Why the Ethereum price is likely to challenge all market participants

- Ethereum price is facing significant resistance near the $1,150 region.

- ETH price holds key support near the mid-$1,050 price levels.

- All uptrend potential depends on the $1,085 swing lows holding as support.

Ethereum price shows a potential double scenario in play as several rejections have occurred near the $1,200 zone. Catching the next trade will be a challenge for all traders as the market may e increase in volatility. Key levels have been defined to gauge ETH’s next potential move.

Ethereum price will soon make a move

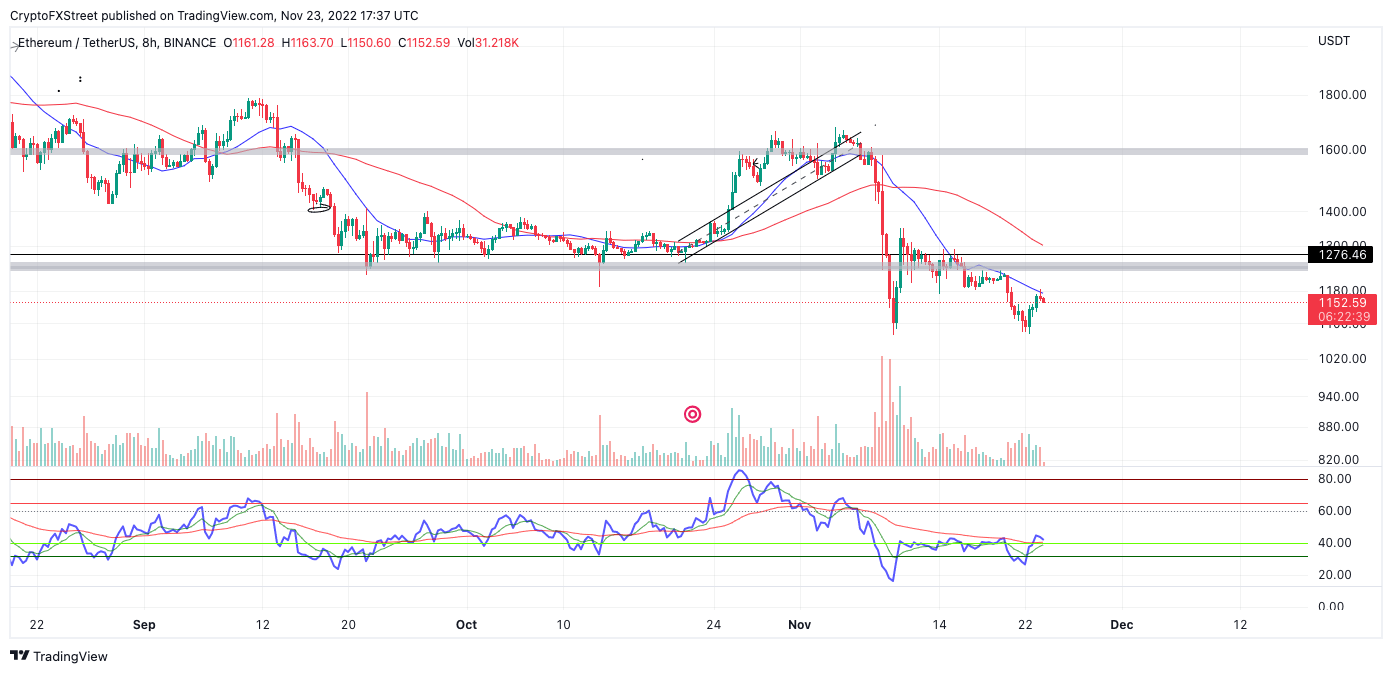

Ethereum price has recovered 7% of lost market value after the weekend’s 10% decline. At the time of writing, the bulls have failed another attempt to hurdle the 8-day exponential moving average (EMA). The indicator has acted as resistance since the middle of November, forging several rejections near the $1,250 zone.

Ethereum price currently auctions at $1,154. The Volume Profile Indicator remains sparse in transactions, suggesting that retail traders are involved in the market. If the 8-day EMA continues to act as resistance, the strong support zone near $1,085 will likely be challenged again. A failure to hold support would lead to a liquidation event targeting swing lows at $1,000 and potentially $939.

Still, a second retest of the broken support level at $1,276 stands a fair chance of occurring. A hurdle of the barrier could trigger a strong buyers’ frenzy targeting the untested 21-day simple moving average at $1,370. The Relative Strength Index has hurdled back into supportive grounds on the 8-hour time frame, which could promote a trickle-down effect of buying interest on smaller time frames. All uptrend scenarios would depend on the swing lows at $1,085 holding as support.

In the following video, our analysts dive deep into the price action of Ethereum, analyzing key market interest levels. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.