XRP Price: Binance announces new XRP investment product, fuels rally in the altcoin

- Binance added XRP to its list of Dual Investment products and published an official blog post to announce the new listing.

- XRP holders are awaiting the US Securities and Exchange Commission’s next move.

- Analysts believe XRP price is on track for a 25% rally in the ongoing bear market.

Binance, the world’s largest exchange by volume, added XRP to its list of Dual Investment products. The exchange announced the launch of the product on its official blog and informed users about a fresh batch of dual investment products with revised target prices and settlement dates.

Also read: Why Joe Biden is speeding up crypto regulation in the US

Why addition of XRP to Binance Dual Investment products matters

Binance users can buy cryptocurrencies at a lower price and sell them at a higher price in the future through dual investment products. The world’s largest exchange by volume has added XRP to this list and this allows users to earn a high yield during the subscription period irrespective of the direction in which the price moves.

Binance currently offers two types of dual investment products, buy low and sell high. The new XRP product is available for trade on Binance from October 4, 10:00 UTC and the subscription format is first come first serve. The Annual Percentage Rate (APR) for the product ranges between 4% and 179%.

The official announcement noted that the product may stop accepting new subscriptions at any moment.

XRP holders are awaiting updates on the ongoing SEC v. Ripple case to identify the direction in which the altcoin’s price will move. The latest court ruling lacks updates and comments and the general sentiment among holders is bullish.

David Gokhstein, an XRP proponent and crypto educator, believes Ripple is closer to a win in the lawsuit.

Analysts predict 50% rally in XRP price

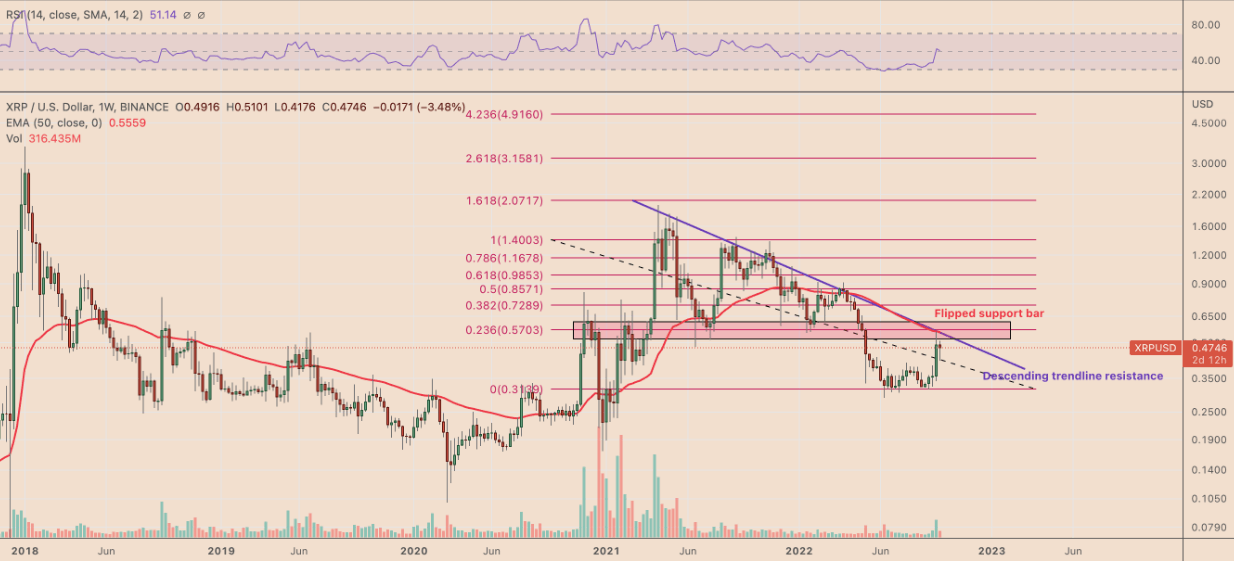

Analysts have evaluated the Ripple price trend and predicted a breakout in the altcoin. Yashu Gola, a technical analyst at Cointelegraph, believes XRP price could post a 50% rally. If XRP breaks past its multi-year descending trendline resistance, the altcoin could target the $0.57 level.

Gola believes XRP price is likely to run up toward the next Fib line near $0.72 level.

XRP-USD price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.