Why Solana price will post explosive gains above this level

- Solana price is steadily moving toward its short-term target at $77.98.

- Investors can ride the 48% upswing to $77.98 which could extend to $80.

- A daily candlestick close below $44.91 will invalidate the bullish thesis for SOL.

Solana price has been consolidating above a stable support level for nearly two weeks and is slowly climbing higher. Patient investors can capitalize on this steady climb to crucial hurdles.

Solana price continues its journey

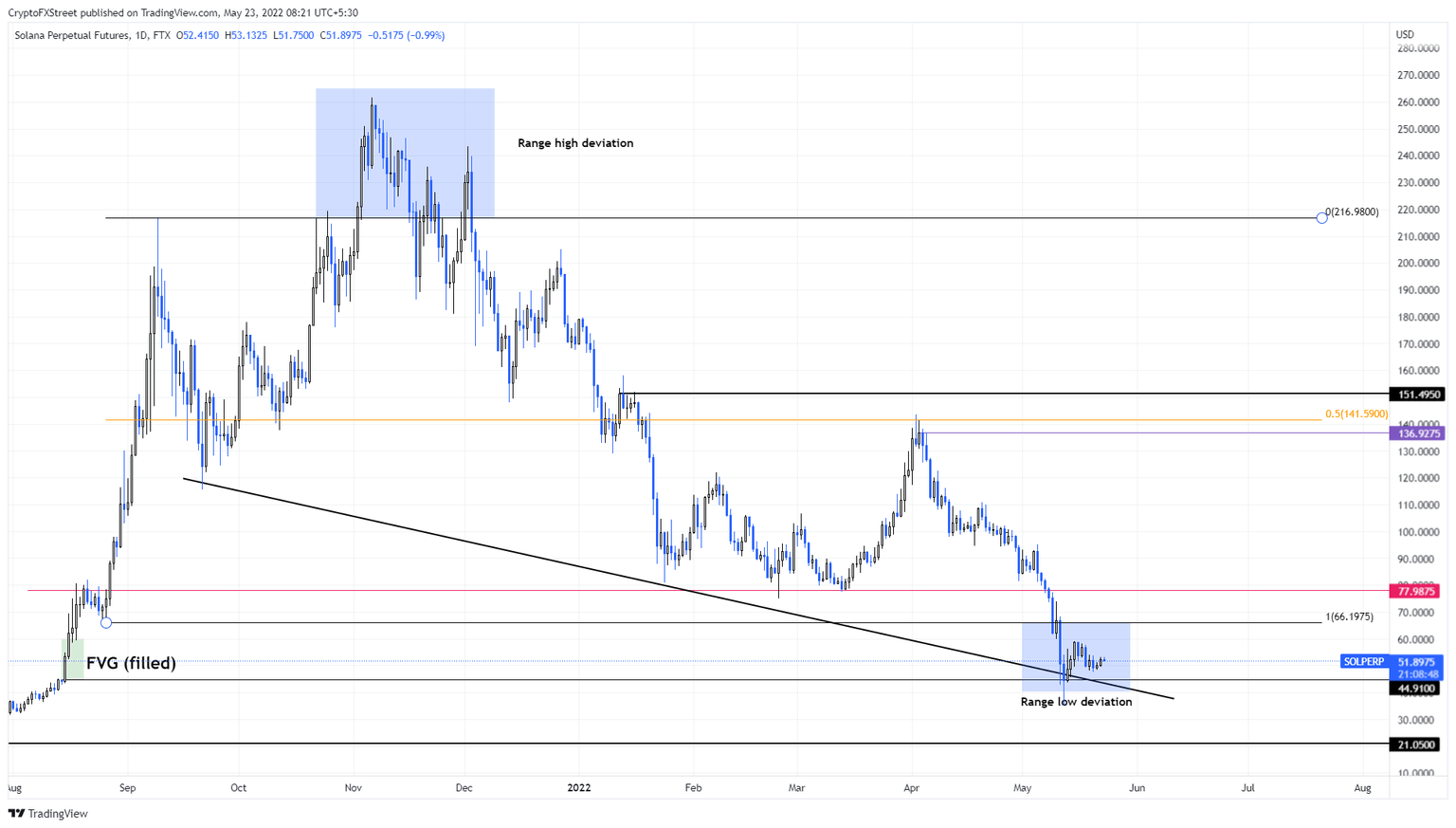

Solana price faced an intense sell-off at $141.59 aka the 50% retracement level of the range extending from $66.19 to $216.98. This sell-off received an extra boost on April 4 as bulls failed to move above the range’s midpoint at $141.59.

As a result, SOL crashed 69% and swept below the range low at $66.19 and has been vying for recovery since. Investors can expect SOL to slowly climb higher and retake the lost grounds. Therefore, interested market participants are likely to gain 48% as Solana price rallies to the $77.49 hurdle.

This run-up to the significant resistance barrier will occur if SOL manages to flip the range low at $66.19 and make its way to the target at $77.98. This level, unlike the other hurdles, has a high chance of stopping Solana price and the bulls from ascending.

SOL/USDT 1-day chart

On the other hand, Solana price has a solid theory backing its recovery and has support from Bitcoin price, which is also trying to bounce back higher. So, an upswing is logical for the Ethereum-killer.

However, if SOL fails to flip the $66.19 barrier and gets rejected, it will indicate a lack of buyer interest. In such a case, SOL could take a U-turn and retest the $44.19 foothold; a breakdown of this level will create a lower low and invalidate the bullish thesis.

Under these circumstances, Solana price could crash 54% and revisit the $21.05 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.