Why Shiba Inu price is set for a 15% value increase

- Shiba Inu price sees losses being paired back instantly.

- SHIB price overall in a wedge that looks set to break to the upside.

- Although still some way off, catalyst events over the weekend could trigger a preemptive breakout.

Shiba Inu (SHIB) price slipped in late trading hours on Thursday after earnings shook the markets. Instead of seeing a continuation to the downside, bulls have already pared back most of the incurred losses and are back on track to test the sloping side of a wedge pattern. Add to that the fact that there is a catalyst event this weekend with the French elections, where Macron is set to win according to the polls, and price action is set to pop in favour of bulls.

SHIB price set to shift to the upside over the weekend

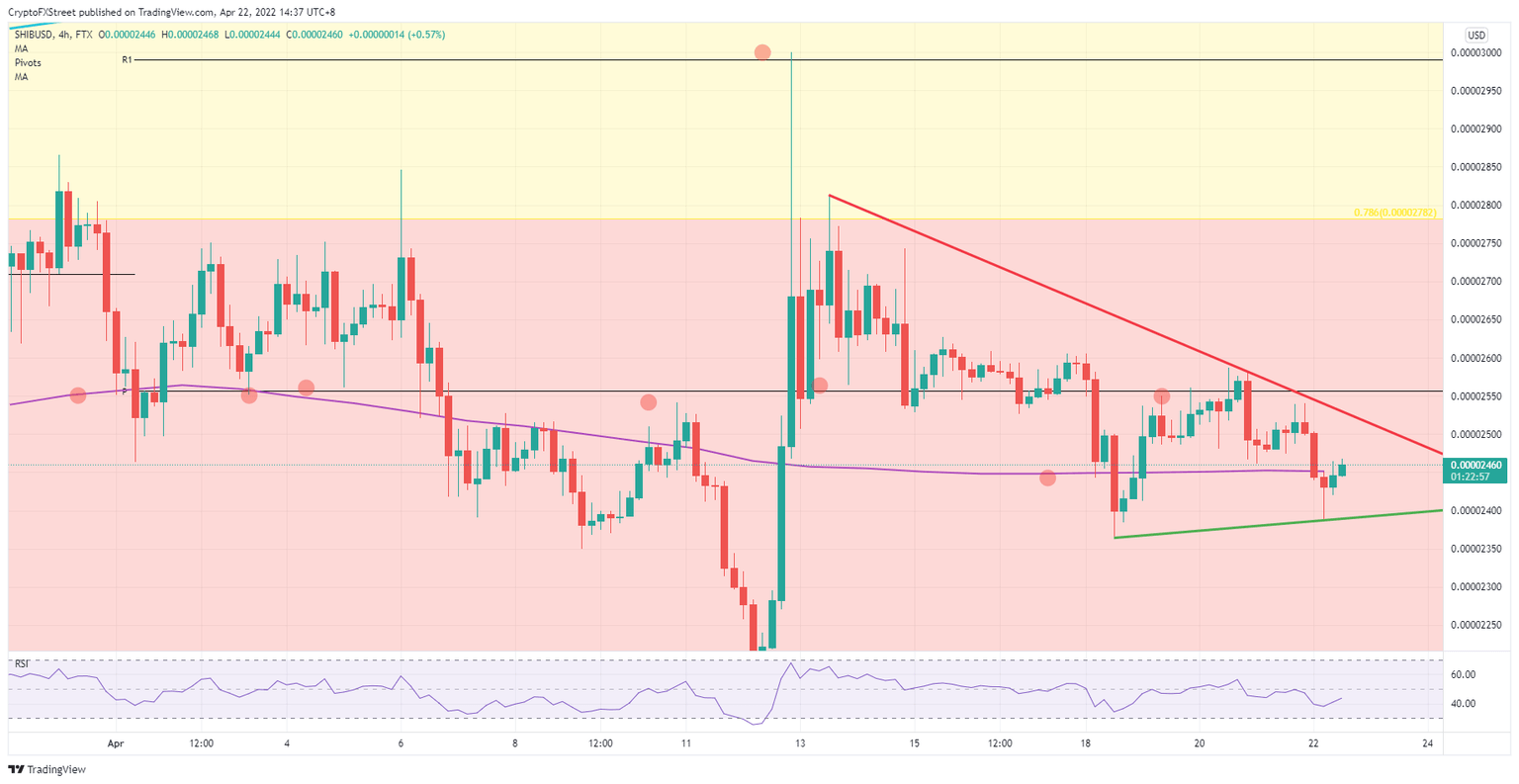

Shiba Inu price is under the pressure of the red descending trendline that kicked in on April 13. Since then, it has withstood two tests followed by a rejection to the downside. But looking from the downside, the green ascending trend line that for now only holds one test is squeezing buyers and sellers towards each other with lower highs and higher lows.

SHIB price is thus in the process of an explosive cocktail once buyers and sellers are so close to one another that a simple catalyst is enough to set a spark to SHIB price to either make a big pop or nose dive move. The biggest known catalyst is the French election over the weekend, where Macron is gaining further in the polls and deepening his lead. Assuming he wins, expect to see a sigh of relief on Monday, helping cryptocurrencies to thrive in a risk-on background, where SHIB price is set to pop above $0.00002550 towards $0.00002800, returning 15% of value to your portfolio.

SHIB/USD 4H-chart

As with any catalyst, the predicted outcome can always surprise in the opposite direction. The French elections could send a shock through the whole political equilibrium of Europe if a far-right president was elected. In such a scenario, expect to see a drop in the euro, feeding dollar strength and, in its turn, a spillover into cryptocurrencies with downward pressure as a result. SHIB price would then drop to $0.00002350 and possibly slip below $0.00002250.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.