Why the Ethereum price may suffer another blow despite reducing energy consumption

- Ethereum price is retesting the $1200 support zone.

- Ethereum price is officially a deflationary token, according to the recent tapering of the supply.

- Invalidation of the downtrend requires a breach above $1,300 for confirmation.

Ethereum price is facing significant bearish pressure going into the third trading week of November. After a 35% decline witnessed earlier this month, the bulls produced a countertrend rally with far less luster than previous uptrend moves. If market conditions persist, ETH could fall back to the $1,000 price level.

Ethereum price remains submerged

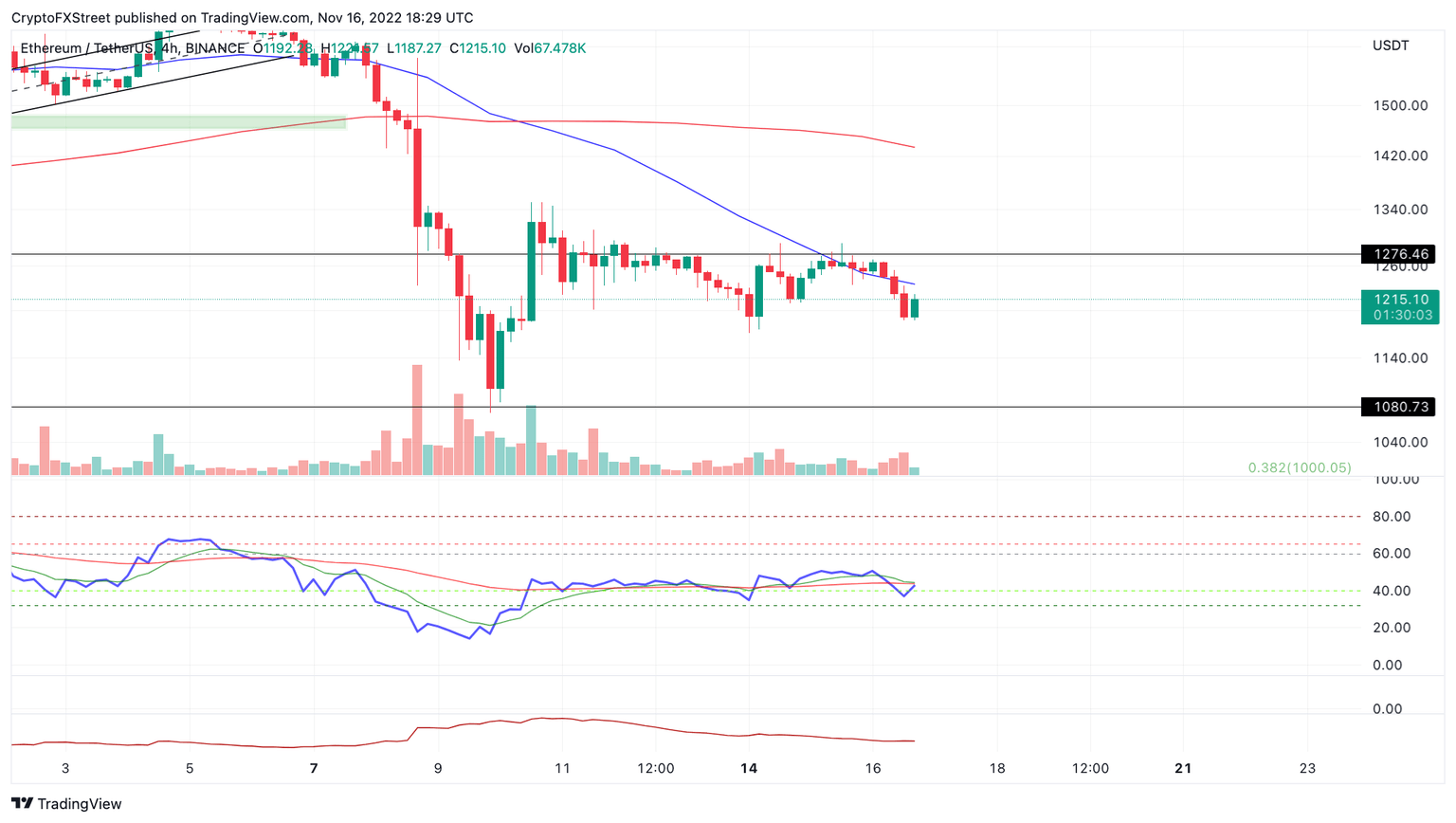

Ethereum price shows signals that warrant concern as the bears attempt to decimate the $1,200 support zone. The recent move south was catalyzed by a rejection from the 8-day exponential moving average (EMA). On smaller time frames, the ETH price looks completely in control of the bears as the Relative Strength Index (RSI) remains in oversold territory.

Ethereum price currently auctions at $1,209 as a quick rebound has occurred since the bears breached the $1,200 level. Still, the Volume Profile Indicator suggests sidelined bulls are uninterested in the current discounted ETH price, which could cascade into further sell-offs in the future.

ETHUSDT 8-hour chart

The ETH price decline comes at an interesting time in the market as many crypto advocates speculate better days will come for the decentralized smart-contract token. FXStreet's News Reporter Ekta Mourya recently noted that ETH's supply has significantly fallen post-merge. According to the article, the altcoin’s energy consumption is down 99%. This is a positive light in the crypto space that will hopefully suffice in combatting the White House’s current and future climate and energy implications involving cryptocurrencies.

Still, bounces cannot be ruled out as invalidation of the bearish remains above $1,300 liquidity levels based on previous outlooks. If the level is tagged, ETH could re-route north and rally towards $1,800 and potentially $2,000. Such a move would result in an 80% increase from the current Ethereum price.

In the following video, our analysts dive deep into the price action of Ethereum, analyzing key market interest levels. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.