LUNC price: Luna Classic holders wait for 1000x recovery as Binance burns 5.59 billion LUNC

- Binance announced the burn of 5.59 billion Luna Classic tokens and permanently removed them from circulation.

- LUNC climbed the ranks to emerge as the sixth most traded cryptocurrency in the last 24 hours.

- Luna Classic holders await a 1000x recovery in the asset as burn implementation is complete and trade volume explodes.

Binance implemented Luna Classic burn and shared details with the LUNC community. The exchange’s move has fueled a bullish sentiment among LUNC holders awaiting a recovery in Terra’s token.

Also read: JUST IN: Kim Kardashian in legal trouble, slammed by US SEC for touting EthereumMax

Binance implements mass burning of Luna Classic

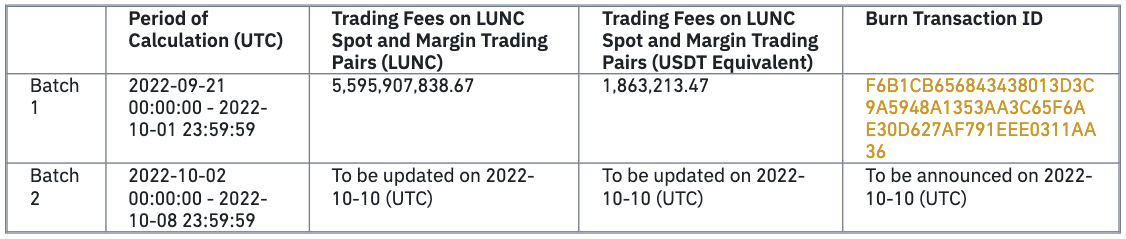

Binance burned 5.59 billion Luna Classic tokens in response to the LUNC community proposal. The world’s largest exchange by volume, Binance, informed users that the burn will be implemented weekly until further notice. Binance burned all the trading fees collected on LUNC spot and margin trading pairs. The specific amount of LUNC burned will change on a weekly basis however, Binance will consistently pull Terra’s Luna Classic tokens out of circulation for the LUNC community.

Luna Classic burn

Burn implementation by Binance has fueled a bullish sentiment among holders. The community started a campaign on crypto Twitter, pushing for a #1000x recovery in Terra Classic price.

Prior to Binance’s LUNC burn, nearly 291 million LUNC was being burned daily. OfficialTravlad, a crypto analyst and trader, expects other cryptocurrency exchanges to start burning Luna Classic tokens as Binance sets an example with the 5.59 billion LUNC burn.

The analyst believes over a period of one year, with other cryptocurrency exchanges onboard, 550 billion LUNC could be pulled out of circulation. This represents 12.5% of LUNC’s supply.

A little #LUNC burning brainstorm.

— Travladd Crypto (@OfficialTravlad) October 3, 2022

Pre-Binance burn and post 1.2% burn implementation (September 21st) around 291M $LUNC was being burned daily.

Binance today burned 5.6B $LUNC which I presume was accumulated over the last week via the 0.1% tx tax. (1/5)#LUNCcommunity

ClassyCrypto_ evaluated the Luna Classic price trend and revealed a bullish outlook. While the community of LUNC holders await a #1000x recovery in Luna Classic, the analyst believes the token could be 3x and lose a zero by the end of 2022 at the current burn rate.

LUNC USDT price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.