Will Dogecoin (DOGE) price pull an XRP and rally 60% next week?

- Dogecoin price coils up on the daily timeframe, hinting at an explosive move.

- If DOGE follows in Ripple’s footsteps, a 50% to 60% upswing is on the cards.

- Invalidation of the bullish outlook will occur if the meme coin fails to hold above the $0.0705 support floor.

Dogecoin price has been in a tight range bound movement since November 22. However, the recent recovery above the range low looks promising and hints at an explosive move for next week.

Also read: What Ripple holders can expect next week as XRP price coils up for explosive move to this level

Dogecoin price primed for a breakout

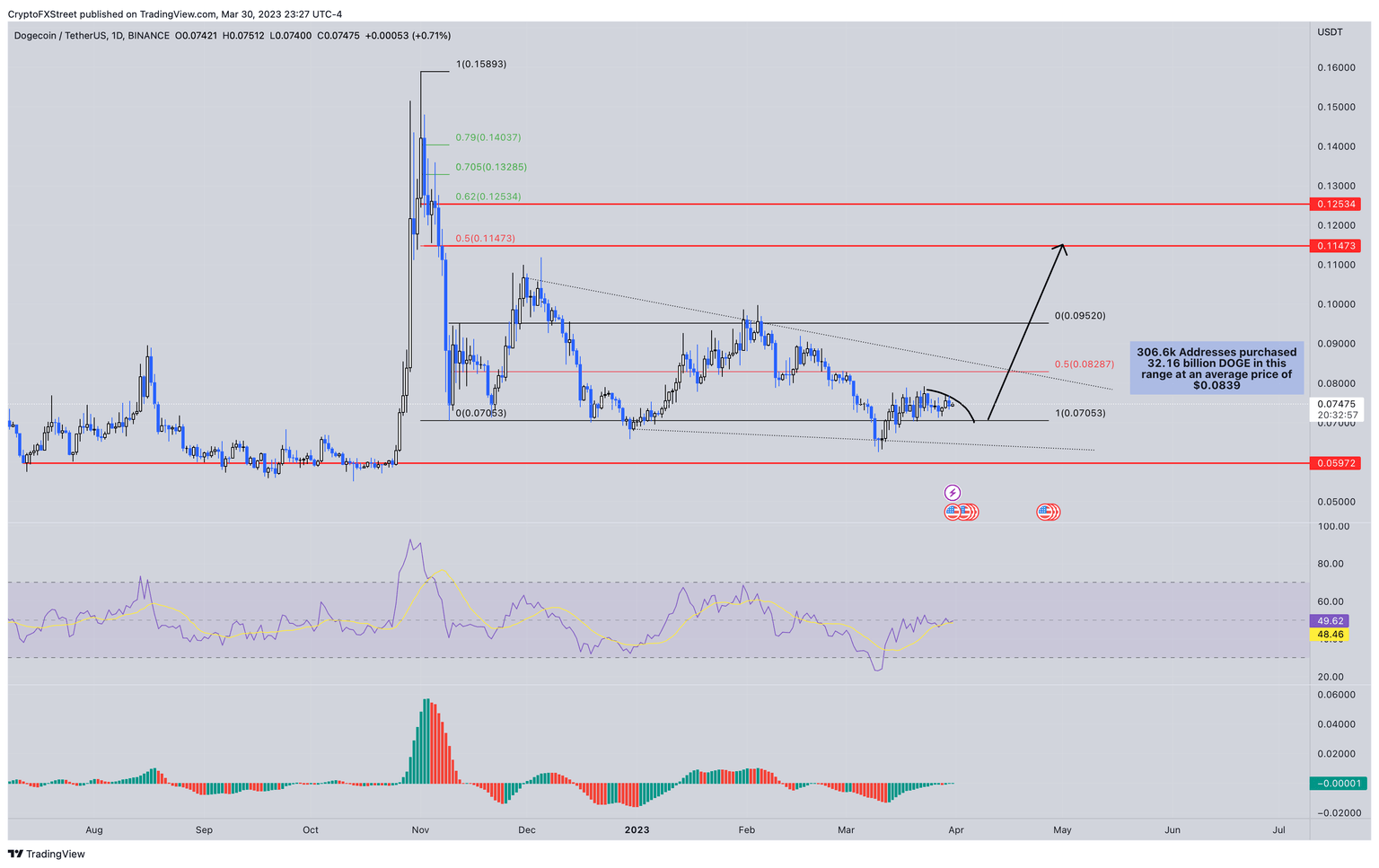

Dogecoin price formed a range, extending from $0.0705 to $0.0952 in November 2022. For roughly five months, DOGE has been trading in the aforementioned range, but the recent deviation below the range low, followed by a quick recovery, suggests that there could be a bullish move waiting to happen.

Early March, Dogecoin price experienced a massive sell-off that pushed it below the $0.0705 level, but recovered above the said level a few days later, showing a strong defense from buyers.

Furthermore, the Relative Strength Index (RSI) is attempting to cross above the midpoint to establish a bullish regime. Budding strength can also be seen with the Awesome Oscillator (AO), which is trying to go above the zero-line. Both momentum indicators suggest that there is a clear effort from the bulls to take control, which adds credence to the breakout thesis.

Now that technicals are showing clear signs of an incoming bullish move, let us take a look at the important levels investors need to pay close attention to.

- There might be a sweep of the range low at $0.0705 for sell-side liquidity before a bullish move kick-starts.

- The uptrend will face massive selling pressure at the midpoint of the range at $0.0828.

