales holding 1,000,000 or more XRP tokens.

Roughly 66 new investors belonging to this category have reallocated or booked profits between May 18 and May 20, indicating that they are not confident in XRP price and its performance.

XRP supply distribution chart

If XRP price produces a convincing close below $0.850, it would invalidate the bullish thesis and trigger a 7% downswing to $0.793.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.