XLM price at a critical juncture amid impending golden cross

- XLM/USD challenges critical daily support line, a rebound on the cards?

- A Forexsuggest study cites Stellar as the most environmentally-friendly cryptocurrency

- RSI stays bullish while a golden cross could be in the offing.

Stellar Lumens (XLM/USD) maintains its bearish momentum starting out a fresh week on Sunday, although hovers within Friday’s trading range between $0.40-$0.36.

In doing so, XLM price is posing a 1.50% loss to trade at $0.3730, awaiting a strong catalyst for the next big move.

Stellar price could receive the much-needed impetus from a research study conducted by Forexsuggest, which reveals that the most environmentally-friendly cryptocurrency is Stellar, a competitor to Ripple that requires just 0.00003KWh per transaction, which is barely a third of what IOTA requires.

Stellar needs 0.00072 oz of CO2 per transaction, which is almost nothing when compared to Bitcoin’s 1,060.5 lbs per transaction.

How is XLM price positioned on the technical graph?

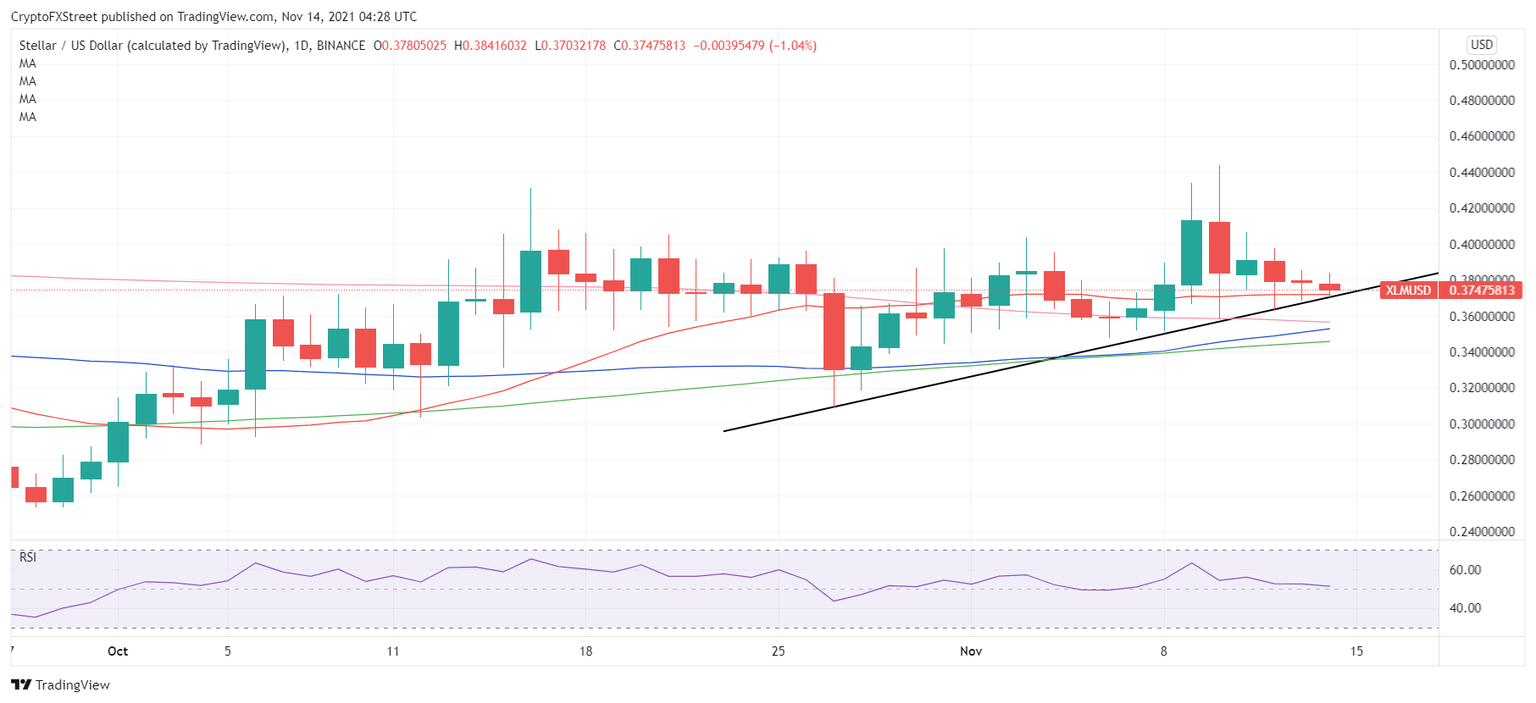

Looking at Stellar Lumen’s daily chart, XLM price has been testing the bullish commitments at the horizontal 21-Daily Moving Average (DMA) over the past week.

This Sunday, the 21-DMA coincides with the rising trendline support, connecting the higher lows since October 27. That powerful line of defense awaits at $0.3710.

A daily closing below the latter will offer extra zest to XLM bears, as they would look to extend the recent downtrend towards the horizontal 200-DMA at $0.3568. The upward-sloping 50-DMA closes in on that point.

Further south, the mildly bullish 100-DMA at $0.3455 will come into play.

XLM/USD: Daily chart

However, with the 50-DMA looking to cross the 200-DMA for the upside, XLM buyers are weighing in their chances, at the moment.

If the above materializes on a daily closing basis, then a golden cross will be confirmed, flashing a strong bullish signal.

A rebound towards the five-month highs of $0.4436 cannot be ruled out. Ahead of that the $0.40 psychological magnate could impede the road to recovery.

The 14-day Relative Strength Index (RSI) points south but still trends above the central line, adding credence to the bullish potential.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.