- Clearing this blockade will open the path for DOGE to tag the range high at $0.0952. This move would constitute nearly 35% gains for investors.

- An upward move to $0.0952 is not the end of the bullish scenario, considering the elaborate consolidation that has been in play since November 2022. Therefore, market participants can expect Dogecoin price to reach the $0.114 level, which is the midpoint of the 55% crash seen between November 1 and 9, 2022. This move would constitute a 62% rally for investors.

- A continuation to the 62% retracement level at $0.125 would net DOGE holders a 77% gain.

DOGE/USDT 1-day chart

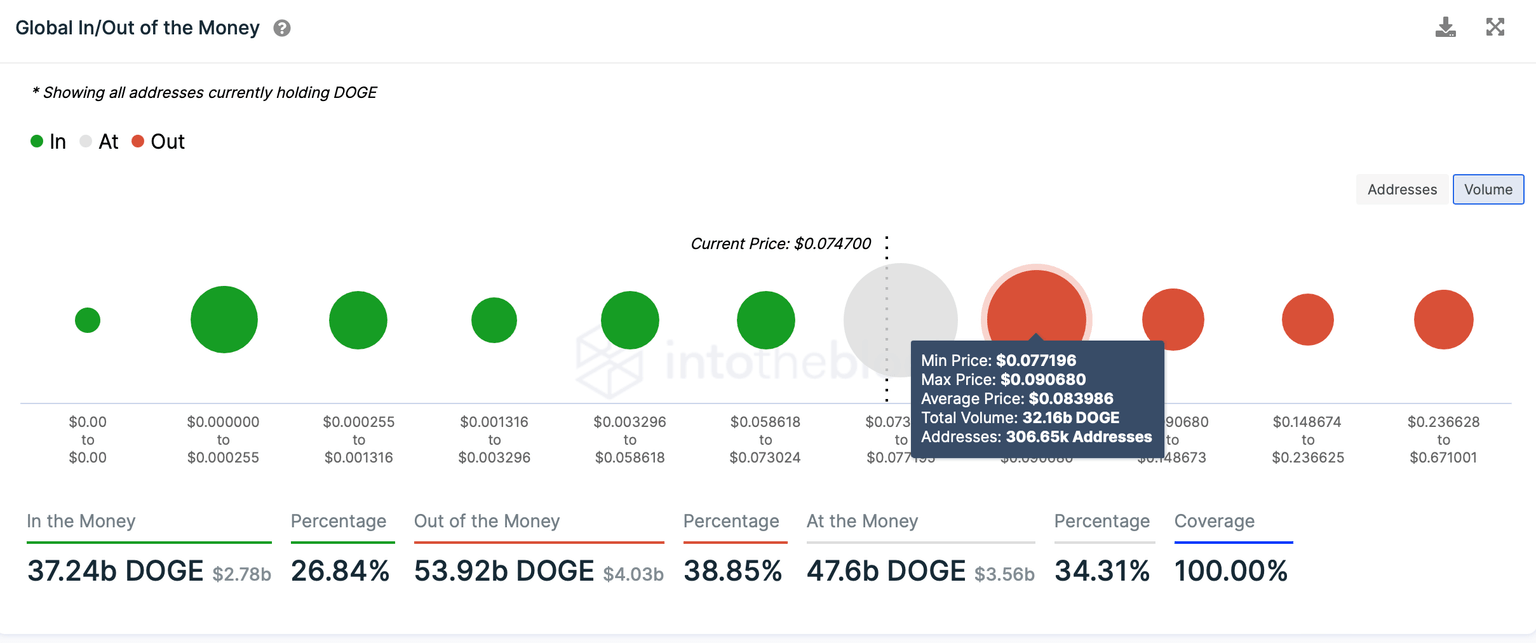

Looking at the transaction data from IntoTheBlock reveals an interesting cluster of “underwater” investors who may pose the biggest threat to DOGE’s bullish outlook. Between $0.0771 and $0.0906, roughly 306.6k addresses purchased a whopping 32.16 billion DOGE at an average price of $0.0839.

These investors are currently “Out of the Money,” and if Dogecoin price rises up to their average purchase level, the bulls could face headwinds from investors trying to sell their holdings at break even.

The good news is that, if DOGE clears the $0.0839 hurdle, it will face clear skies up to $0.0952.

DOGE GIOM

Further supporting the bullish development for Dogecoin is the 24-hour Active Addresses. This on-chain metric has been producing higher highs since March 18 and has gone from 120,000 addresses to 130,000 in under two weeks.

This spike in active addresses suggests that investors are interested in DOGE at the current price levels, suggesting a potential accumulation.

DOGE 24-hour Active Addresses

Additionally, the Supply Distribution chart shows that addresses holding between 100 million and 1 billion DOGE tokens have been increasing at a rapid rate. Between late December 2022 and mid-March 2023, the number of these addresses spiked from 17.50% to 20.95%.

Such a massive uptick in high net worth investors predicts the possibility of an incoming bullish move for Dogecoin price.

DOGE Supply Distribution

While all signs, technical and on-chain, point to a bullish outlook for Dogecoin price, investors need to have a backup plan, should the bulls fail to take control. A breakdown of the range low at $0.0705 followed by a flip of this key support level into a resistance level would invalidate the bullish thesis.

Such a development could see DOGE crash 15% and tag the $0.0597 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B07.49.35%2C%252031%2520Mar%2C%25202023%5D-638158351012128267.png&w=1536&q=95)

%2520%5B07.48.48%2C%252031%2520Mar%2C%25202023%5D-638158351210085298.png&w=1536&q=95)