Why the Ethereum price could rally back to $1,375

- Ethereum price has rallied 8% during the final week of November.

- ETH hurdled past several critical barriers, hinting that the uptrend will continue.

- A breach below $1,214 would make void ETH's bullish potential.

Ethereum price has investors watching closely as the recent recovery could be the start of a much larger move. As the bulls trot higher, subtle signs suggest the ETH price could continue to rally. Traders should consider engaging with Ethereum’s price action while practicing healthy risk management protocols to avoid any last-minute liquidity spikes before the month-end.

Ethereum price shows strength

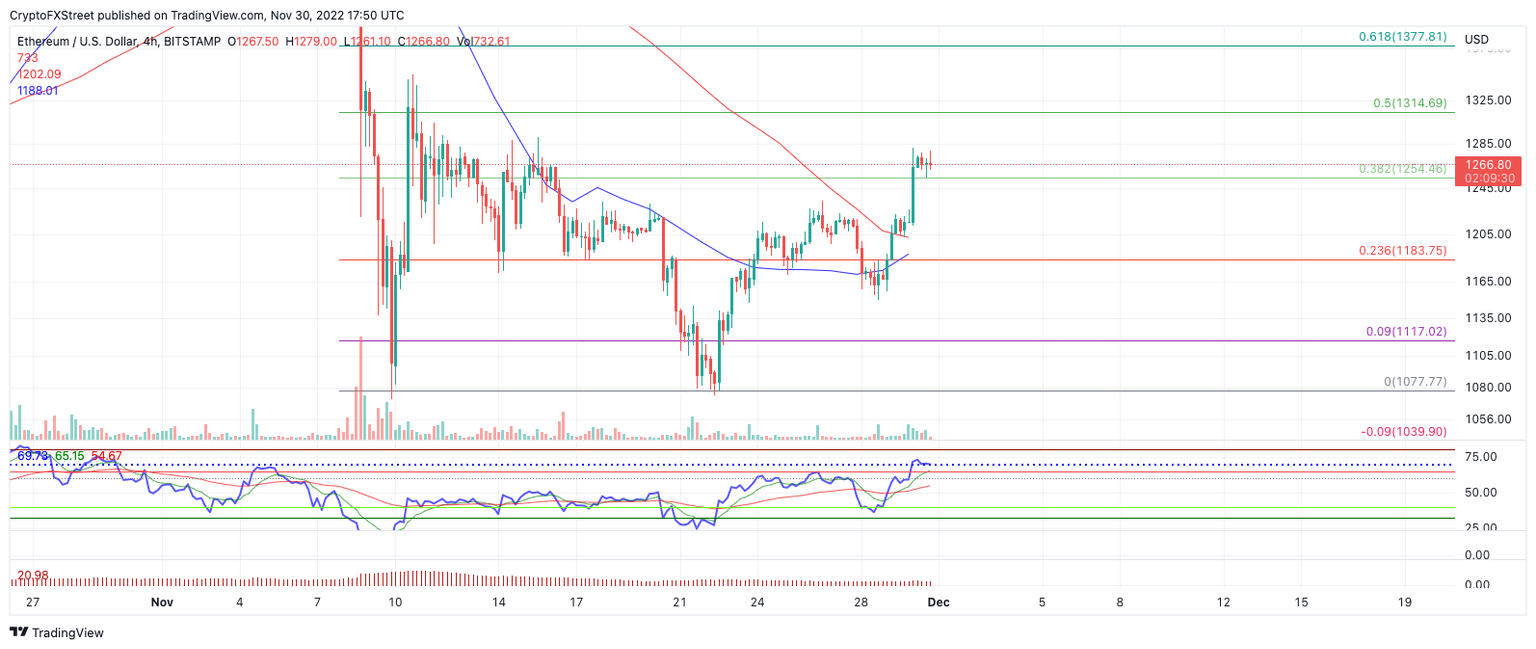

Ethereum price is currently up 8% in the week as the bulls have taken charge following a weekend of rangebound trading. On Tuesday, November 29, the bulls produced a strong bullish engulfing candle that pierced through the 8-day exponential and 21-day simple moving averages. The indicators now hover below the auctioning price. If market conditions persist, a bullish cross will ensue. Bullish crossovers occur when a shorter-term moving average crosses above a longer-term moving average. They are usually the catalyst for significant upticks in volatility and uptrend hikes.

Ethereum price currently auctions at $1,264. If the market is as bullish as the technicals portray, then the $1,374 price zone would be a valid target to aim for. The target is extracted from a Fibonacci retracement tool surrounding the steepest part of the November bear rally. The bulls have successfully breached the 38.2% fib level at $1,254, and the 50% fib level lies at $1,374.

The bullish countertrend rally depends on the thurst candle, which breached the 38.2% Fib level at $1,214 remaining unbreached. If the bears tag that level, the uptrend scenario would be void. A potential to fall back into the previous range near $1,100 would become a likely outcome, and such a move would result in a 14% decrease from the current Ethereum price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.