XRP price enters consolidation, Ripple at risk of plunging 48%

- XRP price has witnessed its momentum flip to the downside following recent weakness.

- Ripple could be awaiting a 48% plunge as the token nears a critical line of support.

- The prevailing chart pattern projects a bearish target at $0.38.

XRP price has continued to set lower highs as Ripple failed to galvanize investors’ enthusiasm. The cross-border remittance token could now be at risk of a sharp decline if it slices below a critical line of defense.

XRP price risk skewed to the downside

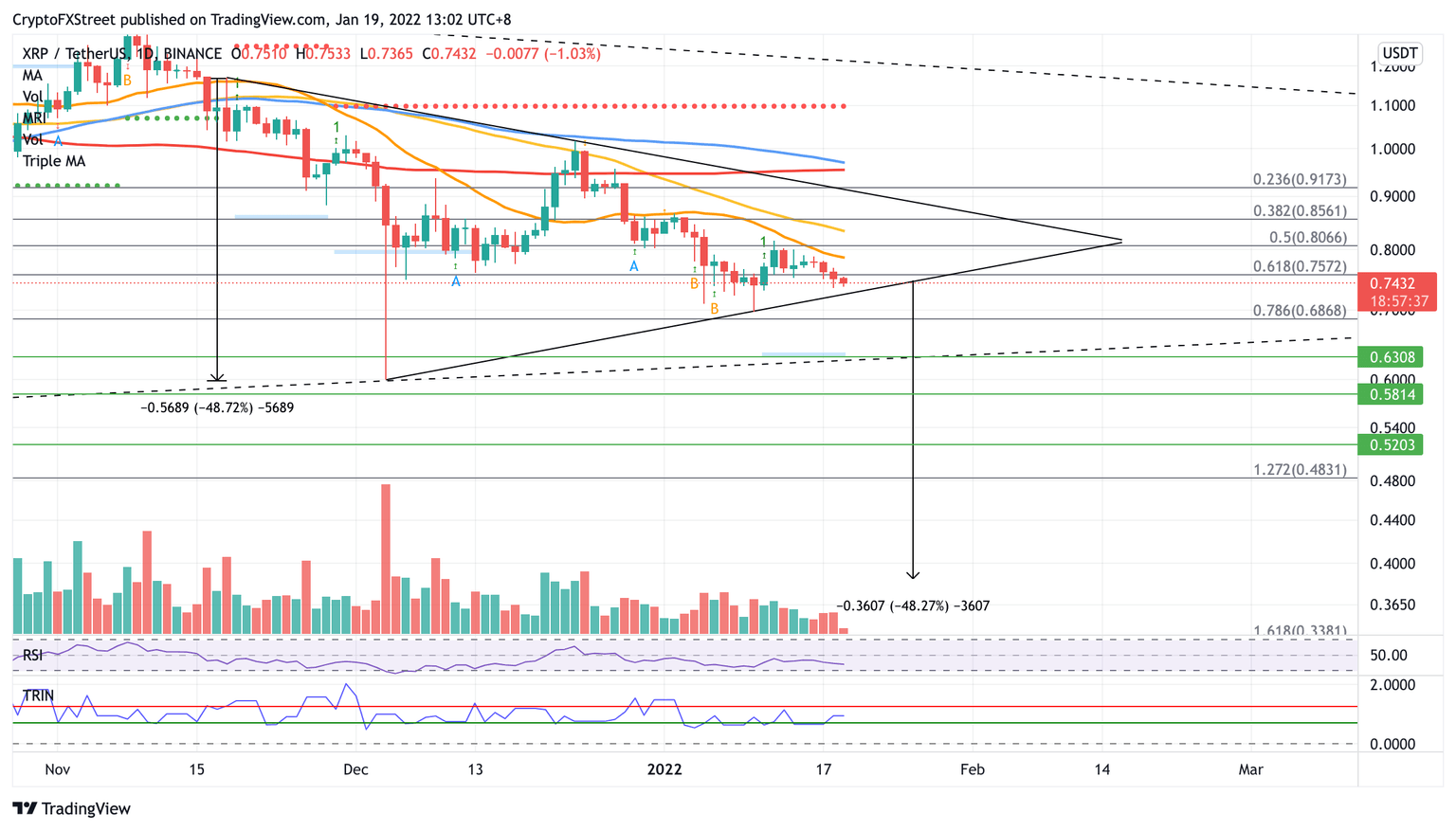

XRP price has formed a symmetrical triangle on the daily chart, as Ripple continues to consolidate. Although the prevailing chart pattern confuses forecasts, the token could be at the edge of a 48% plunge toward $0.38.

If XRP price slices below the lower boundary of the governing technical pattern at $0.72 that acts as crucial support, the aforementioned bearish target given by the prevailing chart pattern could be in the offing.

The first line of defense for XRP price following a break below $0.72 is at the 78.6% Fibonacci retracement level at $0.68, then at the July 28 low at $0.63, coinciding with the multi-month support trend line.

If selling pressure continues to increase, XRP price may drop toward the June 26 low at $0.58, then to the June 23 low at $0.52. Ripple may be able to find reliable support at the 127.2% Fibonacci retracement level at $0.48 before the bears attempt to reach the pessimistic target.

XRP/USDT daily chart

However, if the bulls manage to reverse the period of underperformance, Ripple will meet immediate resistance at the 61.8% Fibonacci retracement level at $0.75. Additional headwinds may emerge at the 21-day Simple Moving Average (SMA) at $0.78, then at the 50-day SMA at $0.83.

Bigger aspirations will target the upper boundary of the symmetrical triangle pattern at $0.90. Investors should note that a break above the topside trend line of the prevailing chart pattern could release a 48% climb for XRP price. If buying pressure continues to rise, Ripple would encounter obstacles at $0.96, where the 100-day SMA and 200-day SMA intersect.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.