Bitcoin price: Watchout for 30% decline in Bitcoin price, according to this indicator

- Bitcoin one-year running Return on Investment (ROI) has formed a bottom pattern, one that occurs a year after hitting cycle top.

- Robert Kiyosaki believes it is a buying opportunity for Bitcoin as the US dollar surges.

- Bitcoin price sustains above the key psychological level of $19,000 despite looming risk of decline.

Bitcoin price surpassed the key psychological barrier at $19,000 and sustained above this level. American businessman and author Robert Kiyosaki believes that it is a buying opportunity for BTC. Analysts warn traders of a decline in the asset’s price in the short-term.

Also read: How eight state regulators orchestrated crypto lender Nexo’s takedown and why it matters

Bottom pattern indicates risk of Bitcoin price drop to $13,200

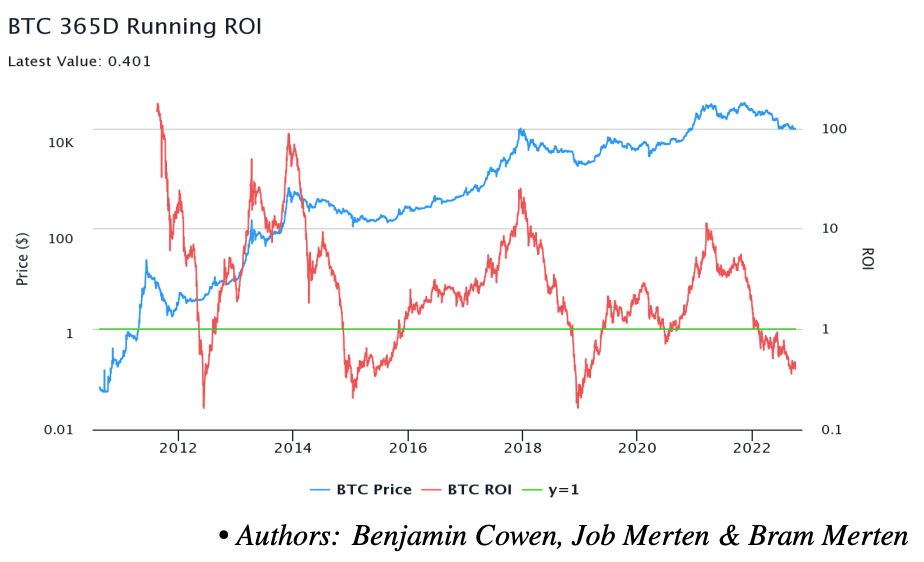

Analysts at crypto intelligence firm IntoTheCryptoverse evaluated the Bitcoin price trend. Analysts used the one-year running ROI indicator to identify a bottom pattern. Typically this pattern emerges when Bitcoin price hits a low a year after the market cycle top. In 2021, Bitcoin price hit $66,500 on October 20 and a new all-time high of $69,000 in November 2021.

Analysts argue that it is likely for ROI to plummet to 0.2 or lower in October 2022. An ROI of 0.2 corresponds to a price of $13,200.

BTC 365-day running ROI

Robert Kiyosaki urges traders to buy BTC

Robert Kiyosaki, American entrepreneur and author, told his 2.1 million followers that prices of assets considered as “safe haven” like Gold, Silver and Bitcoin will continue declining as the U.S. dollar strengthens, proving its worth once the “FED pivots” and drops interest rates.

Kiyosaki believes this pivot could come as soon as January 2023 and the US dollar could “crash” in the same way as the recently collapsed English Pound Sterling. Kiyosaki argues,

Will the US dollar follow English Pound Sterling? I believe it will. I believe the US dollar will crash by January 2023 after the Fed pivots.

Crypto Faibik, a crypto educator and analyst has evaluated the Bitcoin price trend and predicted a lower low before a recovery in BTC. Facebook argues Bitcoin needs to sustain above the $18,400 level to recover. If Bitcoin plummets below its support, the asset is at a risk of 30% decline.

BTC-USDT perpetual contracts

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.