Why Zilliqa price will retest its all-time high soon

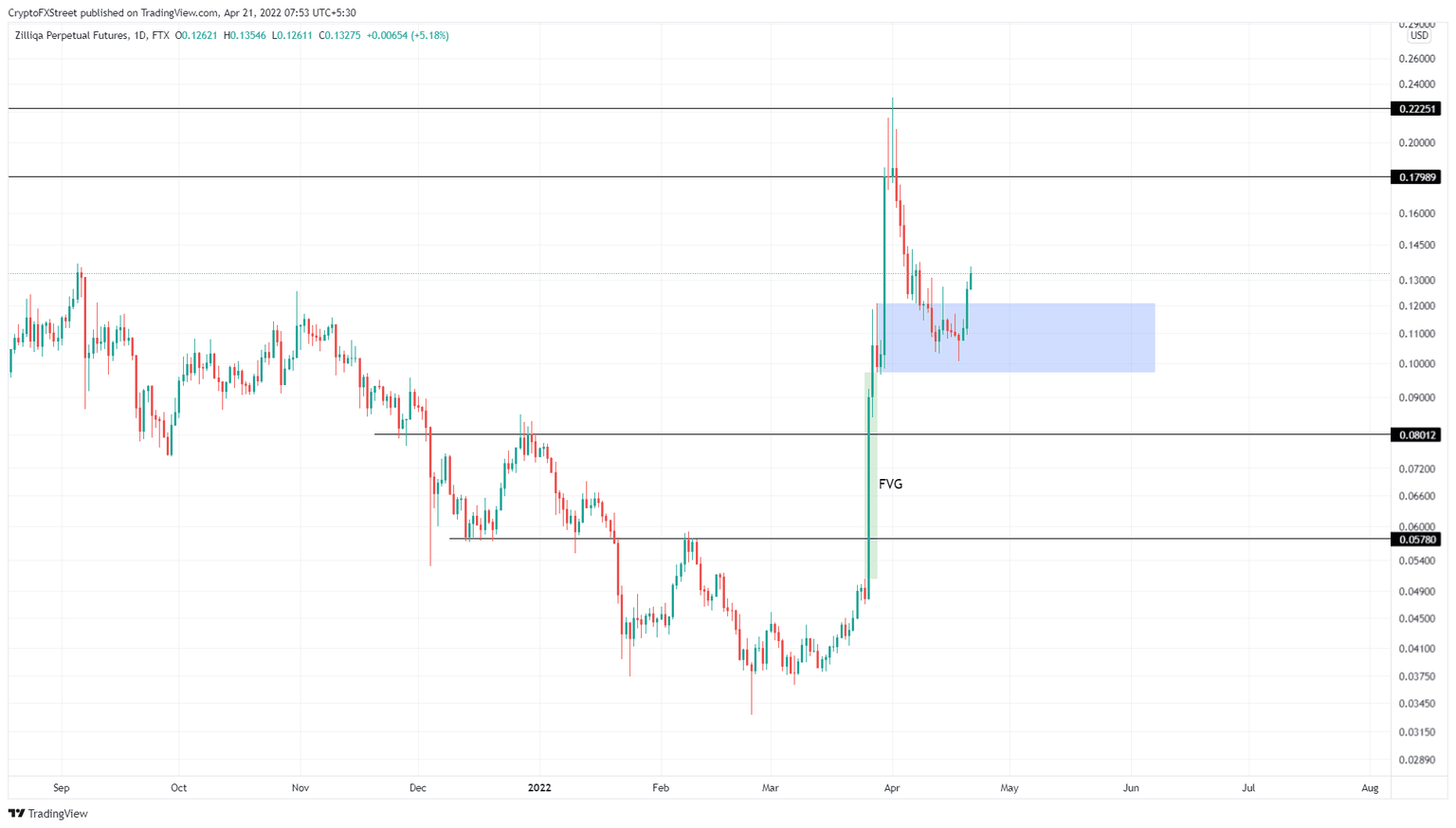

- Zilliqa price is bouncing off the $0.097 to $0.120 demand zone, suggesting a resurgence of buyers.

- Investors can expect a run-up to tag the all-time high at $0.256 after clearing the $0.179 hurdle.

- A daily candlestick close below the $0.097 limit will invalidate the bullish thesis for ZIL.

Zilliqa price is taking a break after an exponential rally, more than quadrupling in around a week. This massive upswing was followed by a retracement to a stable support level where ZIL attempts another leg-up.

Zilliqa price presents a buy signal on two fronts

Zilliqa price crashed 56% after surging 540% in around a week. This uptrend pushed the altcoin from $0.030 to an all-time high at $0.256. However, with investors booking profits and the market structure of the cryptos turning bearish, ZIL dropped from an all-time high of $0.256 to $0.100.

The daily demand zone, extending from $0.097 to $0.120 was the main support level that absorbed the incoming selling pressure. After a swing low at $0.100 on April 18, Zilliqa price has rallied 31% and is currently hovering around $0.131.

Going forward, investors can expect a 36% rally that retests the first hurdle at $0.179. Clearing this barrier is crucial for bulls to make a run for the all-time high at $0.256. Therefore, this resistance barrier will test the bulls’ conviction.

Assuming the above-mentioned level is flipped into a support level, there is a good chance ZIL will retest its all-time high at $0.256. This move to $0.256 would constitute a whopping 91% to $0.25.

ZIL/USDT 4-hour chart

On the other hand, a daily candlestick close below the $0.097 limit will invalidate the bullish thesis for ZIL as it would produce a lower low. This move will skew the odds in the bears’ favor and in some cases, even trigger a 40% crash to $0.059.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.