Can Solana price enter a 50% relief rally?

- Solana price is showing signs of a strong recovery as it coils up above the $44.91 support level.

- Investors can expect bulls to trigger a 50% upswing to $78, which could extend to $80.

- A daily candlestick close below $44.91 would create a lower low and invalidate the bullish thesis.

Solana price is in the beginnings of a quick recovery rally that could propel it back to levels that were last seen nearly two weeks ago. Two technicals back the claim for why SOL could be ready for this ascent.

Solana price ready for recovery

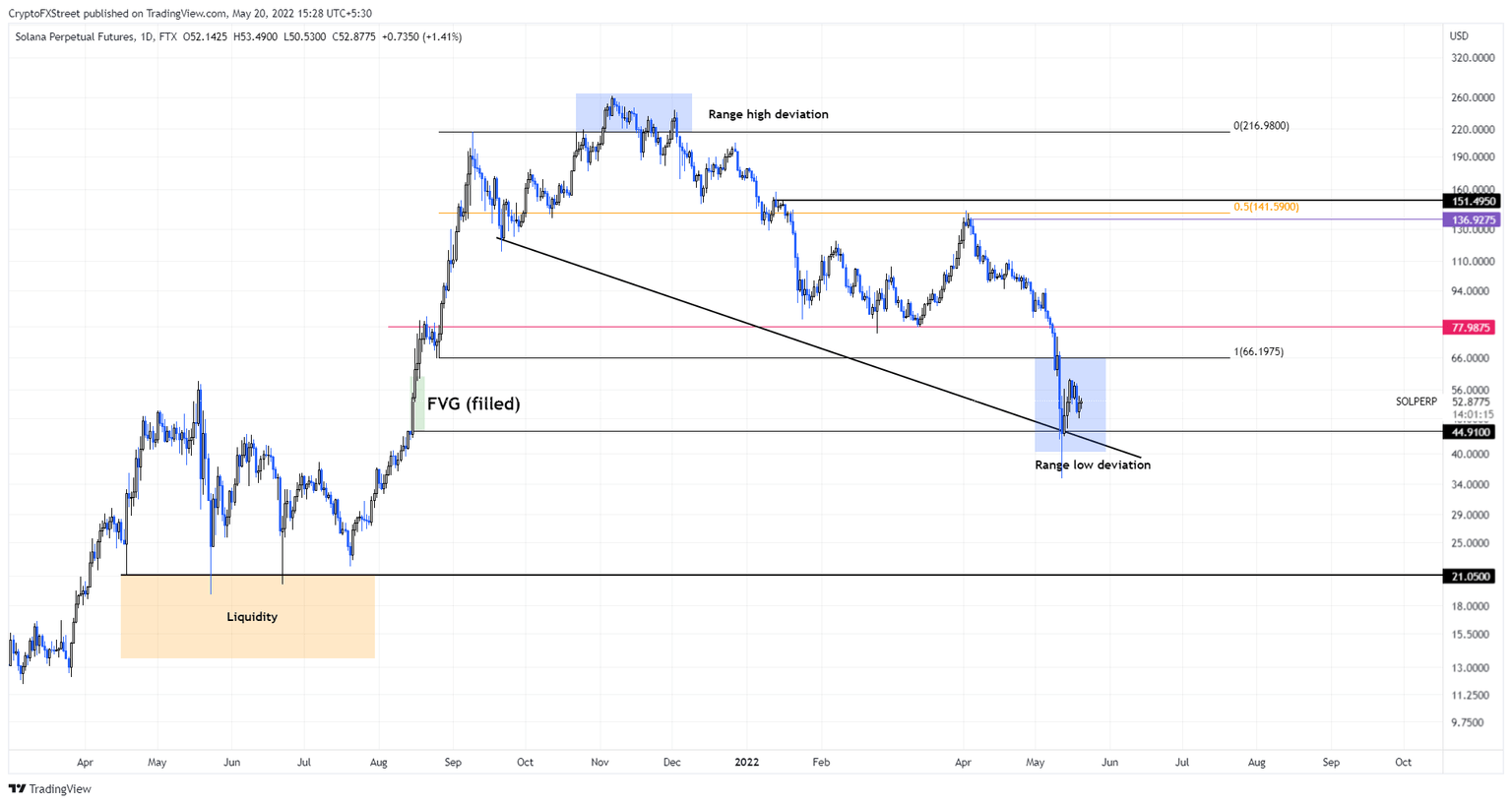

Solana price experienced an 86% crash from its all-time high at $261 on November 6, 2021, to $34.97 on May 12. This downswing increased its pace as LUNA-UST imploded on the first weekend of May. Due to this development, the SOL price tanked roughly 63% between May 5 and May 12.

The explosive move to the downside was met with an equally quick recovery. As a result, Solana price filled the fair value gap, extending from $44.91 to $60.03, removing a part of the sell-side pressure.

Since flipping above the $44.91 support floor SOL has rallied 18% to where it currently trades - $52.45. Going forward, investors can expect Solana price to recover its losses and tag the range low at $66.19. In a highly bullish case, this rally could extend to the $77.98 resistance barrier or $80.

SOL/USDT 1-day chart

While things are looking optimistic for Solana price, a daily candlestick close below $44.91 would create a lower low and skew the odds in the bears’ favor. Such a move would invalidate the bullish thesis and potentially trigger a 51% crash in Solana price to $21.05.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.