Dogecoin price breaching this key barrier would save $2.5 billion worth of DOGE from losses

- Dogecoin price is currently trading at $0.0745, looking to rally by 12.5% to touch $0.0840.

- Nearly 32.3 billion DOGE were purchased at an average price of $0.0840, which would turn profitable if prices rose further.

- The meme coin is noting no significant support from investors or bulls, making the probability of a 12.5% rally rather weak.

Dogecoin price has had one of the most disappointing runs over the last 30 days, which has resulted from a lack of interest from investors. However, if these investors were to suffer more losses, it would be a making of their own as DOGE only needs a push to this level for holders to become profitable again.

Dogecoin price needs a little push

Dogecoin price drew a lot of interest from investors back in October last year but declined significantly over the next few months as the quotes kept falling. DOGE has been painting red on the charts since marking the year-to-date high of $0.959 back in February.

While other altcoins managed to mark new 2023 highs in the last few days, Dogecoin price only increased by a little over 15% to trade at $0.0745. But investors are awaiting another 12.6% rally that could bring back the profits that they have not seen for over a month now.

According to the Global In/Out of the Money (GIOM) indicator, over 32.27 billion DOGE worth nearly $2.5 billion at current trading price await recovery.

Bought at an average price of $0.0840, these tokens would become profitable once again when the Dogecoin price flips the critical resistance of $0.0826 into a support floor. This would enable the investors to push the price further up and turn the DOGE holders profitable once again.

Dogecoin GIOM

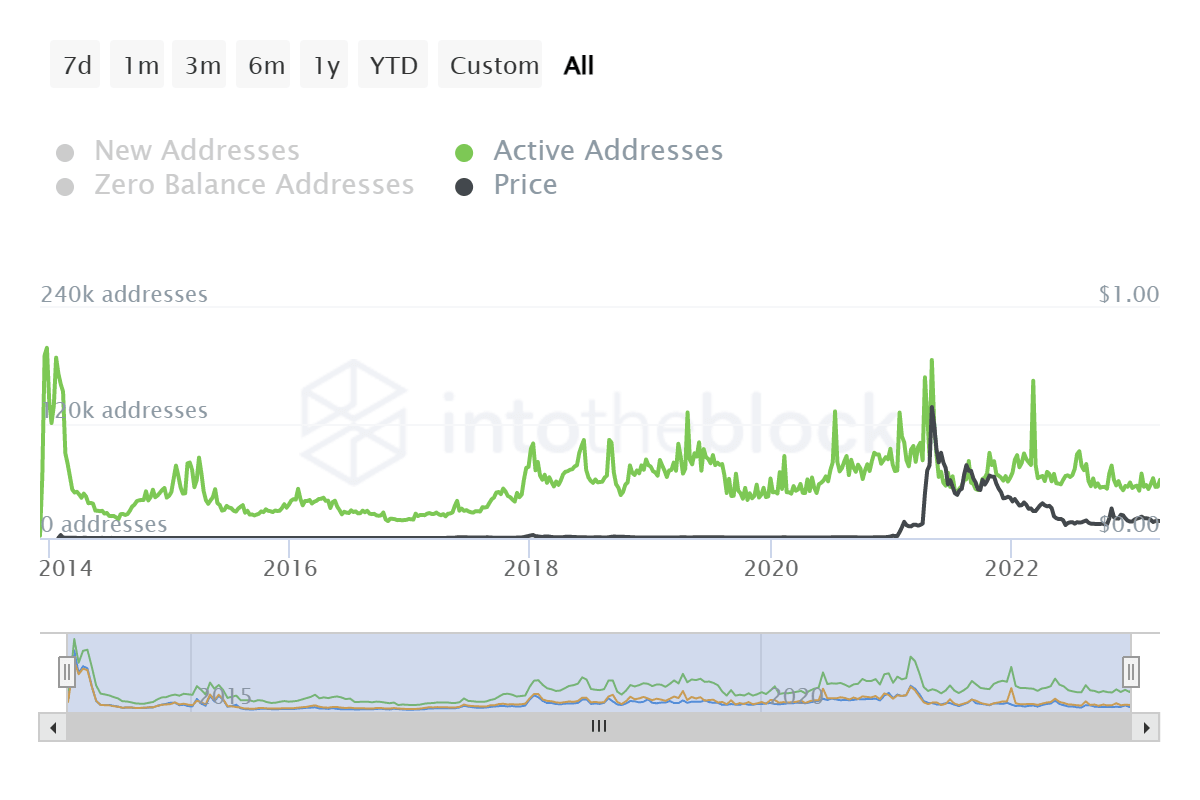

However, the investors are the issue at the moment. The network has been noting very little presence when it comes to DOGE holders. The daily active addresses in the case of Dogecoin have been hovering at an average of 53,000 against 4.26 million total addresses with a balance on the network.

Dogecoin daily active addresses

Not even Dogecoin whales have been active, as observed by the transaction volume. Except for a spike to $1.62 billion last week, the average whale movement has generated less than $1 billion on a daily basis.

Thus, DOGE investors need to become active again in order for the Dogecoin price to take a bullish turn and chart a 12% rally.

DOGE/USD 1-day chart

If that fails to happen and investors pull back as the attempt to breach the critical resistance fails, the meme coin could decline again to potentially test the critical support at $0.0618. Losing this level would invalidate the bullish thesis and drag the altcoin down to September 2022 lows of $0.0570.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.