XRP Price Prediction: Ripple clears one of two hurdles, primed for 25% advance

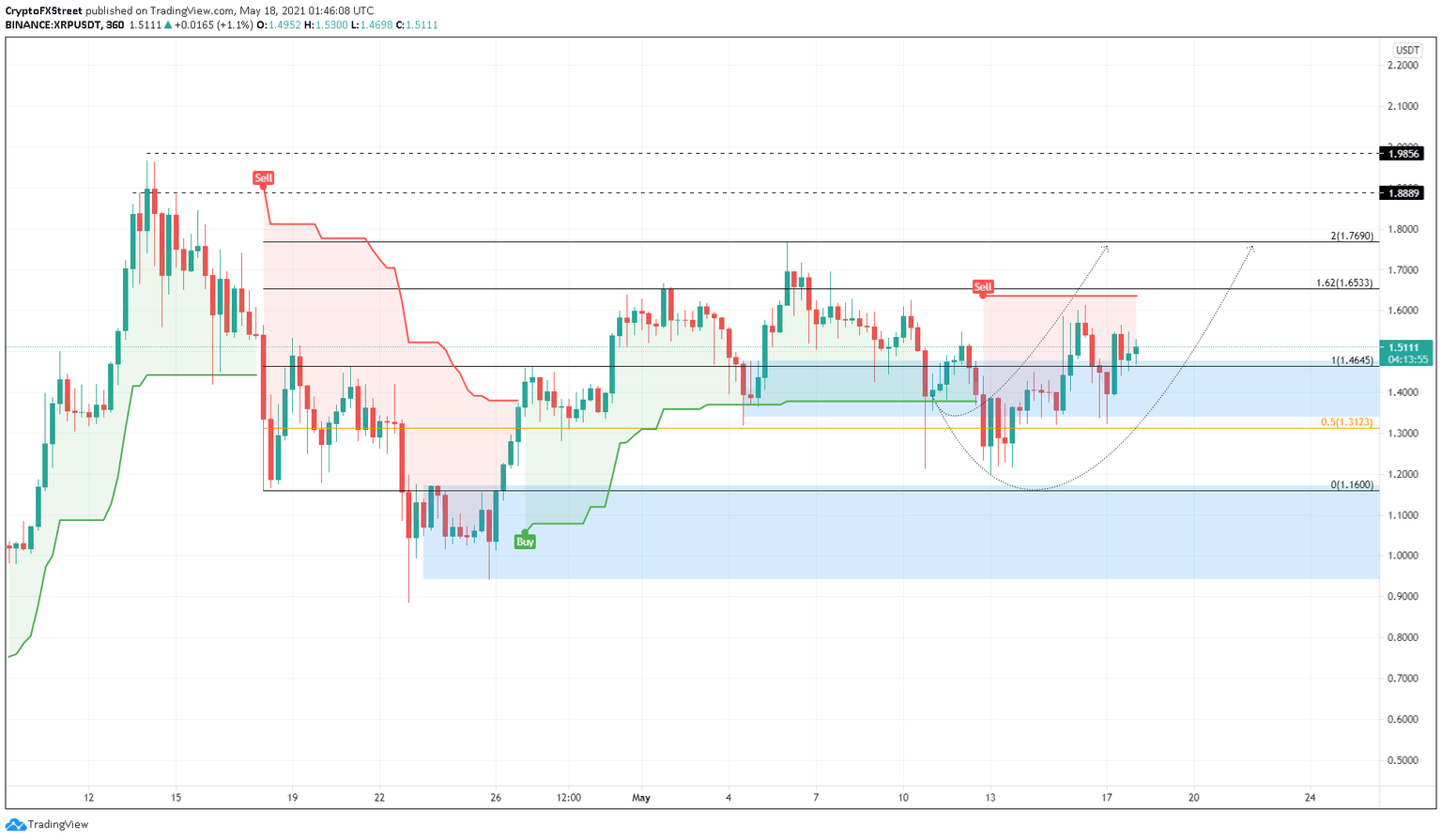

- XRP price recently flipped a supply zone into a demand area that extends from $1.340 to $1.477.

- An 11% surge followed by a decisive close above $1.65 will add more strength to the bullish thesis.

- A breakdown of $1.312 will spell trouble for Ripple and might invalidate it.

XRP price is showing a bullish bias after its recent upswing that cleared a crucial level. Another stiff resistance level stands between Ripple and its move to new yearly highs.

XRP price coiling up for a blast off

XRP price sliced through a resistance barrier that stretches from $1.340 to $1.477, flipping it into a support level. This move comes as the entire market, including Bitcoin, is starting to surge higher after the recent mishaps.

While the first major trouble area has been cleared, XRP price needs to shatter the supply level at $1.653 to seal its bullish fate. If such a move were to happen, the SuperTrend indicator would flash a buy signal, suggesting a shift in trend from bearish to bullish.

Additionally, this move would provide the buyers with clear skies up to $1.888, a 14% surge from $1.65 or a 25% bull rally from the current price ($1.508).

After testing $1.888, if the bullish momentum persists and the overall market structure remains bullish or neutral, investors could see the remittance token rally to new yearly highs at $1.98 or even $2.

XRP/USDT 6-hour chart

While the bullish thesis is straightforward, a breakdown of the flipped demand zone's lower boundary at $1.340 would jeopardize the upswing.

However, a potential spike in selling pressure that produces a decisive 6-hour candlestick close below $1.312 will invalidate the optimistic scenario detailed above.

In such a case, market participants can expect XRP price to slide 8.5% lower to the recent swing low at $1.2.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.