Worldcoin crumbles under selling pressure even as OpenAI eyes human-level problem-solving

- Worldcoin is under selling pressure and could extend recent losses.

- OpenAI announced five tiers to human-level problem-solving AGI, firm says is on tier one with ChatGPT.

- WLD trades at $1.789 on Binance, down over 25% in July.

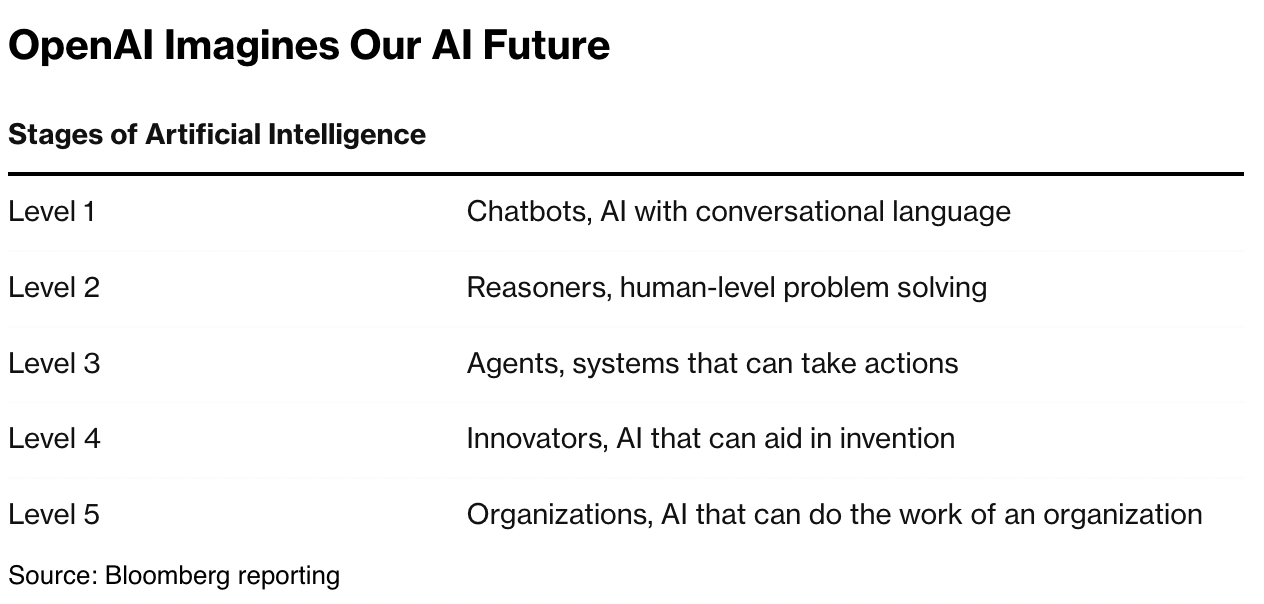

OpenAI, the American tech firm behind the Large Language Model (LLM) ChatGPT, announced five levels towards building an Artificial General Intelligence (AGI). Employees at the firm told Bloomberg that with ChatGPT, Open AI is currently at level one.

As the firm lays out a plan of progress towards AGI, Worldcoin (WLD), a project spearheaded by OpenAI founder Sam Altman, struggles to recover. WLD faces selling pressure from token unlocks, and the asset has erased over 25% of its value in July.

WLD trades at $1.789 on Friday.

Worldcoin faced with uphill battle as WLD price crumbles

Per a recent Bloomberg report, OpenAI has revealed that the path to building Artificial General Intelligence is five-tier. While OpenAI gears toward tier 2, that is, human-level reasoning, it fails to catalyze gains in Worldcoin price.

Since its inception, WLD has been closely tied to progress and updates from OpenAI, given that the two projects are spearheaded by Sam Altman. WLD is currently facing mounting selling pressure from token unlocks in July, increasing supply on exchanges.

Santiment data shows that supply on exchanges is 43.97 million on Friday, close to the highest level since October 2023. Typically, high supply on exchanges means there is a higher volume of tokens available for traders to sell, increasing the pressure on the asset. This could drive prices lower.

The creator of ChatGPT continues to race toward building the most powerful tier-five AGI, which will replace organizations.

OpenAI describes five tiers on the path to AGI

The latest development at OpenAI was driven by executives and senior leaders. The tier system is currently a work in progress, and the tech firm will continue gathering feedback to tweak the levels over time.

In the absence of other key market movers, traders turn to WLD on-chain metrics and OpenAI developments to identify where the AI token is headed. Recovery for the Worldcoin price seems unlikely in July as token unlocks continue to add 6.62 million WLD to the supply daily, per Token Unlock data.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.